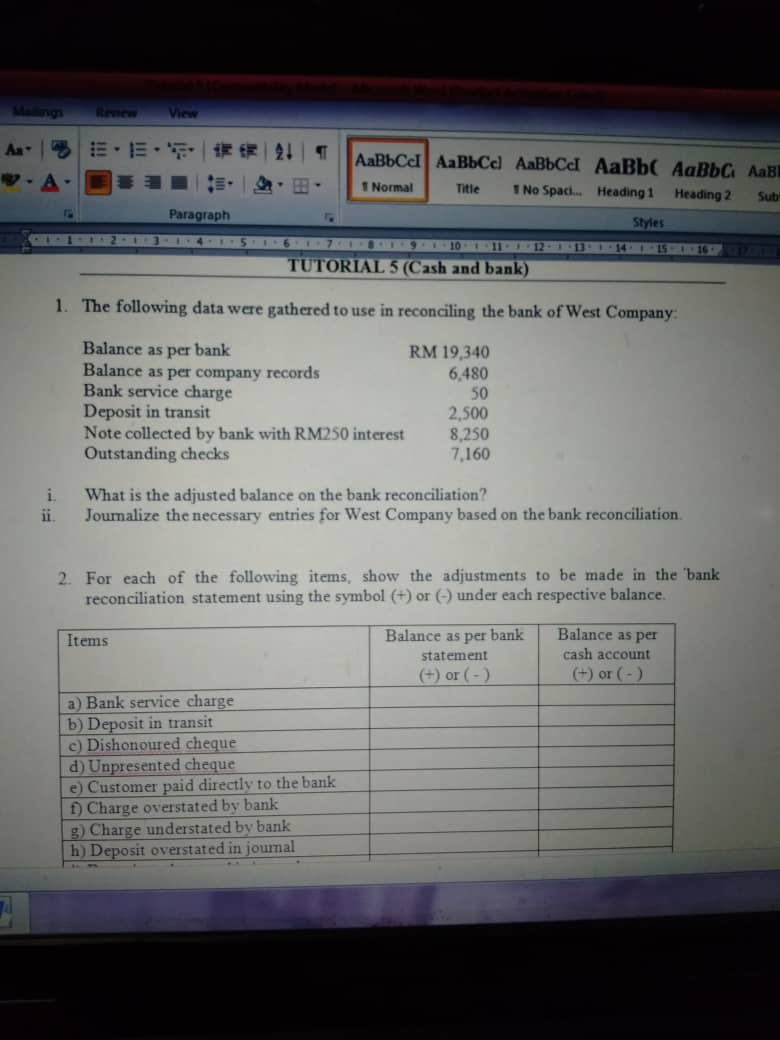

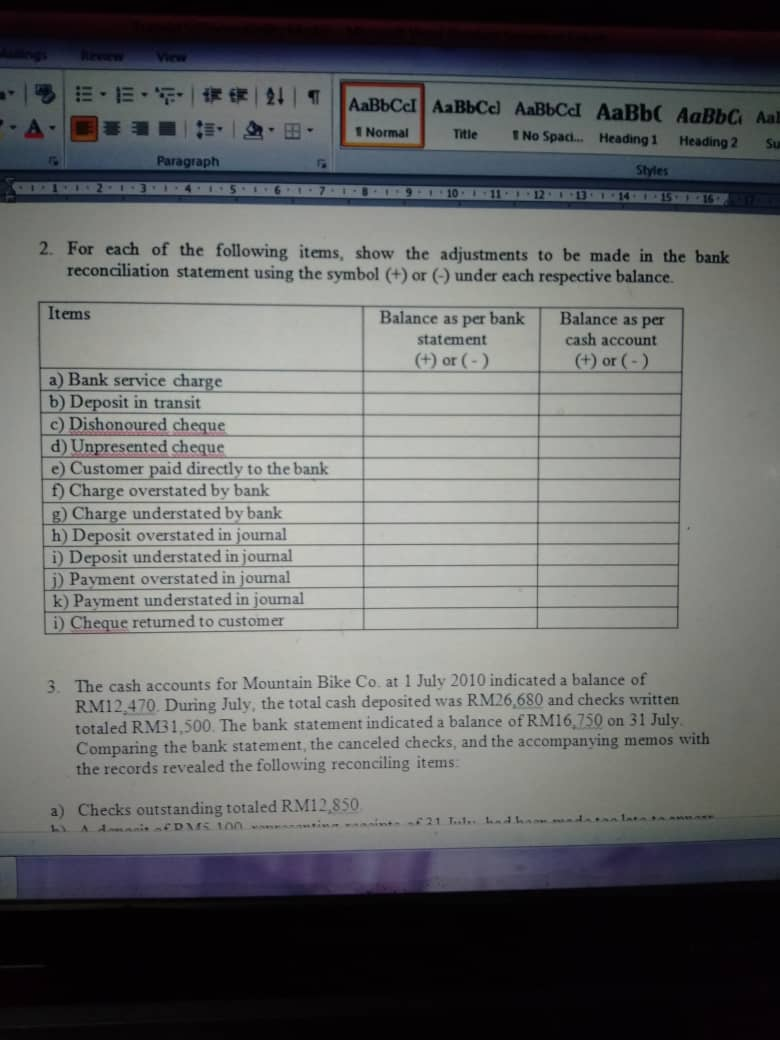

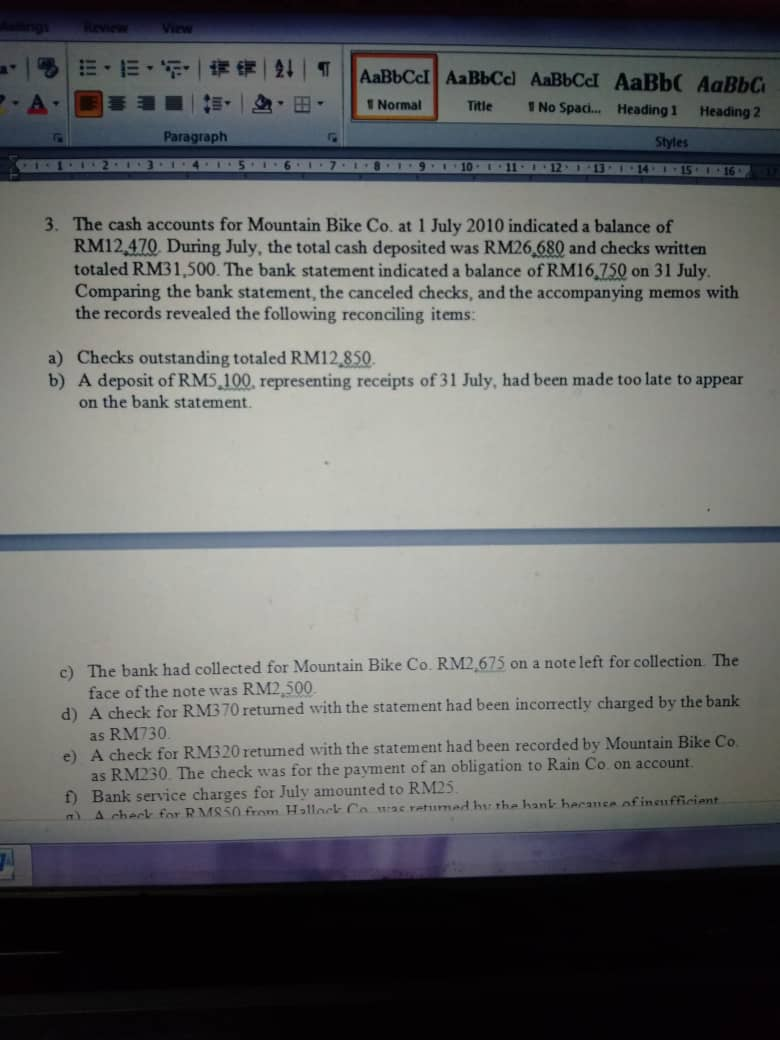

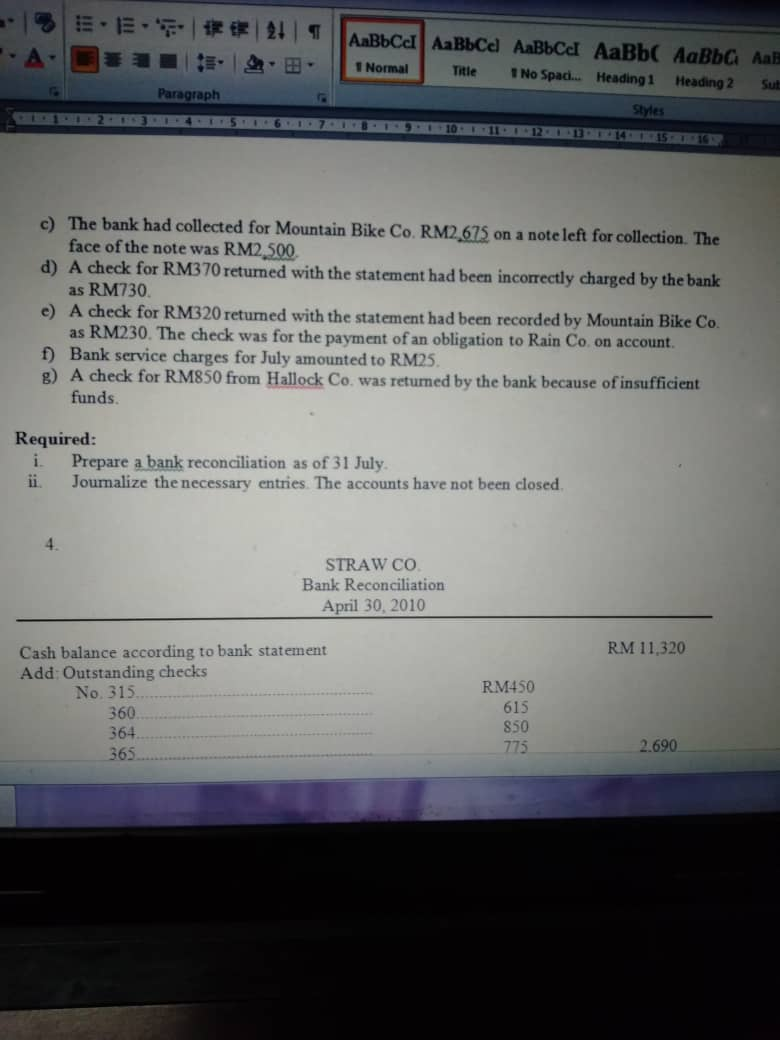

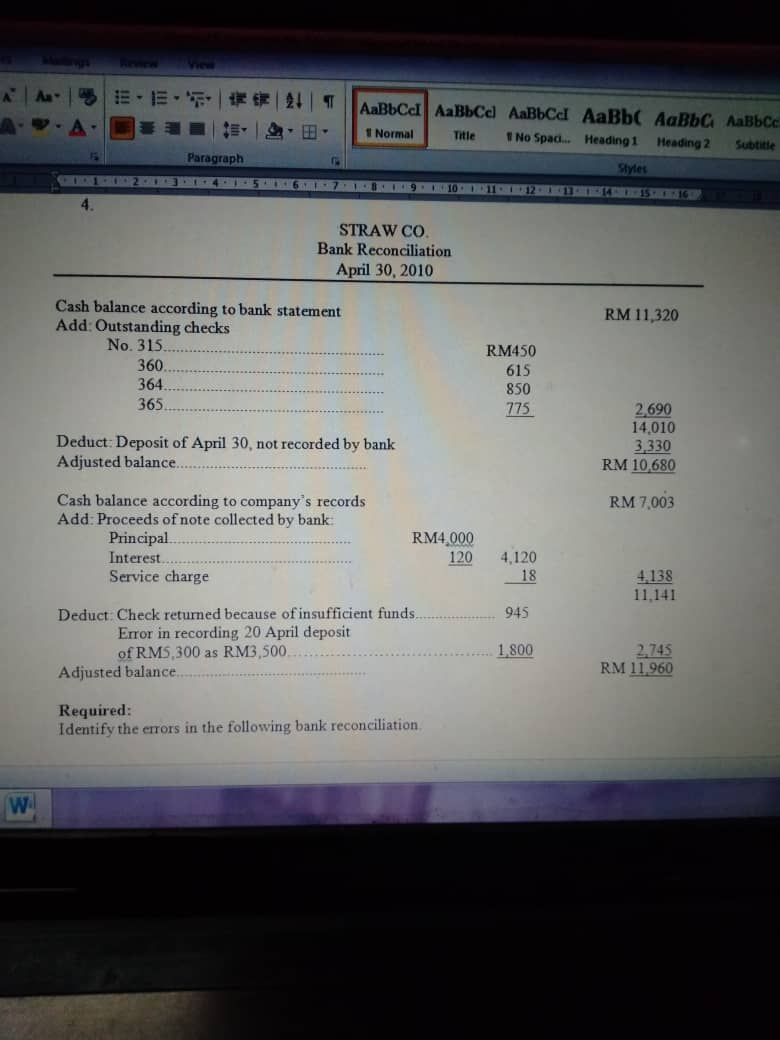

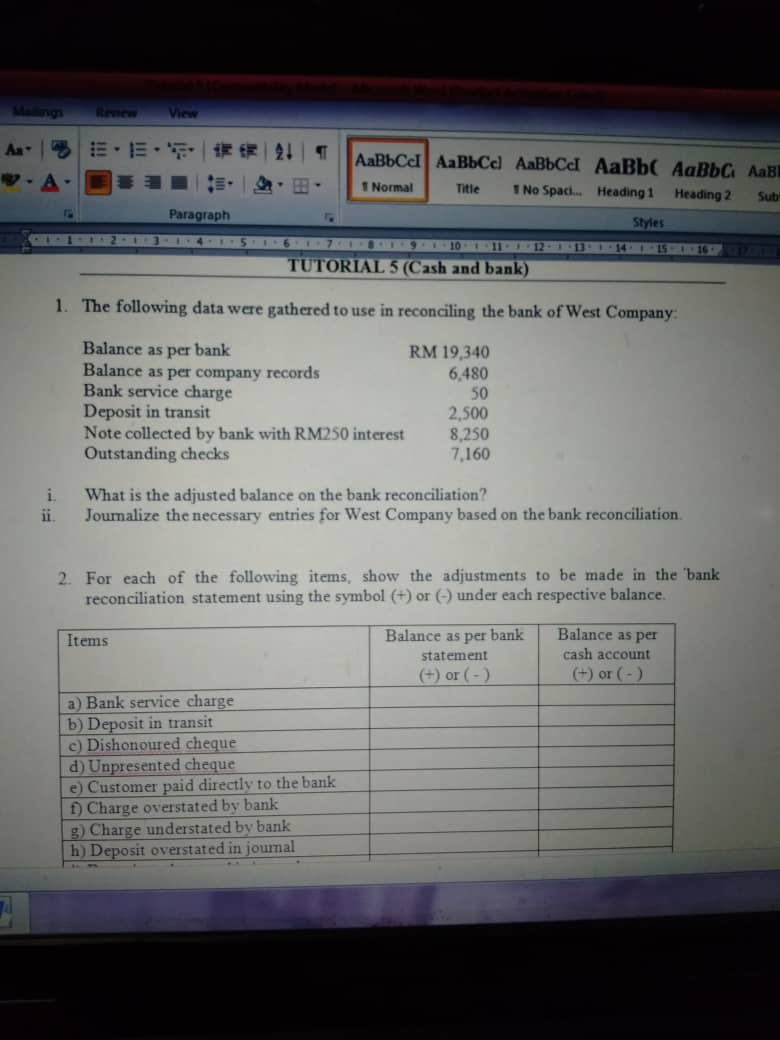

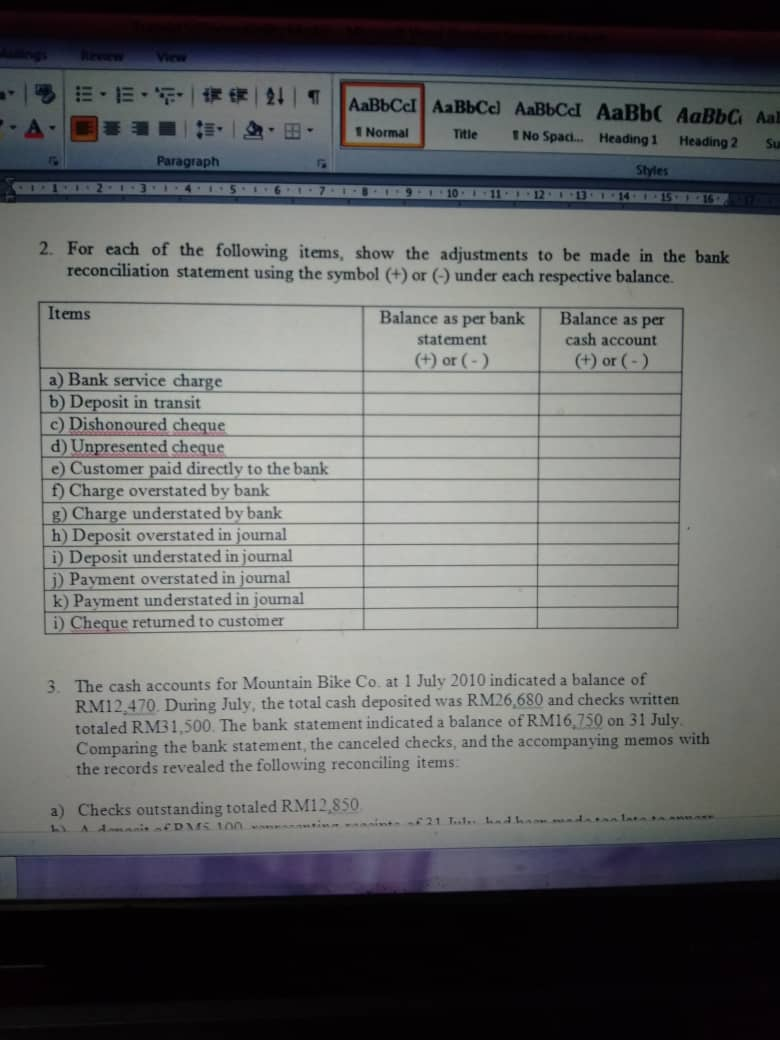

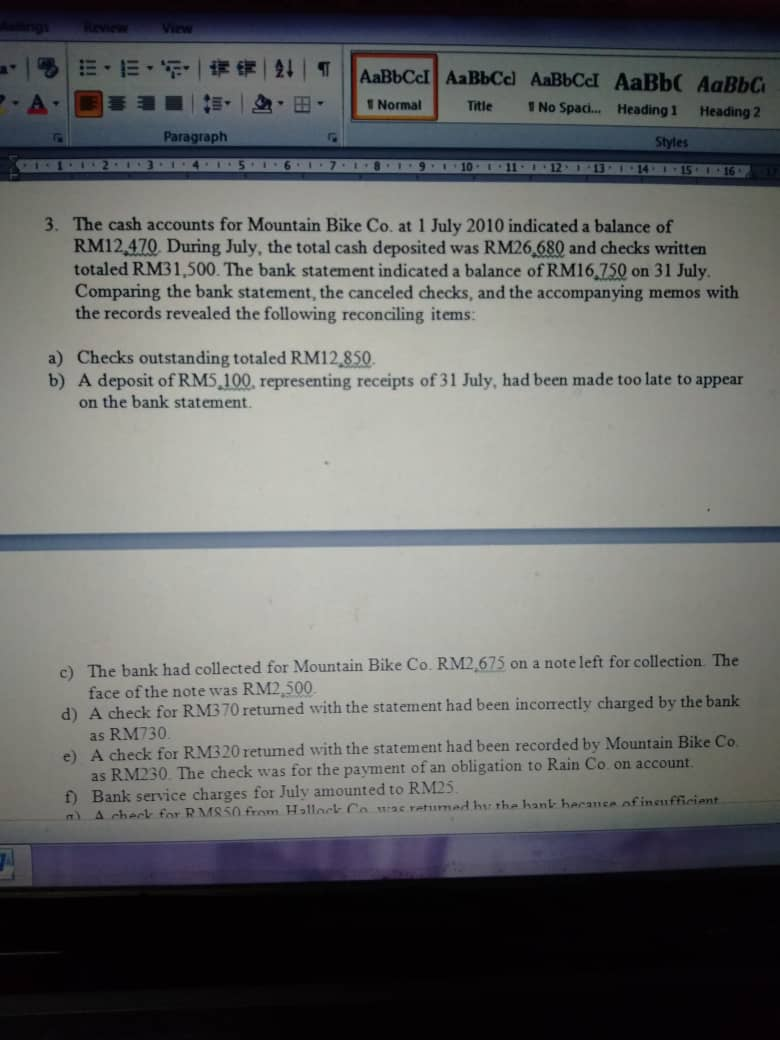

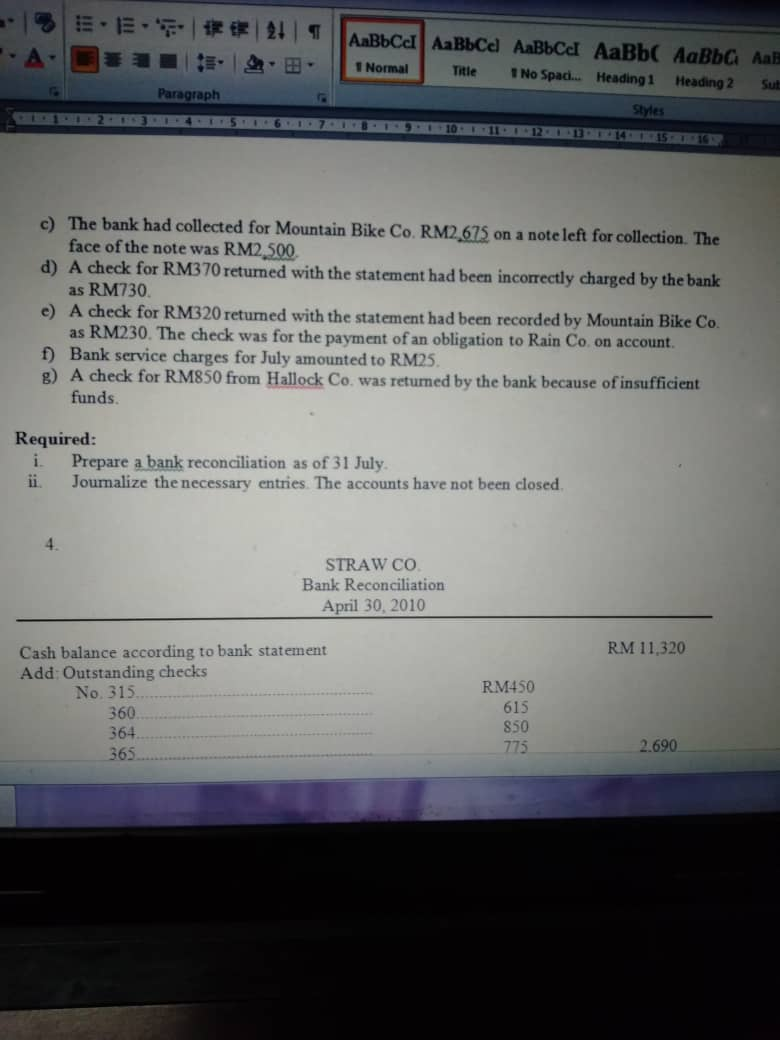

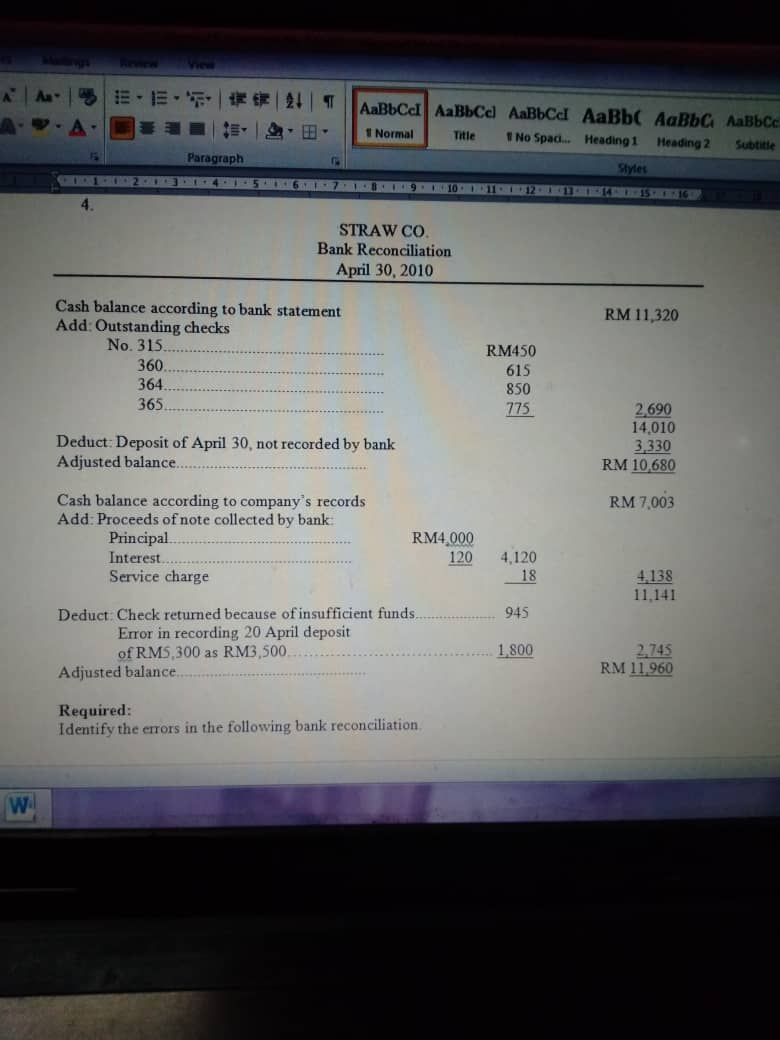

A 13 F 21 AaBbca AaBbCd AaBbcd AaBb AaBbG AaB 1 Normal Title No Spaci... Heading 1 Heading 2 Sube Styles Paragraph - 2 +134 5 617 91 10 11 12 13 14 15 16 TUTORIAL 5 (Cash and bank) 1. The following data were gathered to use in reconciling the bank of