Question

A 30-year bond with face amount 10,000 is bought to yield (2) .08. In each of the following cases find the purchase price of

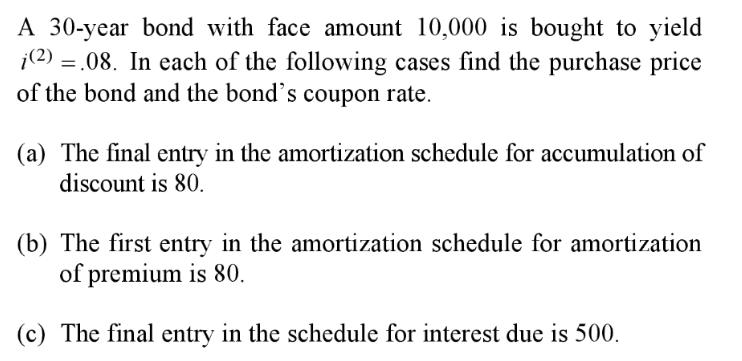

A 30-year bond with face amount 10,000 is bought to yield (2) .08. In each of the following cases find the purchase price of the bond and the bond's coupon rate. (a) The final entry in the amortization schedule for accumulation of discount is 80. (b) The first entry in the amortization schedule for amortization of premium is 80. (c) The final entry in the schedule for interest due is 500.

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To find the purchase price of the bond and the bonds coupon rate we need to calculate the present value of the bonds cash flows based on the given yield rate Lets calculate them for each case a The fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investments

Authors: Zvi Bodie, Alex Kane, Alan Marcus, Stylianos Perrakis, Peter

8th Canadian Edition

007133887X, 978-0071338875

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App