Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A 30-year zero-coupon bond yields 8% today and has a face value of $100. The price of such a bond can be calculated using

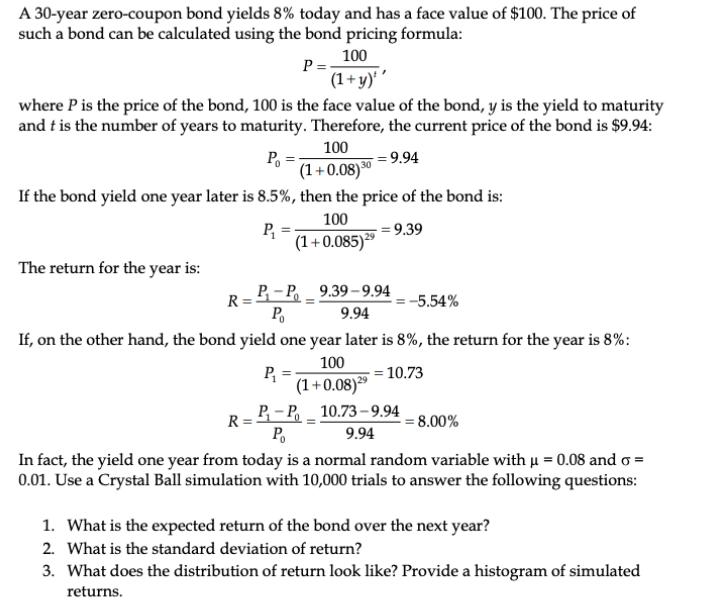

A 30-year zero-coupon bond yields 8% today and has a face value of $100. The price of such a bond can be calculated using the bond pricing formula: P=- 100 (1+y)'' where P is the price of the bond, 100 is the face value of the bond, y is the yield to maturity and t is the number of years to maturity. Therefore, the current price of the bond is $9.94: P = 100 (1+0.08)30 -= 9.94 If the bond yield one year later is 8.5%, then the price of the bond is: P The return for the year is: 100 (1+0.085)29 = 9.39 R=P-P-9.39-9.94 = -5.54% 9.94 If, on the other hand, the bond yield one year later is 8%, the return for the year is 8%: 100 P = = 10.73 (1+0.08)29 P-P R Po 10.73-9.94 9.94 8.00% In fact, the yield one year from today is a normal random variable with = 0.08 and = 0.01. Use a Crystal Ball simulation with 10,000 trials to answer the following questions: 1. What is the expected return of the bond over the next year? 2. What is the standard deviation of return? 3. What does the distribution of return look like? Provide a histogram of simulated returns.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started