Question: A 3-year project is under consideration. Here's what's known about its cash flows: $3,000,000 would need to be spent immediately to buy production equipment

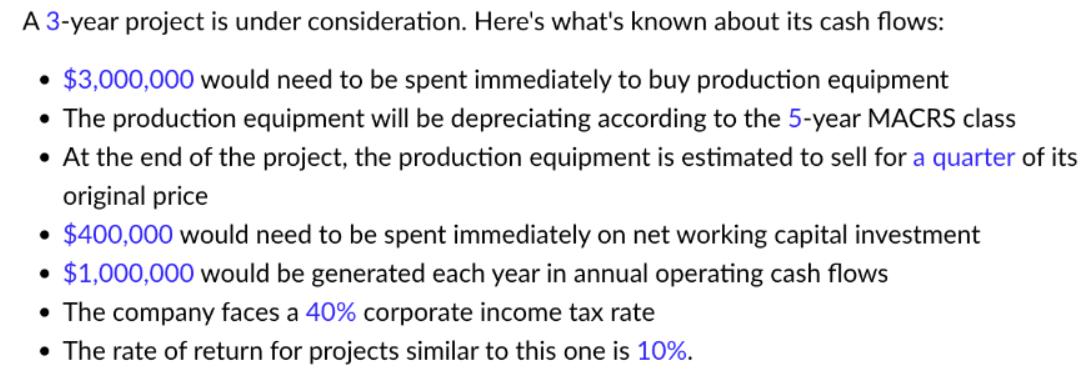

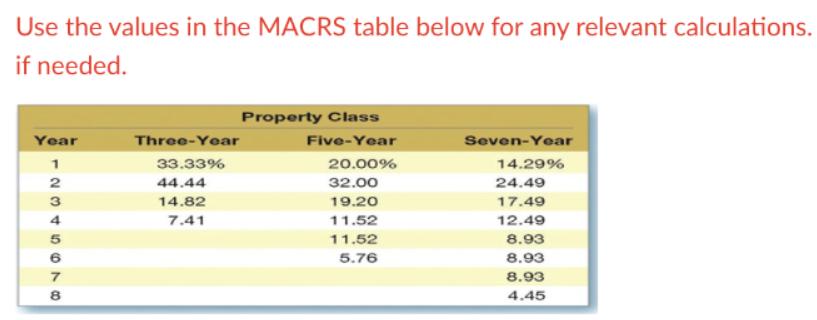

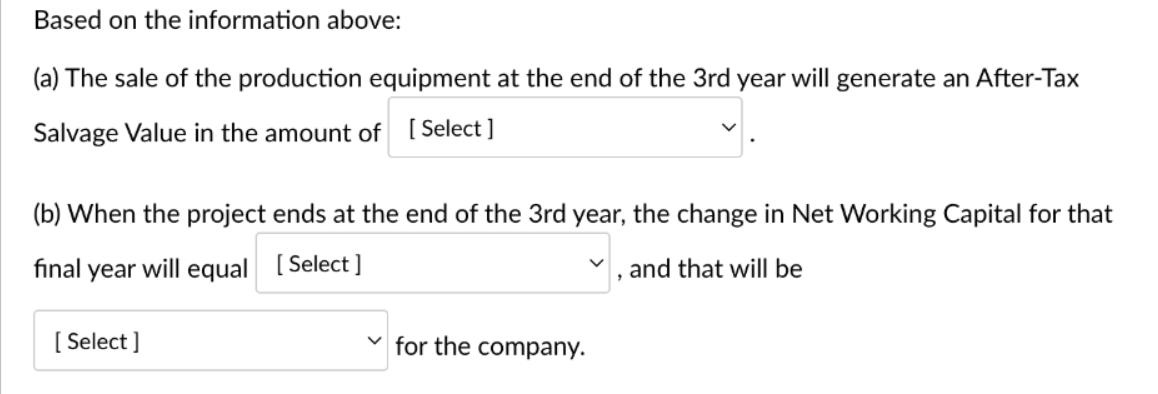

A 3-year project is under consideration. Here's what's known about its cash flows: $3,000,000 would need to be spent immediately to buy production equipment The production equipment will be depreciating according to the 5-year MACRS class At the end of the project, the production equipment is estimated to sell for a quarter of its original price $400,000 would need to be spent immediately on net working capital investment $1,000,000 would be generated each year in annual operating cash flows The company faces a 40% corporate income tax rate The rate of return for projects similar to this one is 10%. Use the values in the MACRS table below for any relevant calculations. if needed. Year 12345678 Three-Year 33.33% 44.44 14.82 7.41 Property Class Five-Year 20.00% 32.00 19.20 11.52 11.52 5.76 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.93 8.93 4.45 Based on the information above: (a) The sale of the production equipment at the end of the 3rd year will generate an After-Tax Salvage Value in the amount of [Select] (b) When the project ends at the end of the 3rd year, the change in Net Working Capital for that final year will equal [Select] [Select] for the company. V 2 and that will be

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

ans a i iiiiii iv viviii viv40 viiivvi Ans b computation of ATSV Cost ... View full answer

Get step-by-step solutions from verified subject matter experts