Question: A 30 -year maturity, 7% coupon bond paying coupons semiannually is callable in five years at a call price of $1,100. The bond curre sells

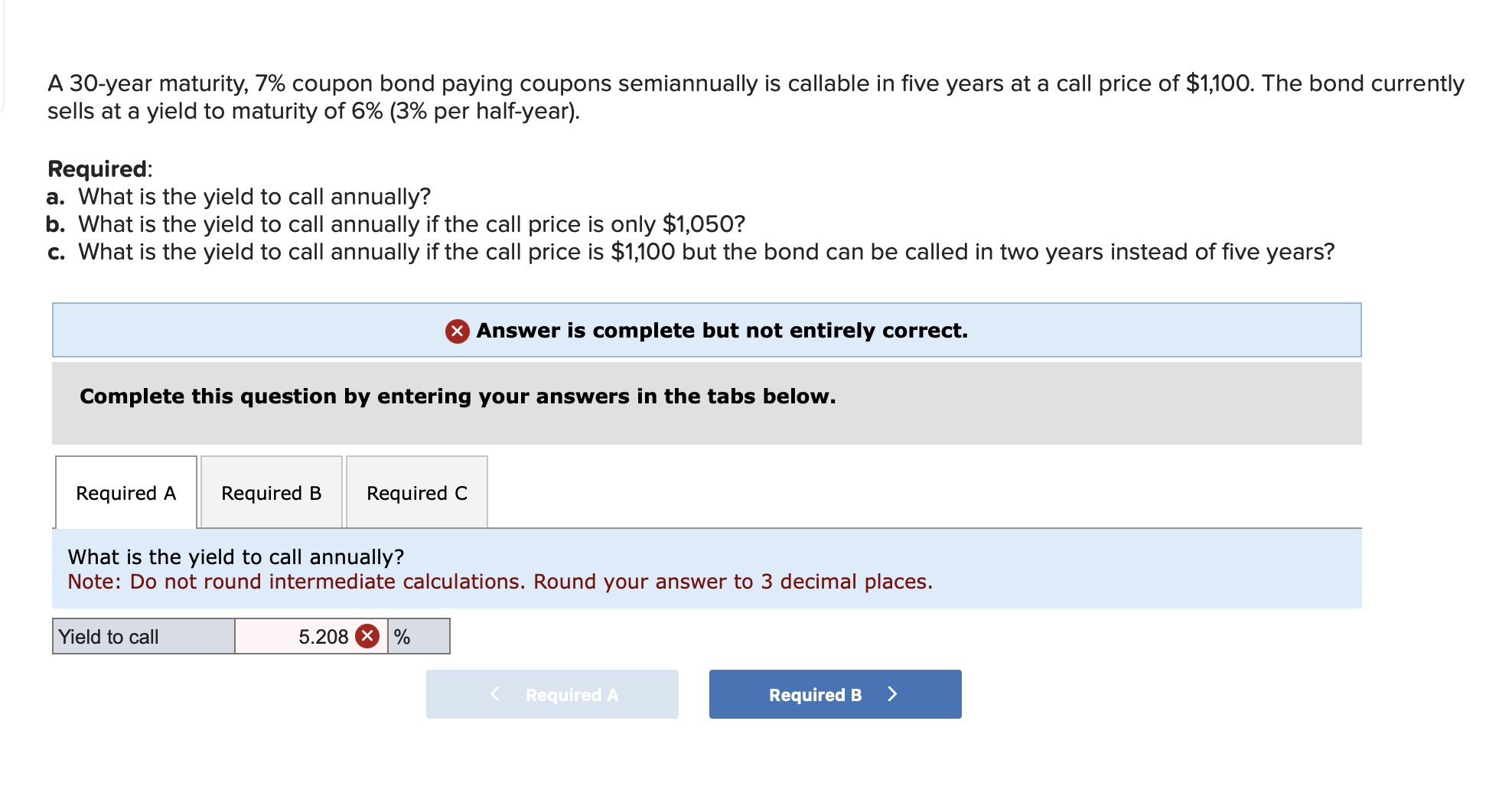

A 30 -year maturity, 7% coupon bond paying coupons semiannually is callable in five years at a call price of $1,100. The bond curre sells at a yield to maturity of 6% (3\% per half-year). Required: a. What is the yield to call annually? b. What is the yield to call annually if the call price is only $1,050 ? c. What is the yield to call annually if the call price is $1,100 but the bond can be called in two years instead of five years? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the yield to call annually? Note: Do not round intermediate calculations. Round your answer to 3 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts