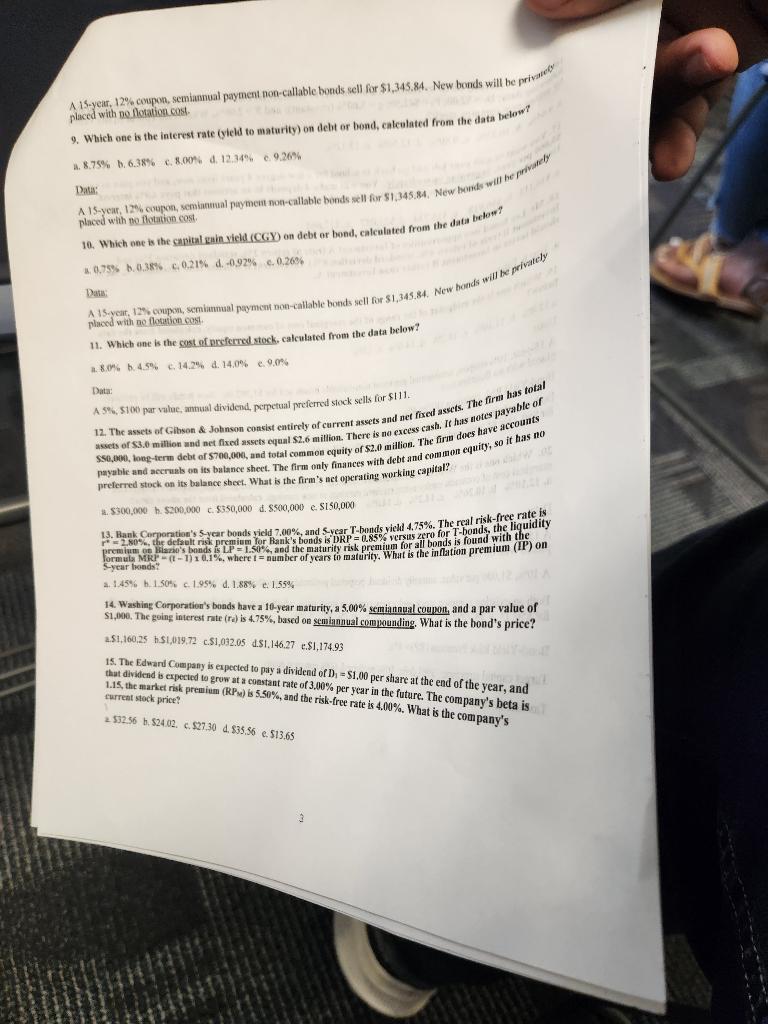

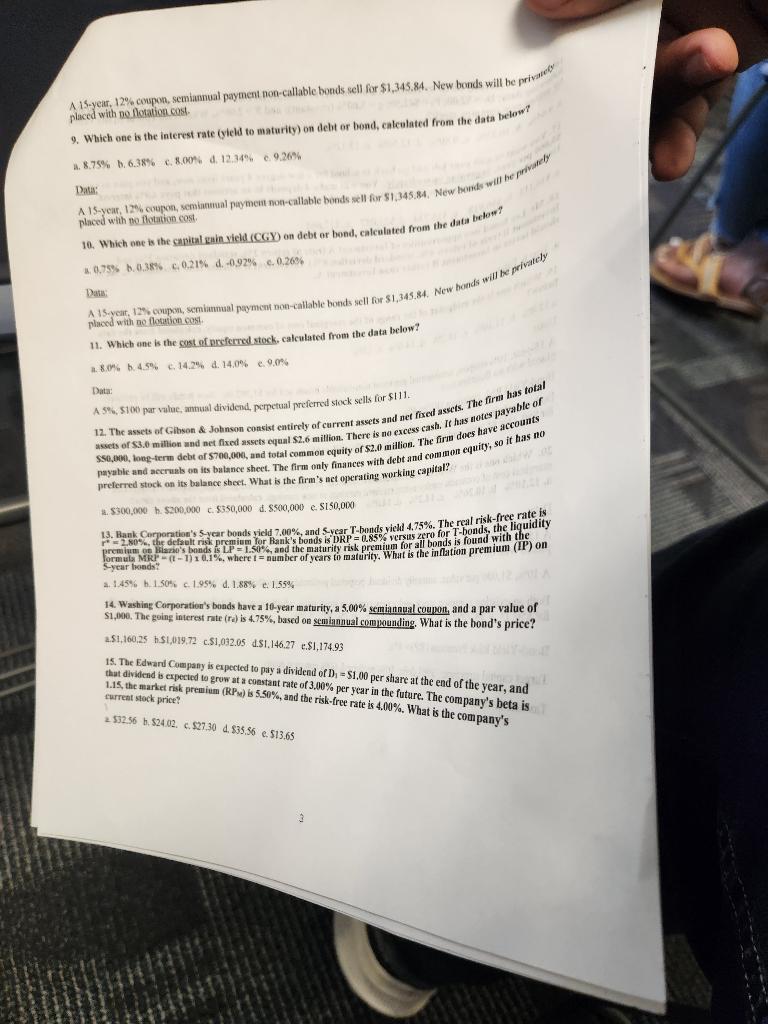

A 15 -year, 12% covspon, semiannal payment non-callable bonds sell for $1,345.84. New bonds will be prival 9. Wbich one is the interest rate (yield to maturity) on deht or bond. calcalated from the data below? placed with no flotation cost. 3. 8.75% b. 6.3876 c. 8.094 d. 12.34% o. 9.26% Distis: 10. Which one is the chpital gain yield (CGY) on debt or bond, caleulated from the datia below? placed whith no thotation cost A 15.ycir, 12% coupon, semiumual payment non-callable bonds sell for 51,345.84. New honds wil] be privith placed with no flotution cost. i., 0,75% b. 0,38% c. 0,21% d. 0,92% c. 0,26% Dass: 11. Which ane is the gost of preferred stock, calculated from the data below? a. 8.0% b. 4.5% c. 14.2% d. 14.0% e. 9.0% 12. The sssets of Gibson \& Jobnson consist entirely of current assets and net fixed asects. The firal lias total Data: A 5\%, 5100 par vulue, monal dividend, pometual preferted siock sells for $111. asses of $3.0 miltion and net fixed assets equal $2.6 million. There is no excess cash. It has uletes payable of S\$Q,000, hoe-term debt of 5700,000 , and total commos cquity of $2,0 million. The firm des have accounts payabic and acerumb on its bulance sheet. The firm only finances with debt and connont equity, so it has no preferred stock on its belance sbeet. What is the firm's net operating working capital? 3. $300,000 h. $200,000 c. $550,000 d. $500,000 e. $150,000 13. Bank Corporation's 5-year bonds rield 7.00%, and 5 -year T-bonds yied 4.75%. The real risk-free rate is r2=2.80%, the defoult risk premiem for Bank's bonds is DRP =0.85% versas zero for T-bonds, the liquidity premium on Bismo's bonds is LP=1.50% and the maturity risk premiun for all bonds is found with the Hormula Mrer (t1)10,1%, where t= number of years to maturity. What is the inflation premium (IPP) on 5-ycar hoeds: a. 1.45% b. 1.50% c. 1.95% d. 1.88% e. 1.55% 14. Washing Corporation's boads bave a 10-year maturity, a 5,00% remiannual coupon, and a par value of 51,000, The going interest nte ( re ) is 4.75%, based on semignmual comenouding. What is the bond's price? a.S1,160,25 h.\$1,019,72 c.\$1,032.05 d.\$1.146.27 e.\$1,174.93 15. The Edward Company is expected to pay a dividend of D3=$1,00 per stiare at the end of the year, and that dividend is expected to grow at a constant rate of 3,00% per fear in the future. The company's beta is 1.15, the market risk premium (RPs) is 5.50%, and the rish-free rate is 4.00%. What is the company's furreat stock price? 