West Company Balance as per bank RM 19,340 Balance as per company records 6,480 Bank service charge 50 Deposit in transit Note collected by bank with RM250 interest 8.250 Outstanding checks 7,160 2,500 ii. What is the adjusted balance on the bank reconciliation? Journalize the necessary entries for West Company based on the bank reconciliation 2. For each of the following items, show the adjustments to be made in the 'bank reconciliation statement using the symbol (+) or (-) under each respective balance. Items Balance as per bank statement (+) or (-) Balance as per cash account (+) or (-) a) Bank service charge b) Deposit in transit c) Dishonoured cheque d) Unpresented cheque e) Customer paid directly to the bank Charge overstated by bank g) Charge understated by bank h) Deposit overstated in journal | . . 1 Normal Title No Spac... Heading 1 Heading 2 Su Styles Paragraph 2. For each of the following items, show the adjustments to be made in the bank reconciliation statement using the symbol (+) or (-) under each respective balance. Items Balance as per bank statement (+) or (-) Balance as per cash account (+) or (-) a) Bank service charge b) Deposit in transit c) Dishonoured cheque d) Unpresented cheque e) Customer paid directly to the bank f) Charge overstated by bank g) Charge understated by bank h) Deposit overstated in journal i) Deposit understated in journal j) Payment overstated in journal k) Payment understated in journal i) Cheque retumed to customer 3. The cash accounts for Mountain Bike Co. at 1 July 2010 indicated a balance of RM12. 470. During July, the total cash deposited was RM26,680 and checks written totaled RM31.500. The bank statement indicated a balance of RM16,750 on 31 July Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items! a) Checks outstanding totaled RM12,850 A DNS 10 -21 That 5.1. 21 PAESE : 3. Paragraph 2000 00 5000 600 AaBbCd AaBbCd AaBbcd AaBb AaBbc Normal Title No Spac... Heading 1 Heading 2 Styles 15 1 0 TOT 12 16 3. The cash accounts for