Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. $157,331.88 B. $196,131.39 C. $177,528.67 D. $187, 073.73 E. $169, 157.01 Question 11 (3 points) Wellington Corp would like to purchase a machine and

A. $157,331.88 B. $196,131.39 C. $177,528.67 D. $187, 073.73 E. $169,157.01

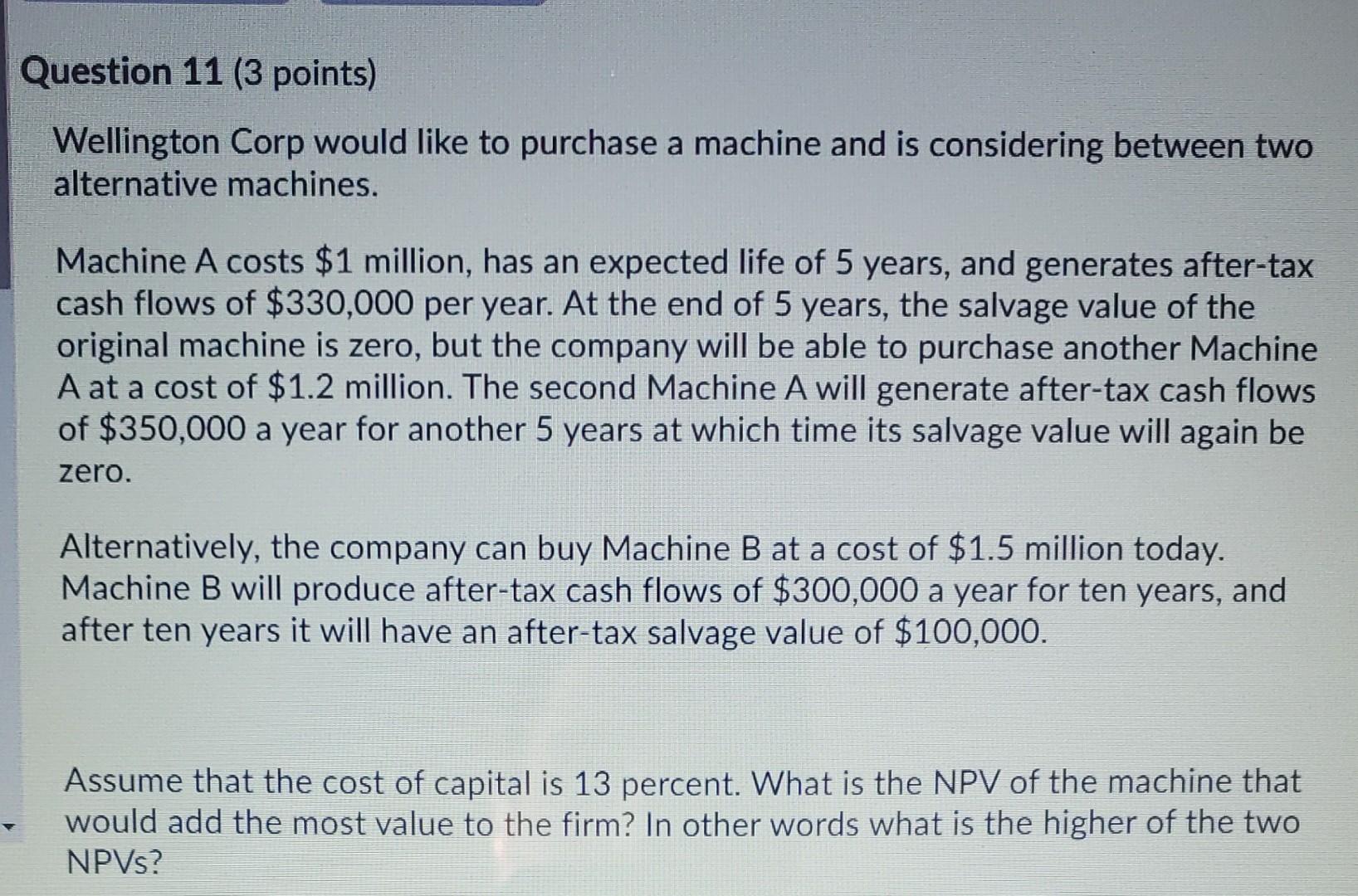

Question 11 (3 points) Wellington Corp would like to purchase a machine and is considering between two alternative machines. Machine A costs $1 million, has an expected life of 5 years, and generates after-tax cash flows of $330,000 per year. At the end of 5 years, the salvage value of the original machine is zero, but the company will be able to purchase another Machine A at a cost of $1.2 million. The second Machine A will generate after-tax cash flows of $350,000 a year for another 5 years at which time its salvage value will again be zero. Alternatively, the company can buy Machine B at a cost of $1.5 million today. Machine B will produce after-tax cash flows of $300,000 a year for ten years, and after ten years it will have an after-tax salvage value of $100,000. Assume that the cost of capital is 13 percent. What is the NPV of the machine that would add the most value to the firm? In other words what is the higher of the two NPVsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started