Answered step by step

Verified Expert Solution

Question

1 Approved Answer

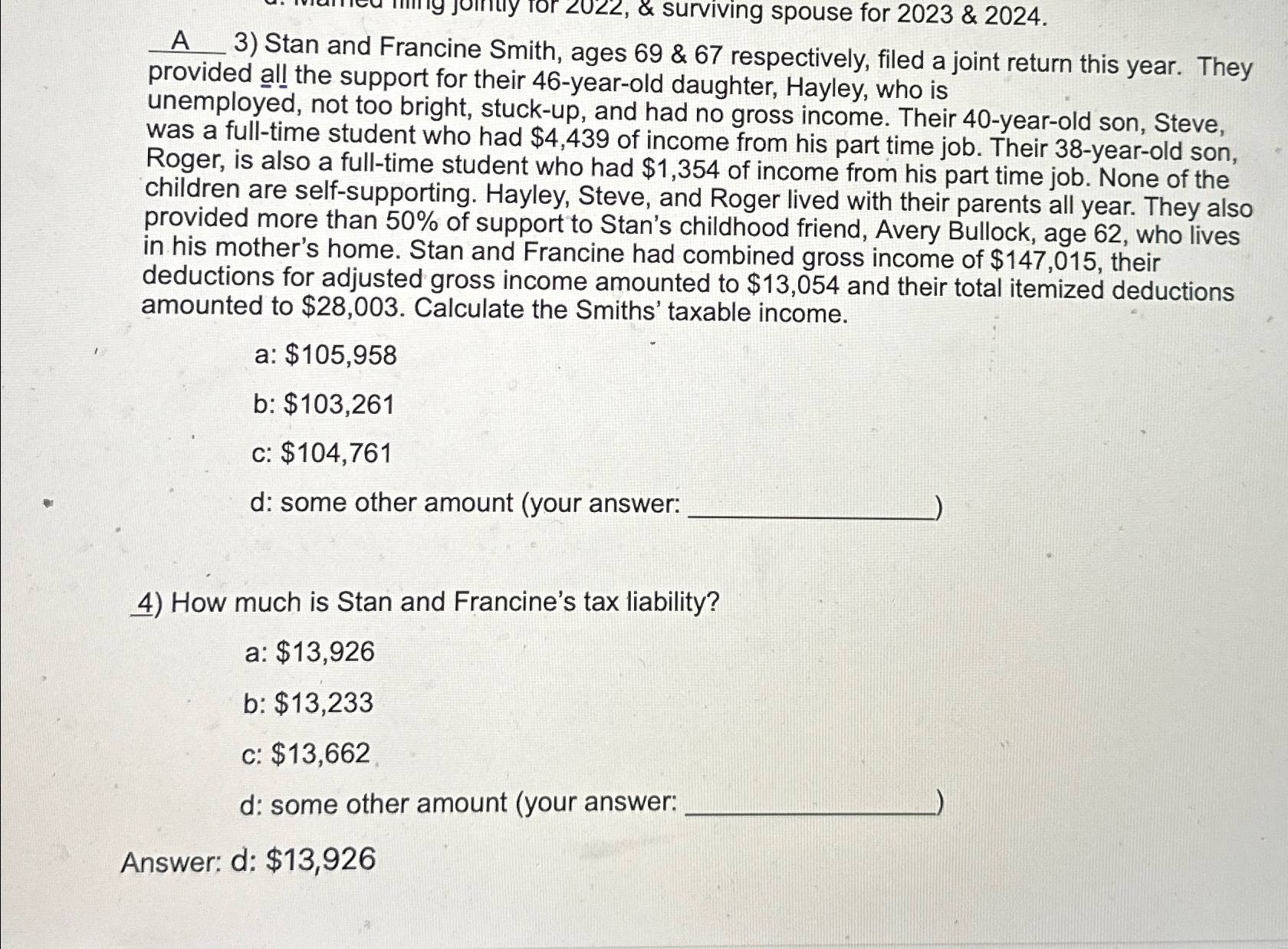

A 3 ) Stan and Francine Smith, ages 6 9 & 6 7 respectively, filed a joint return this year. They provided all the support

A Stan and Francine Smith, ages & respectively, filed a joint return this year. They provided all the support for their yearold daughter, Hayley, who is unemployed, not too bright, stuckup and had no gross income. Their yearold son, Steve, was a fulltime student who had $ of income from his part time job. Their yearold son, Roger, is also a fulltime student who had $ of income from his part time job. None of the children are selfsupporting. Hayley, Steve, and Roger lived with their parents all year. They also provided more than of support to Stan's childhood friend, Avery Bullock, age who lives in his mother's home. Stan and Francine had combined gross income of $ their deductions for adjusted gross income amounted to $ and their total itemized deductions amounted to $ Calculate the Smiths' taxable income.

a: $

b: $

c: $

d: some other amount your answer:

How much is Stan and Francine's tax liability?

a: $

b: $

c: $

d: some other amount your answer:

Answer: d: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started