Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) 25% Contribution margin Percent =(SP - VC)/ SP B) $ 4,000.00 C) $ 16,000.00 sold Contribution margin Percent = (4000 - 3000)/4000 Sales

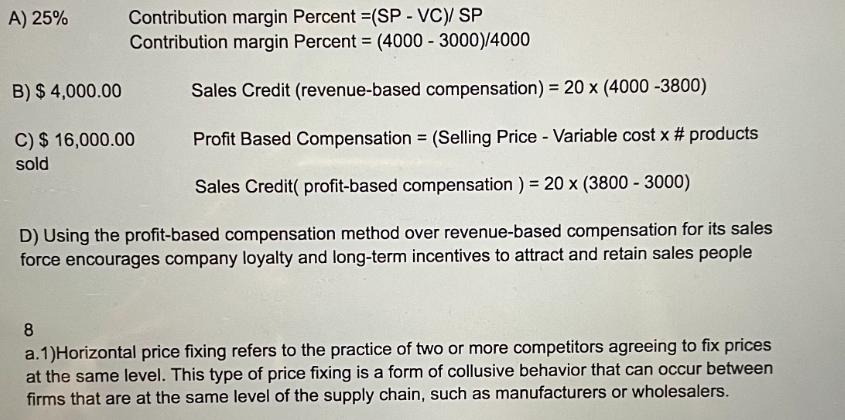

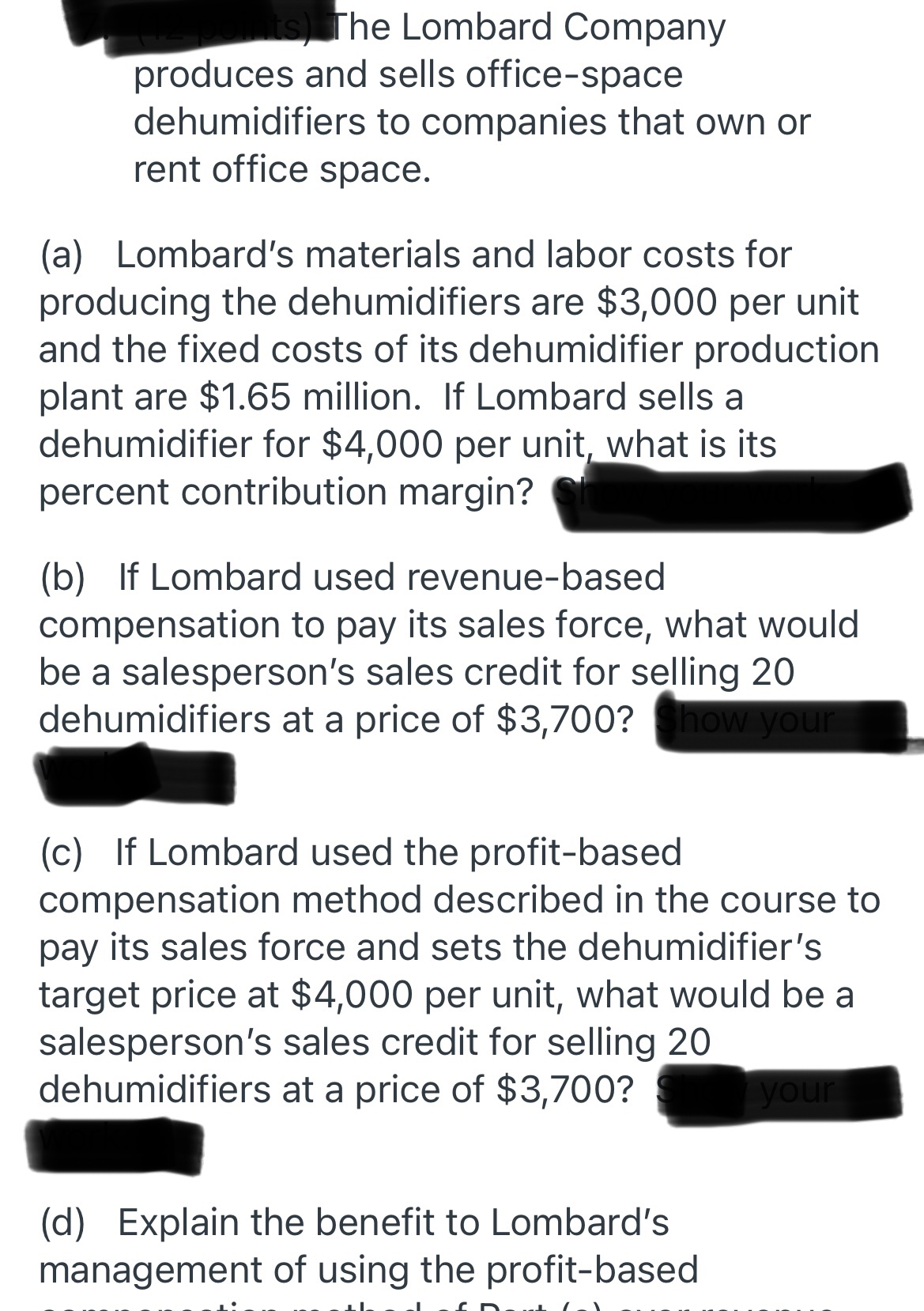

A) 25% Contribution margin Percent =(SP - VC)/ SP B) $ 4,000.00 C) $ 16,000.00 sold Contribution margin Percent = (4000 - 3000)/4000 Sales Credit (revenue-based compensation) = 20 x (4000 -3800) Profit Based Compensation = (Selling Price - Variable cost x # products Sales Credit( profit-based compensation ) = 20 x (3800 - 3000) D) Using the profit-based compensation method over revenue-based compensation for its sales force encourages company loyalty and long-term incentives to attract and retain sales people 8 a.1)Horizontal price fixing refers to the practice of two or more competitors agreeing to fix prices at the same level. This type of price fixing is a form of collusive behavior that can occur between firms that are at the same level of the supply chain, such as manufacturers or wholesalers. ts) The Lombard Company produces and sells office-space dehumidifiers to companies that own or rent office space. (a) Lombard's materials and labor costs for producing the dehumidifiers are $3,000 per unit and the fixed costs of its dehumidifier production plant are $1.65 million. If Lombard sells a dehumidifier for $4,000 per unit, what is its percent contribution margin? (b) If Lombard used revenue-based compensation to pay its sales force, what would be a salesperson's sales credit for selling 20 dehumidifiers at a price of $3,700? Show your (c) If Lombard used the profit-based compensation method described in the course to pay its sales force and sets the dehumidifier's target price at $4,000 per unit, what would be a salesperson's sales credit for selling 20 dehumidifiers at a price of $3,700? (d) Explain the benefit to Lombard's management of using the profit-based your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started