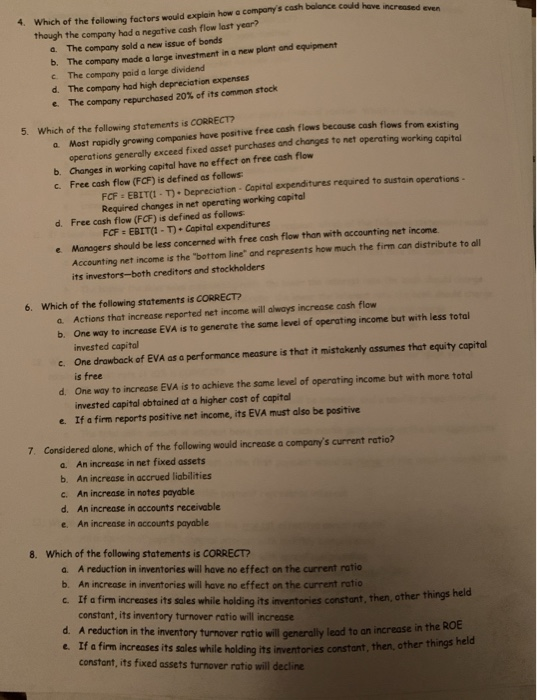

a 4. Which of the following factors would explain how a company's cash balance could have increased even though the company had a negative cash flow last year? The company sold a new issue of bonds b. The company made a large investment in a new plant and equipment The company paid a large dividend d. The company had high depreciation expenses e. The company repurchased 20% of its common stock c 5. Which of the following statements is CORRECT? Most rapidly growing companies have positive free cash flows because cash flows from existing operations generally exceed fixed asset purchases and changes to net operating working capital b. Changes in working capital have no effect on free cash flow c. Free cash flow (FCF) is defined as follows: FCF - EBITCI - T). Depreciation - Capital expenditures required to sustain operations Required changes in net operating working capital d. Free cash flow (FCF) is defined as follows FCF EBIT(1-T). Capital expenditures e Managers should be less concerned with free cash flow then with accounting net income. Accounting net income is the "bottom line and represents how much the firm can distribute to all its investors-both creditors and stockholders 6. Which of the following statements is CORRECT? e Actions that increase reported net income will always increase cash flow b. One way to increase EVA is to generate the same level of operating income but with less total invested capital c. One drawback of EVA as a performance measure is that it mistakenly assumes that equity capital is free d. One way to increase EVA is to achieve the same level of operating income but with more total invested capital obtained at a higher cost of capital e. If a firm reports positive net income, its EVA must also be positive 7. Considered alone, which of the following would increase a company's current ratio? An increase in net fixed assets b. An increase in accrued liabilities c. An increase in notes payable d. An increase in accounts receivable e. An increase in accounts payable a. 8. Which of the following statements is CORRECT? A reduction in inventories will have no effect on the current ratio b. An increase in inventories will have no effect on the current ratio c. If a firm increases its sales while holding its inventories constant, then, ether things held constant, its inventory turnover ratio will increase A reduction in the inventory turnover ratio will generally lead to an increase in the ROE e. If a firm increases its sales while holding its inventories constant, then, other things held constant, its fixed assets turnover ratio will decline