Question

The average return on a security with a beta of 0.3 is $13.09 per year. The risk free rate is 0.02 and the return

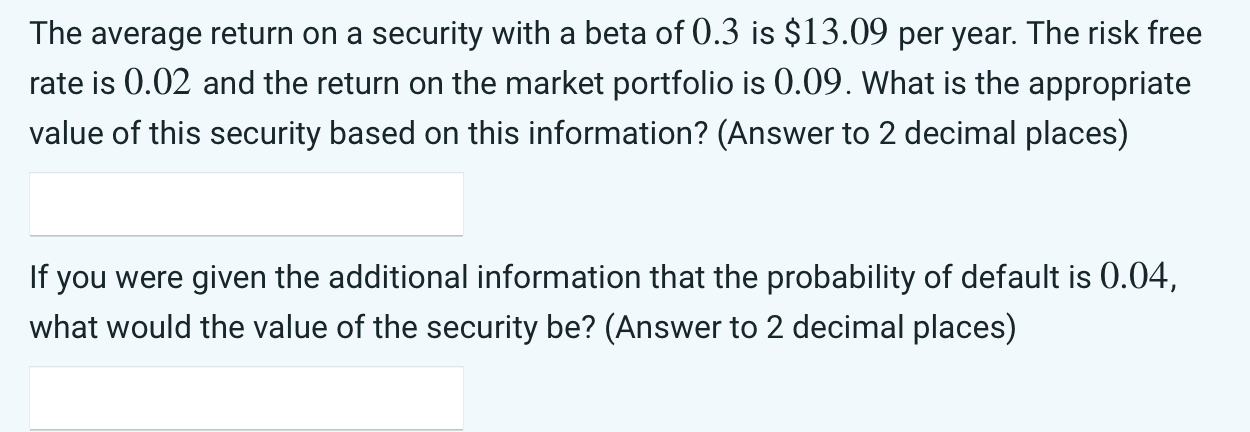

The average return on a security with a beta of 0.3 is $13.09 per year. The risk free rate is 0.02 and the return on the market portfolio is 0.09. What is the appropriate value of this security based on this information? (Answer to 2 decimal places) If you were given the additional information that the probability of default is 0.04, what would the value of the security be? (Answer to 2 decimal places)

Step by Step Solution

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the appropriate value of the security based on the provided information we can use the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Econometrics

Authors: R Carter Hill, William E Griffiths, Guay C Lim

5th Edition

1118452275, 9781118452271

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App