Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) (15 points) Consider the following IID N(0,1) random variables Xj that come from a pseudo-random number generator: Use these random numbers to construct the

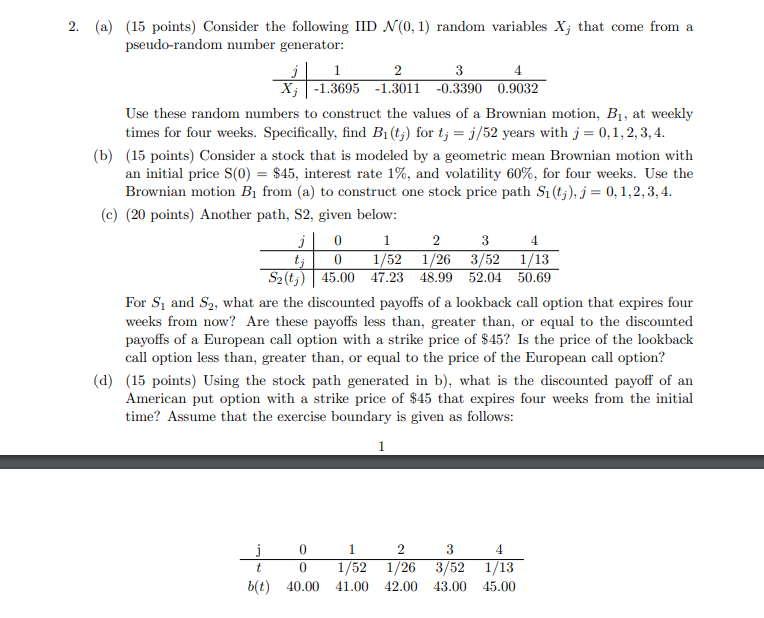

(a) (15 points) Consider the following IID N(0,1) random variables Xj that come from a pseudo-random number generator: Use these random numbers to construct the values of a Brownian motion, B1, at weekly times for four weeks. Specifically, find B1(tj) for tj=j/52 years with j=0,1,2,3,4. (b) (15 points) Consider a stock that is modeled by a geometric mean Brownian motion with an initial price S(0)=$45, interest rate 1%, and volatility 60%, for four weeks. Use the Brownian motion B1 from (a) to construct one stock price path S1(tj),j=0,1,2,3,4. (c) (20 points) Another path, S2, given below: For S1 and S2, what are the discounted payoffs of a lookback call option that expires four weeks from now? Are these payoffs less than, greater than, or equal to the discounted payoffs of a European call option with a strike price of $45 ? Is the price of the lookback call option less than, greater than, or equal to the price of the European call option? (d) (15 points) Using the stock path generated in b), what is the discounted payoff of an American put option with a strike price of $45 that expires four weeks from the initial time? Assume that the exercise boundary is given as follows

(a) (15 points) Consider the following IID N(0,1) random variables Xj that come from a pseudo-random number generator: Use these random numbers to construct the values of a Brownian motion, B1, at weekly times for four weeks. Specifically, find B1(tj) for tj=j/52 years with j=0,1,2,3,4. (b) (15 points) Consider a stock that is modeled by a geometric mean Brownian motion with an initial price S(0)=$45, interest rate 1%, and volatility 60%, for four weeks. Use the Brownian motion B1 from (a) to construct one stock price path S1(tj),j=0,1,2,3,4. (c) (20 points) Another path, S2, given below: For S1 and S2, what are the discounted payoffs of a lookback call option that expires four weeks from now? Are these payoffs less than, greater than, or equal to the discounted payoffs of a European call option with a strike price of $45 ? Is the price of the lookback call option less than, greater than, or equal to the price of the European call option? (d) (15 points) Using the stock path generated in b), what is the discounted payoff of an American put option with a strike price of $45 that expires four weeks from the initial time? Assume that the exercise boundary is given as follows Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started