Answered step by step

Verified Expert Solution

Question

1 Approved Answer

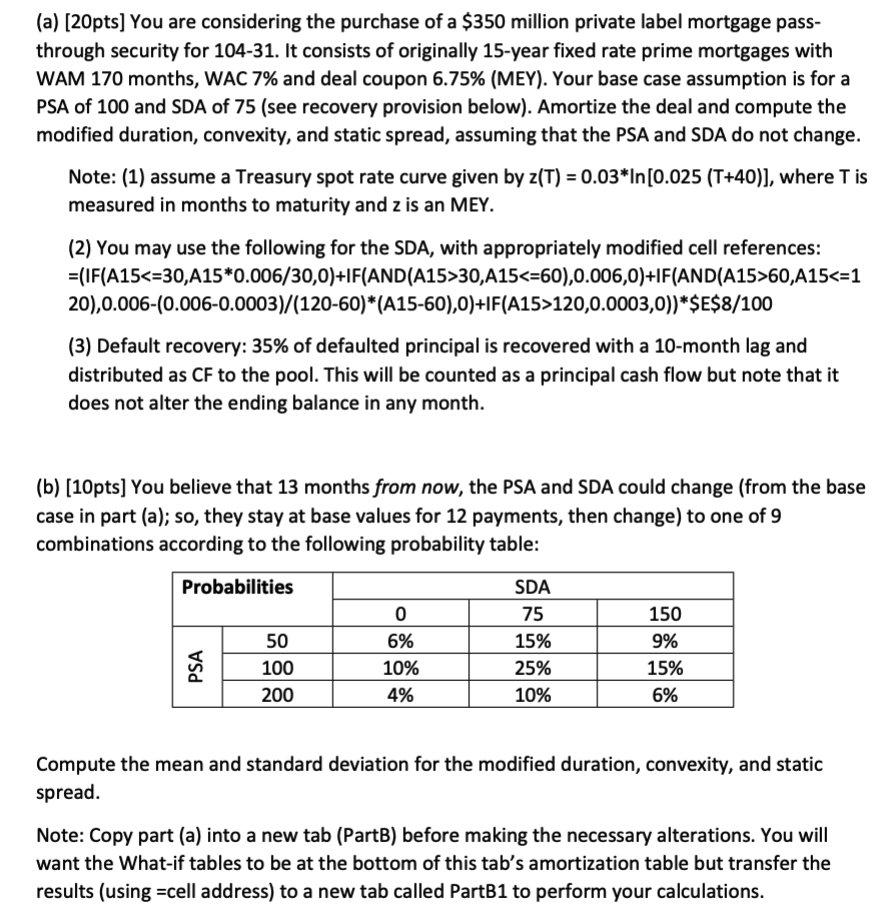

( a ) [ 2 0 pts ] You are considering the purchase of a $ 3 5 0 million private label mortgage pass -

apts You are considering the purchase of a $ million private label mortgage pass

through security for It consists of originally year fixed rate prime mortgages with

WAM months, WAC and deal coupon MEY Your base case assumption is for a

PSA of and SDA of see recovery provision below Amortize the deal and compute the

modified duration, convexity, and static spread, assuming that the PSA and SDA do not change.

Note: assume a Treasury spot rate curve given by where is

measured in months to maturity and is an MEY.

You may use the following for the SDA, with appropriately modified cell references:

Default recovery: of defaulted principal is recovered with a month lag and

distributed as CF to the pool. This will be counted as a principal cash flow but note that it

does not alter the ending balance in any month.

bpts You believe that months from now, the PSA and SDA could change from the base

case in part a; so they stay at base values for payments, then change to one of

combinations according to the following probability table:

Compute the mean and standard deviation for the modified duration, convexity, and static

spread.

Note: Copy part a into a new tab PartB before making the necessary alterations. You will

want the Whatif tables to be at the bottom of this tab's amortization table but transfer the

results using cell address to a new tab called PartB to perform your calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started