Answered step by step

Verified Expert Solution

Question

1 Approved Answer

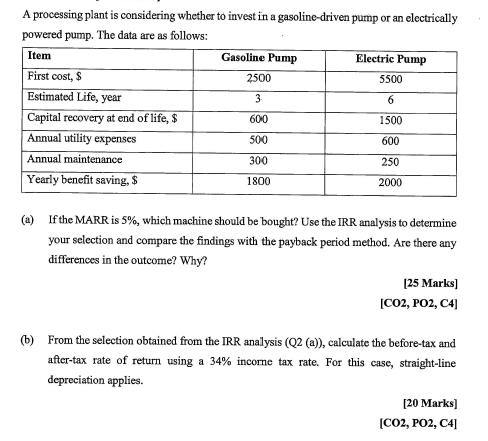

A processing plant is considering whether to invest in a gasoline-driven pump or an electrically powered pump. The data are as follows: Item First

A processing plant is considering whether to invest in a gasoline-driven pump or an electrically powered pump. The data are as follows: Item First cost, $ Estimated Life, year Capital recovery at end of life, $ Annual utility expenses Annual maintenance Yearly benefit saving, $ Gasoline Pump 2500 3 600 500 300 1800 Electric Pump 5500 6 1500 600 250 2000 (a) If the MARR is 5%, which machine should be bought? Use the IRR analysis to determine your selection and compare the findings with the payback period method. Are there any differences in the outcome? Why? [25 Marks] [CO2, PO2, C4] the before-tax and (b) From the selection obtained from the IRR analysis (Q2 (a)), calculate after-tax rate of return using a 34% incorne tax rate. For this case, straight-line depreciation applies. [20 Marks] [CO2, PO2, C4]

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Ans SOLUTION STATEMENT OF FINANCIAL POSITION OF SAHARA TRADERS AS AT 28TH FEB2021 Balanc sheet is a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started