Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. 18. Assuming an interest rate of 2.125% p.a., but with monthly compounding, what is the future value at the end of year 37 of

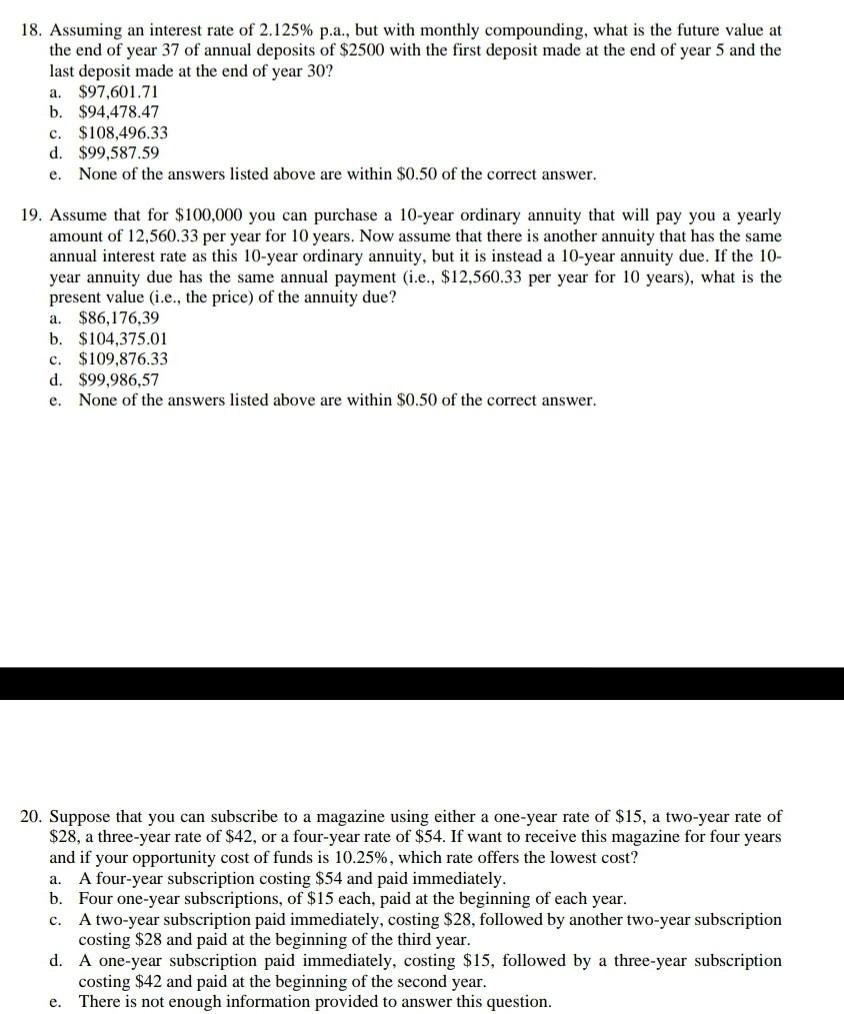

a. 18. Assuming an interest rate of 2.125% p.a., but with monthly compounding, what is the future value at the end of year 37 of annual deposits of $2500 with the first deposit made at the end of year 5 and the last deposit made at the end of year 30? $97.601.71 b. $94,478.47 $108,496.33 d. $99,587.59 None of the answers listed above are within $0.50 of the correct answer. c. e. 19. Assume that for $100,000 you can purchase a 10-year ordinary annuity that will pay you a yearly amount of 12,560.33 per year for 10 years. Now assume that there is another annuity that has the same annual interest rate as this 10-year ordinary annuity, but it is instead a 10-year annuity due. If the 10- year annuity due has the same annual payment (i.e., $12,560.33 per year for 10 years), what is the present value (i.e., the price) of the annuity due? $86,176,39 b. $104,375.01 c. $109,876.33 d. $99,986,57 None of the answers listed above are within $0.50 of the correct answer. a. e. 20. Suppose that you can subscribe to a magazine using either a one-year rate of $15, a two-year rate of $28, a three-year rate of $42, or a four-year rate of $54. If want to receive this magazine for four years and if your opportunity cost of funds is 10.25%, which rate offers the lowest cost? a. A four-year subscription costing $54 and paid immediately. b. Four one-year subscriptions, of $15 each, paid at the beginning of each year. c. A two-year subscription paid immediately, costing $28, followed by another two-year subscription costing $28 and paid at the beginning of the third year. d. A one-year subscription paid immediately, costing $15, followed by a three-year subscription costing $42 and paid at the beginning of the second year. There is not enough information provided to answer this question. e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started