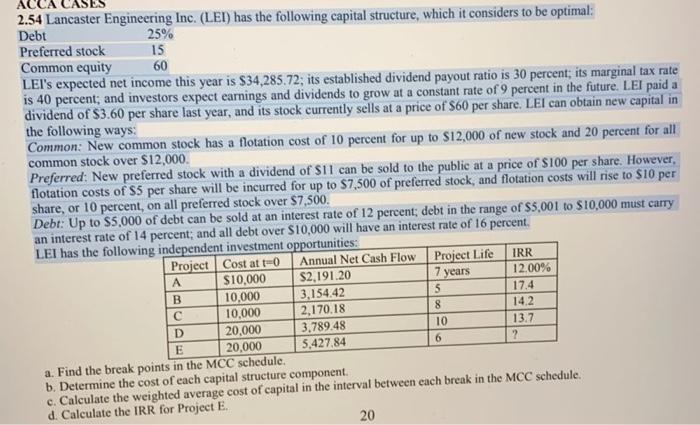

a 2.54 Lancaster Engineering Inc. (LEI) has the following capital structure, which it considers to be optimal: Debt 25% Preferred stock 15 Common equity 60 LEI's expected net income this year is $34,285.72; its established dividend payout ratio is 30 percent; its marginal tax rate is 40 percent; and investors expect earnings and dividends to grow at a constant rate of 9 percent in the future. LEI paid a dividend of $3.60 per share last year, and its stock currently sells at a price of $60 per share. LEI can obtain new capital in the following ways: Common: New common stock has a flotation cost of 10 percent for up to $12,000 of new stock and 20 percent for all common stock over $12,000. Preferred: New preferred stock with a dividend of $11 can be sold to the public at a price of $100 per share. However, flotation costs of $5 per share will be incurred for up to $7,500 of preferred stock, and flotation costs will rise to $10 per share, or 10 percent, on all preferred stock over $7,500. Debt: Up to $5,000 of debt can be sold at an interest rate of 12 percent; debt in the range of $5,001 to $10,000 must carry an interest rate of 14 percent; and all debt over $10,000 will have an interest rate of 16 percent, LEI has the following independent investment opportunities: Project Cost at t=0 Annual Net Cash Flow Project Life $10,000 $2.191.20 7 years 12.00% 10,000 3,154.42 17.4 10,000 2,170.18 20,000 3.789.48 20,000 5,427.84 a. Find the break points in the MCC schedule. b. Determine the cost of each capital structure component. e. Calculate the weighted average cost of capital in the interval between each break in the MCC schedule. d. Calculate the IRR for Project E. 20 IRR B D E 5 8 10 14.2 13.7 ? 6 a 2.54 Lancaster Engineering Inc. (LEI) has the following capital structure, which it considers to be optimal: Debt 25% Preferred stock 15 Common equity 60 LEI's expected net income this year is $34,285.72; its established dividend payout ratio is 30 percent; its marginal tax rate is 40 percent; and investors expect earnings and dividends to grow at a constant rate of 9 percent in the future. LEI paid a dividend of $3.60 per share last year, and its stock currently sells at a price of $60 per share. LEI can obtain new capital in the following ways: Common: New common stock has a flotation cost of 10 percent for up to $12,000 of new stock and 20 percent for all common stock over $12,000. Preferred: New preferred stock with a dividend of $11 can be sold to the public at a price of $100 per share. However, flotation costs of $5 per share will be incurred for up to $7,500 of preferred stock, and flotation costs will rise to $10 per share, or 10 percent, on all preferred stock over $7,500. Debt: Up to $5,000 of debt can be sold at an interest rate of 12 percent; debt in the range of $5,001 to $10,000 must carry an interest rate of 14 percent; and all debt over $10,000 will have an interest rate of 16 percent, LEI has the following independent investment opportunities: Project Cost at t=0 Annual Net Cash Flow Project Life $10,000 $2.191.20 7 years 12.00% 10,000 3,154.42 17.4 10,000 2,170.18 20,000 3.789.48 20,000 5,427.84 a. Find the break points in the MCC schedule. b. Determine the cost of each capital structure component. e. Calculate the weighted average cost of capital in the interval between each break in the MCC schedule. d. Calculate the IRR for Project E. 20 IRR B D E 5 8 10 14.2 13.7 ? 6