Mountain Bike Co. at 1 July 2010 indicated a balance of RM12,470. During July, the total cash deposited was RM26 680 and checks written totaled RM31,500. The bank statement indicated a balance of RM16.750 on 31 July. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: a) Checks outstanding totaled RM12.850. b) A deposit of RM5,100. representing receipts of 31 July, had been made too late to appear on the bank statement. c) The bank had collected for Mountain Bike Co. RM2,675 on a note left for collection. The face of the note was RM2.500. d) A check for RM370 returned with the statement had been incorrectly charged by the bank! as RM730. e) A check for RM320 retumed with the statement had been recorded by Mountain Bike Co as RM230. The check was for the payment of an obligation to Rain Co on account f) Bank service charges for July amounted to RM25 A check for RM8SO from Hallack Come ratumad hurtha antharanes of insufficien AaBbCd AaBbCd AaBbCd AaBb AaBbG AB 1 Normal Title No Spac... Heading 1 Heading 2 Sut Styles Paragraph c) The bank had collected for Mountain Bike Co. RM2.675 on a note left for collection. The face of the note was RM2,500 d) A check for RM370 returned with the statement had been incorrectly charged by the bank as RM730. e) A check for RM320 returned with the statement had been recorded by Mountain Bike Co. as RM230. The check was for the payment of an obligation to Rain Co. on account. f) Bank service charges for July amounted to RM25. g) A check for RM850 from Hallock Co. was returned by the bank because of insufficient funds. Required: i. Prepare a bank reconciliation as of 31 July ii. Journalize the necessary entries. The accounts have not been closed STRAW CO. Bank Reconciliation April 30, 2010 RM 11,320 Cash balance according to bank statement Add: Outstanding checks No. 315... 360 364 365...... RM450 615 850 775 2.690 MEET#21 | T | 1 Normal Title No Spac... Headingt Heading 2 Subtitle Styles Paragraph 2 3 + 4 + 5 .6 7 . 9 10 11. 112- 1 1 -14 15 16 STRAW CO. Bank Reconciliation April 30, 2010 RM 11,320 Cash balance according to bank statement Add: Outstanding checks No. 315. 360 364. 365. RM450 615 850 775 Deduct: Deposit of April 30. not recorded by bank Adjusted balance...... 2690 14.010 3,330 RM 10,680 RM 7,003 Cash balance according to company's records Add: Proceeds of note collected by bank: Principal. Interest. Service charge RM4,000 120 4.120 18 4,138 11.141 945 Deduct: Check returned because of insufficient funds. Error in recording 20 April deposit of RMS 300 as RM3,500... ........... Adjusted balance... ..........1 800 2,745 RM 11.960 Required: Identify the errors in the following bank reconciliation WA