Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A $ 3 6 0 0 0 0 . 0 0 mortgage is amortized by making monthly payments of $ 2 6 0 0 .

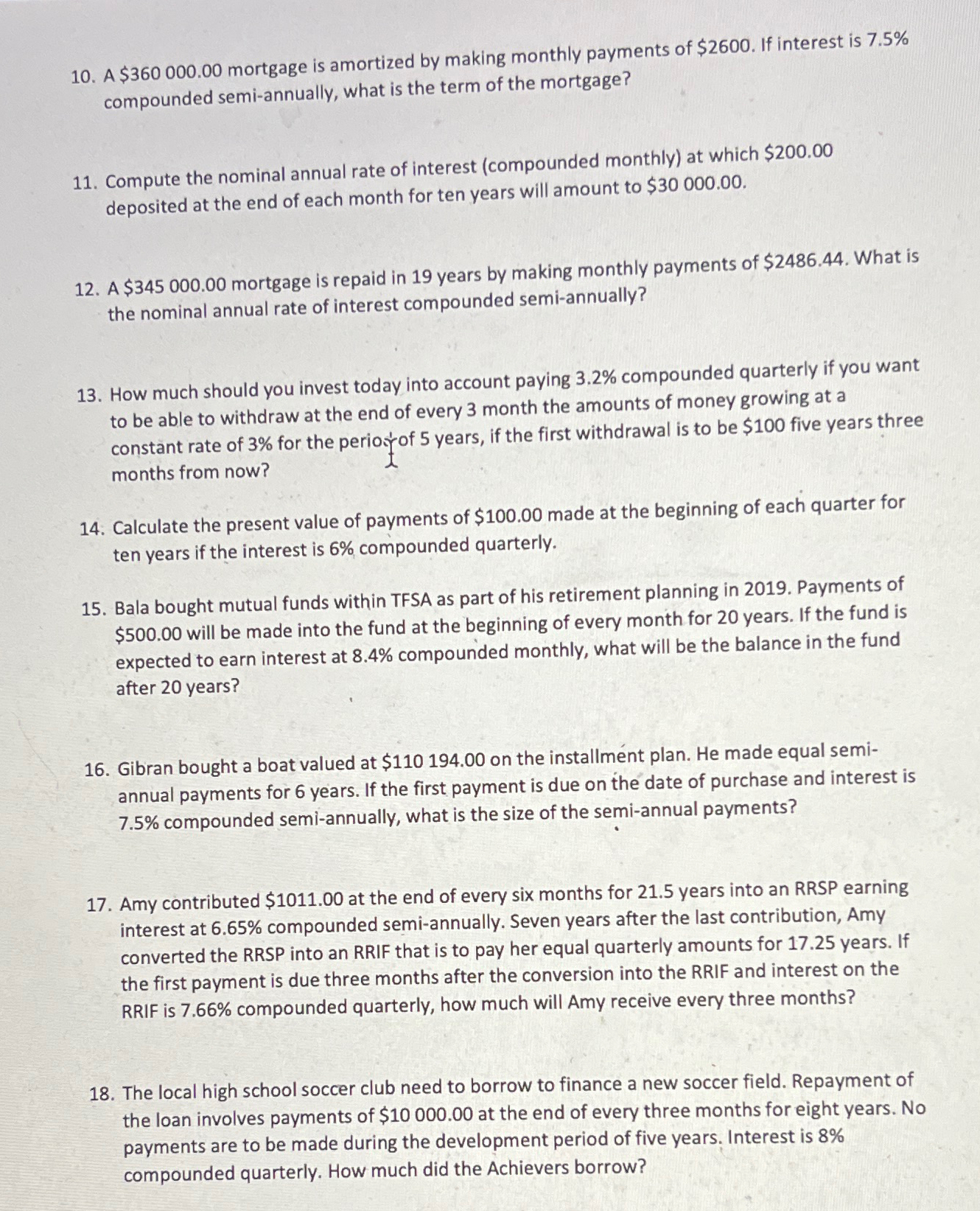

A $ mortgage is amortized by making monthly payments of $ If interest is compounded semiannually, what is the term of the mortgage? Compute the nominal annual rate of interest compounded monthly at which $ deposited at the end of each month for ten years will amount to $ A $ mortgage is repaid in years by making monthly payments of $ What is the nominal annual rate of interest compounded semiannually? How much should you invest today into account paying compounded quarterly if you want to be able to withdraw at the end of every month the amounts of money growing at a constant rate of for the perio of years, if the first withdrawal is to be $ five years three months from now? Calculate the present value of payments of $ made at the beginning of each quarter for ten years if the interest is compounded quarterly. Bala bought mutual funds within TFSA as part of his retirement planning in Payments of $ will be made into the fund at the beginning of every month for years. If the fund is expected to earn interest at compounded monthly, what will be the balance in the fund after years? Gibran bought a boat valued at $ on the installment plan. He made equal semiannual payments for years. If the first payment is due on the date of purchase and interest is compounded semiannually, what is the size of the semiannual payments? Amy contributed $ at the end of every six months for years into an RRSP earning interest at compounded semiannually. Seven years after the last contribution, Amy converted the RRSP into an RRIF that is to pay her equal quarterly amounts for years. If the first payment is due three months after the conversion into the RRIF and interest on the RRIF is compounded quarterly, how much will Amy receive every three months? The local high school soccer club need to borrow to finance a new soccer field. Repayment of the loan involves payments of $ at the end of every three months for eight years. No payments are to be made during the development period of five years. Interest is compounded quarterly. How much did the Achievers borrow?

A $ mortgage is amortized by making monthly payments of $ If interest is compounded semiannually, what is the term of the mortgage?

Compute the nominal annual rate of interest compounded monthly at which $ deposited at the end of each month for ten years will amount to $

A $ mortgage is repaid in years by making monthly payments of $ What is the nominal annual rate of interest compounded semiannually?

How much should you invest today into account paying compounded quarterly if you want to be able to withdraw at the end of every month the amounts of money growing at a constant rate of for the perio of years, if the first withdrawal is to be $ five years three months from now?

Calculate the present value of payments of $ made at the beginning of each quarter for ten years if the interest is compounded quarterly.

Bala bought mutual funds within TFSA as part of his retirement planning in Payments of $ will be made into the fund at the beginning of every month for years. If the fund is expected to earn interest at compounded monthly, what will be the balance in the fund after years?

Gibran bought a boat valued at $ on the installment plan. He made equal semiannual payments for years. If the first payment is due on the date of purchase and interest is compounded semiannually, what is the size of the semiannual payments?

Amy contributed $ at the end of every six months for years into an RRSP earning interest at compounded semiannually. Seven years after the last contribution, Amy converted the RRSP into an RRIF that is to pay her equal quarterly amounts for years. If the first payment is due three months after the conversion into the RRIF and interest on the RRIF is compounded quarterly, how much will Amy receive every three months?

The local high school soccer club need to borrow to finance a new soccer field. Repayment of the loan involves payments of $ at the end of every three months for eight years. No payments are to be made during the development period of five years. Interest is compounded quarterly. How much did the Achievers borrow?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started