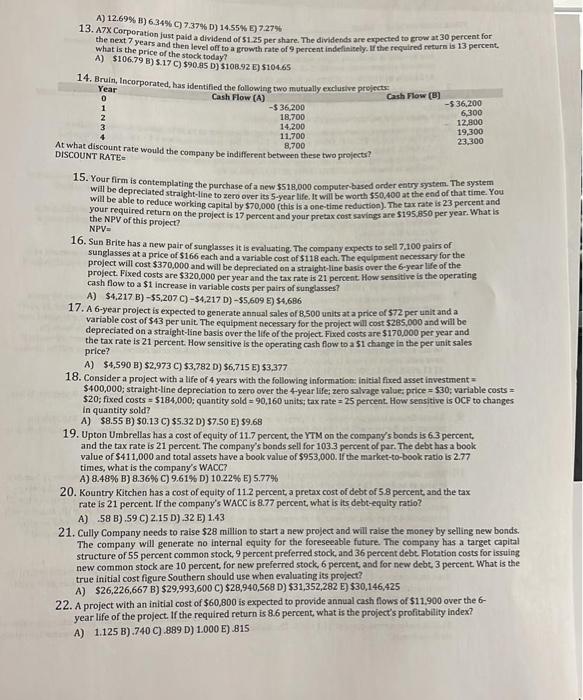

A) 12.69% B) 6.34 % C) 7.37 % D) 14.55% E) 7.27 % 13. A7X Corporation just paid a dividend of $1.25 per share. The dividends are expected to grow at 30 percent for what is the price of the stock today? the next 7 years return is 13 percent. A) $106.79 B) 5.17 C) $90.85 D) $108.92 E) $104.65 14. Bruin, Incorporated, has identified the following two mutually exclusive projects Year Cash Flow (A) 0 -$36,200 18,700 3 14,200 4 11,700 At what discount rate would the company be indifferent between these two projects? DISCOUNT RATE= 8,700 1 2 Cash Flow (B) -$36,200 6,300 12,800 19,300 23,300 15. Your of a new order will be depreciated straight-line to zero over its 5-year life. It will be worth $50,400 at the end of that time. You will be able to reduce working capital by $70,000 (this is a one-time reduction). The tax rate is 23 percent and your required return on the project is 17 percent and your pretax cost savings are $195,850 per year. What is the NPV of this project? NPV= 16. Sun Brite has a new pair of sunglasses it is evaluating. The company expects to sell 7,100 pairs of sunglasses at a price of $166 each and a variable cost of $118 each. The equipment necessary for the project will cost $370,000 and will be depreciated on a straight-line basis over the 6-year life of the project. Fixed costs are $320,000 per year and the tax rate is 21 percent How sensitive is the operating cash flow to a $1 increase in variable costs per pairs of sunglasses? A) $4,217 B)-$5,207 C)-$4,217 D)-$5,609 E) $4,686 17. A 6-year project is expected to generate annual sales of 8,500 units at a price of $72 per unit and a variable cost of $43 per unit. The equipment necessary for the project will cost $285,000 and will be depreciated on a straight-line basis over the life of the project. Fixed costs are $170,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a $1 change in the per unit sales price? A) $4,590 B) $2,973 C) $3,782 D) $6,715 E) $3,377 18. Consider a project with a life of 4 years with the following information: initial fixed asset investment= $400,000; straight-line depreciation to zero over the 4-year life; zero salvage value: price = $30; variable costs = $20; fixed costs = $184,000; quantity sold = 90,160 units; tax rate=25 percent. How sensitive is OCF to changes in quantity sold? A) $8.55 B) $0.13 C) $5.32 D) $7.50 E) $9.68 19. Upton Umbrellas has a cost of equity of 11.7 percent, the YTM on the company's bonds is 6.3 percent, and the tax rate is 21 percent. The company's bonds sell for 103.3 percent of par. The debt has a book value of $411,000 and total assets have a book value of $953,000. If the market-to-book ratio is 2.77 times, what is the company's WACC? A) 8.48% B) 8.36 % C) 9.61% D) 10.22% E) 5.77% 20. Kountry Kitchen has a cost of equity of 11.2 percent, a pretax cost of debt of 5.8 percent, and the tax rate is 21 percent. If the company's WACC is 8.77 percent, what is its debt-equity ratio? A) 58 B).59 C) 2.15 D) .32 E) 1.43 21. Cully Company needs to raise $28 million to start a new project and will raise the money by selling new bonds. The company will generate no internal equity for the foreseeable future. The company has a target capital structure of 55 percent common stock, 9 percent preferred stock, and 36 percent debt. Flotation costs for issuing new common stock are 10 percent, for new preferred stock, 6 percent, and for new debt, 3 percent. What is the true initial cost figure Southern should use when evaluating its project? A) $26,226,667 B) $29,993,600 C) $28,940,568 D) $31,352,282 E) $30,146,425 22. A project with an initial cost of $60,800 is expected to provide annual cash flows of $11.900 over the 6- year life of the project. If the required return is 8.6 percent, what is the project's profitability index? A) 1.125 B).740 C) .889 D) 1.000 E) .815