2532.56 b. 524.02 . c. $27,30 d. 835,56 e. 513,65 A 15 -year, 12% covspon, semiannal payment non-callable bonds sell for $1,345.84. New bonds will be prival 9. Wbich one is the interest rate (yield to maturity) on deht or bond. calcalated from the data below? placed with no flotation cost. 3. 8.75% b. 6.3876 c. 8.094 d. 12.34% o. 9.26% Distis: 10. Which one is the chpital gain yield (CGY) on debt or bond, caleulated from the datia below? placed whith no thotation cost A 15.ycir, 12% coupon, semiumual payment non-callable bonds sell for 51,345.84. New honds wil] be privith placed with no flotution cost. i., 0,75% b. 0,38% c. 0,21% d. 0,92% c. 0,26% Dass: 11. Which ane is the gost of preferred stock, calculated from the data below? a. 8.0% b. 4.5% c. 14.2% d. 14.0% e. 9.0% 12. The sssets of Gibson \& Jobnson consist entirely of current assets and net fixed asects. The firal lias total Data: A 5\%, 5100 par vulue, monal dividend, pometual preferted siock sells for $111. asses of $3.0 miltion and net fixed assets equal $2.6 million. There is no excess cash. It has uletes payable of S\$Q,000, hoe-term debt of 5700,000 , and total commos cquity of $2,0 million. The firm des have accounts payabic and acerumb on its bulance sheet. The firm only finances with debt and connont equity, so it has no preferred stock on its belance sbeet. What is the firm's net operating working capital? 3. $300,000 h. $200,000 c. $550,000 d. $500,000 e. $150,000 13. Bank Corporation's 5-year bonds rield 7.00%, and 5 -year T-bonds yied 4.75%. The real risk-free rate is r2=2.80%, the defoult risk premiem for Bank's bonds is DRP =0.85% versas zero for T-bonds, the liquidity premium on Bismo's bonds is LP=1.50% and the maturity risk premiun for all bonds is found with the Hormula Mrer (t1)10,1%, where t= number of years to maturity. What is the inflation premium (IPP) on 5-ycar hoeds: a. 1.45% b. 1.50% c. 1.95% d. 1.88% e. 1.55% 14. Washing Corporation's boads bave a 10-year maturity, a 5,00% remiannual coupon, and a par value of 51,000, The going interest nte ( re ) is 4.75%, based on semignmual comenouding. What is the bond's price? a.S1,160,25 h.\$1,019,72 c.\$1,032.05 d.\$1.146.27 e.\$1,174.93 15. The Edward Company is expected to pay a dividend of D3=$1,00 per stiare at the end of the year, and that dividend is expected to grow at a constant rate of 3,00% per fear in the future. The company's beta is 1.15, the market risk premium (RPs) is 5.50%, and the rish-free rate is 4.00%. What is the company's furreat stock price? 2532.56 b. 524.02 . c. $27,30 d. 835,56 e. 513,65