Question

a. (15 pts) Suppose the country imposes a 25% ad valorem (i.e., as a percentage of price) tariff on the good. Calculate the changes

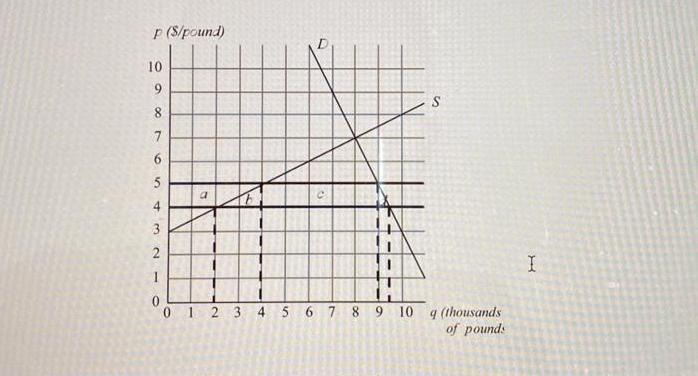

a. (15 pts) Suppose the country imposes a 25% ad valorem (i.e., as a percentage of price) tariff on the good. Calculate the changes in quantities supplied, demanded, and imported, and the welfare effects of the tariff on suppliers, demanders, government, and the country as a whole. Use the labels to show your work. b. (10 pts) Now suppose that the economy is large and can impact the world price. Assume that if it chooses to impose a tariff of $2 per pound of the good, the world price will fall to $3 per pound. Calculate the terms of trade gain for the country. Does welfare for the country as a whole rise or fall as a result of the tariff? By how much? Show your work. P (S/pound) 10 9 8 7 654 3 NO 2 1 S 0 0 1 2 3 4 5 6 7 8 9 10 q (thousands of pounds I

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Trade

Authors: John McLaren

1st edition

0470408790, 978-0470408797

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App