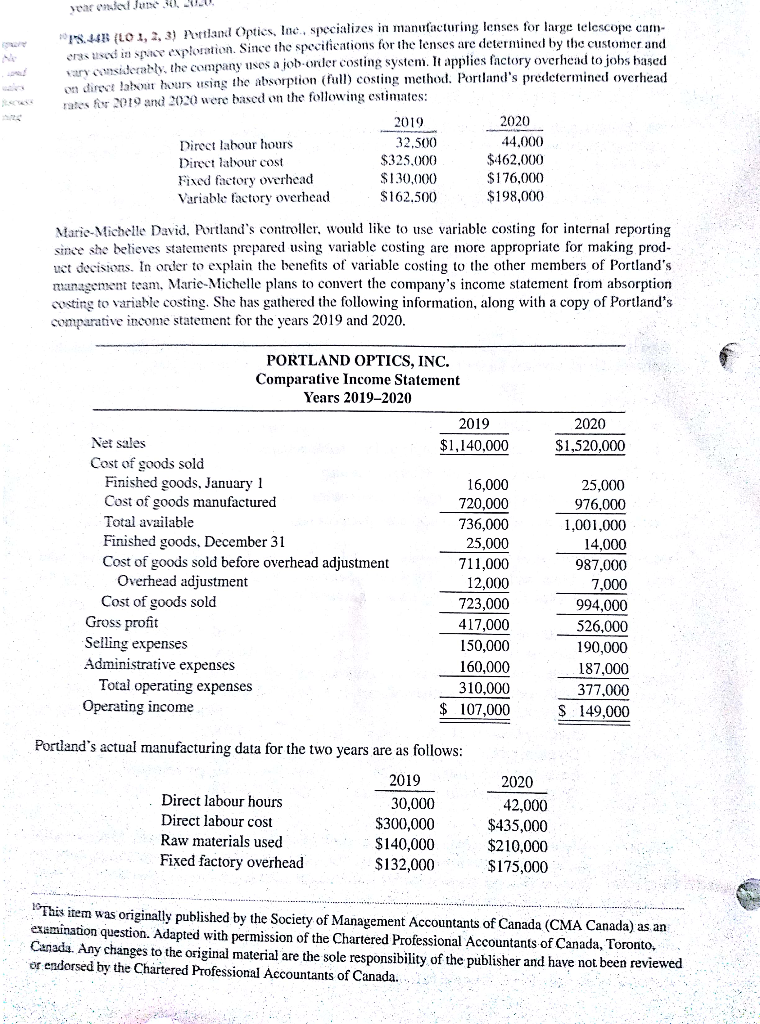

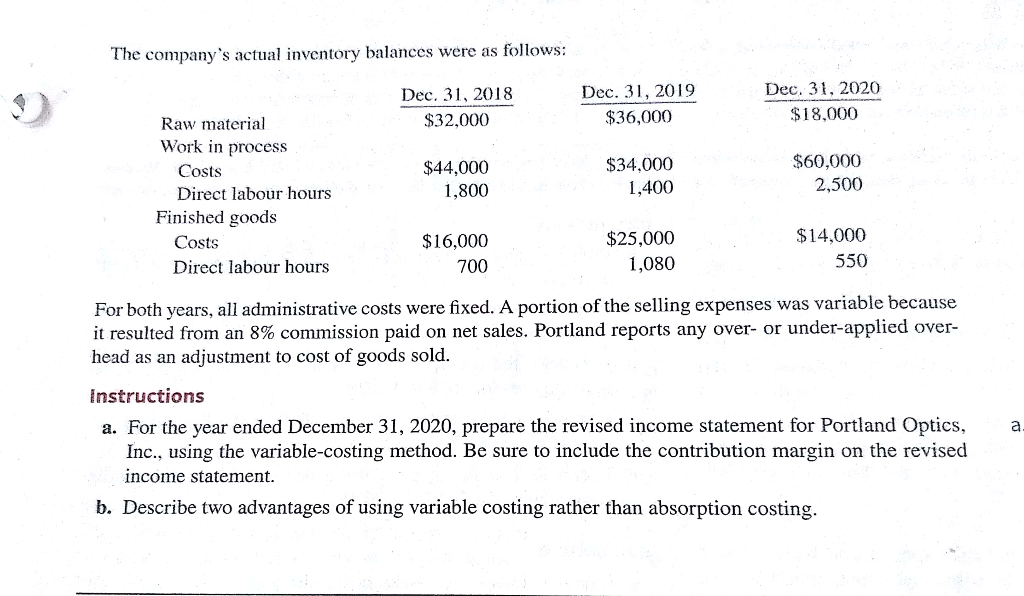

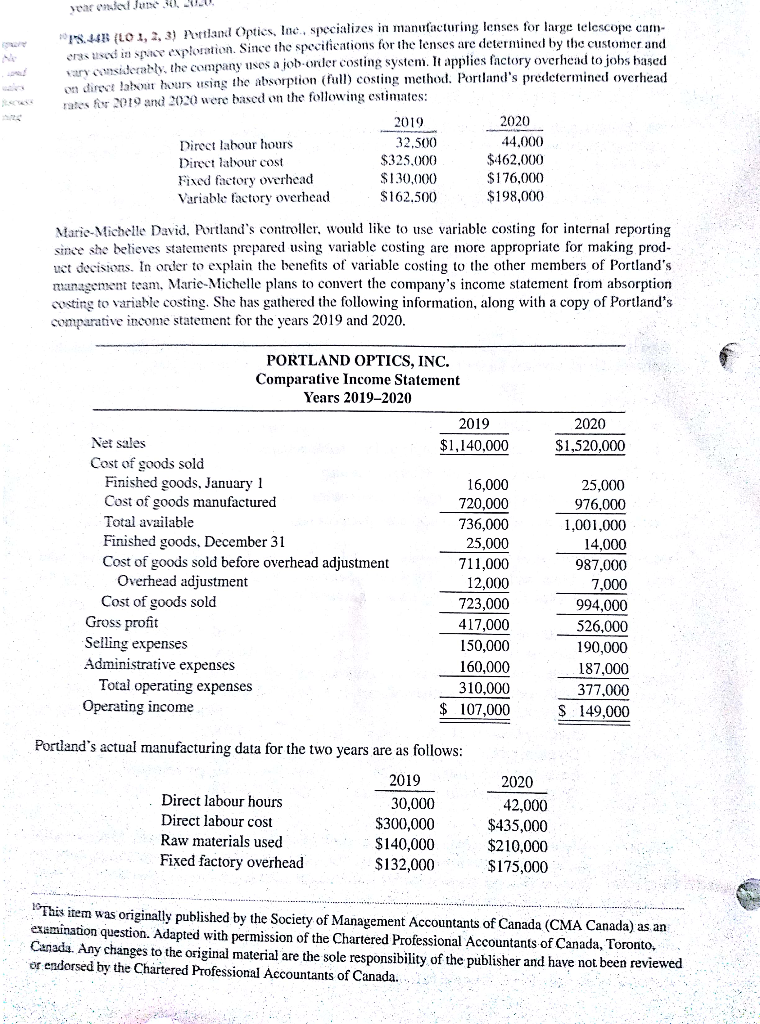

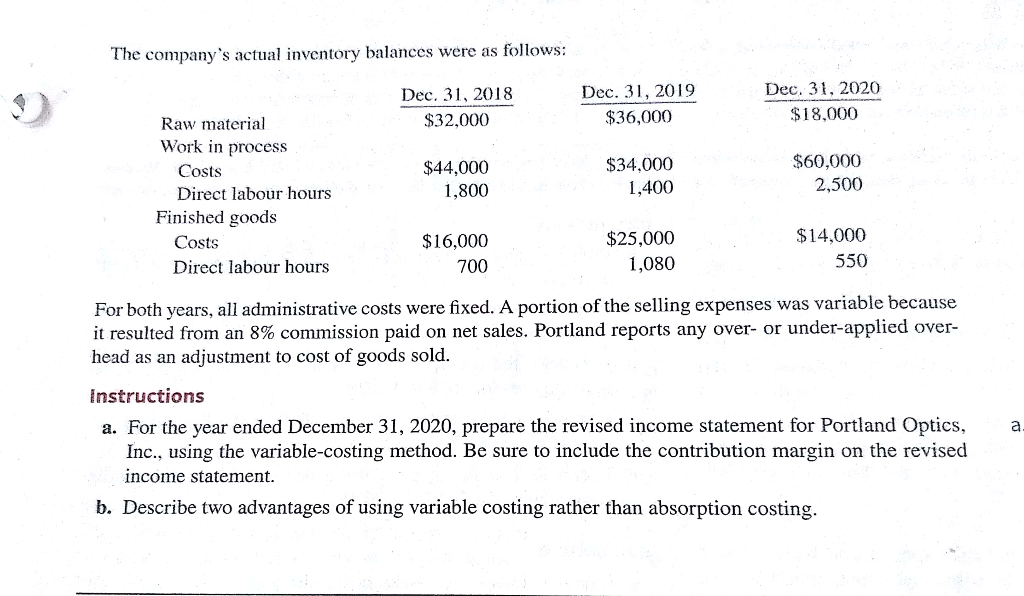

IS.LAB {LO 1, 2, 3) Portland Optics, Inc., specializes in manufacturing lenses for large telescope cam- erss used in space exploration. Since the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-under costing system. It applies factory overhead to jobs hased on direct laborat bours using the absorption (full) costing method. Portland's predetermined overhead rates for 2019 and 2020 were based on the following estimates: 2019 Direct labour hours 32.500 44.000 Direct labour cost $325.000 $462.000 Fixed factory overhead $130,000 $176,000 Variable factory overhead $162.500 $198.000 2020 Marie-Michelle David, Portland's controller, would like to use variable costing for internal reporting since she believes statements prepared using variable costing are more appropriate for making prod- uet decisions. In order to explain the benefits of variable costing to the other members of Portland's management team, Marie-Michelle plans to convert the company's income statement from absorption opsting to variable costing. She has gathered the following information, along with a copy of Portland's comparative income statement for the years 2019 and 2020. 2020 $1,520,000 PORTLAND OPTICS, INC. Comparative Income Statement Years 2019-2020 2019 Net sales $1,140,000 Cost of goods sold Finished goods, January 1 16,000 Cost of goods manufactured 720,000 Total available 736,000 Finished goods, December 31 25,000 Cost of goods sold before overhead adjustment 711,000 Overhead adjustment 12,000 Cost of goods sold 723,000 Gross profit 417,000 Selling expenses 150,000 Administrative expenses 160.000 Total operating expenses 310,000 Operating income $ 107,000 25,000 976,000 1,001,000 14,000 987,000 7,000 994,000 526,000 190,000 187,000 377,000 $ 149,000 Portland's actual manufacturing data for the two years are as follows: 2019 Direct labour hours 30,000 Direct labour cost $300,000 Raw materials used $140,000 Fixed factory overhead $132,000 2020 42,000 $435,000 $210,000 $175,000 This item was originally published by the Society of Management Accountants of Canada (CMA Canada) as an examination question. Adapted with permission of the Chartered Professional Accountants of Canada, Toronto, Canada. Any changes to the original material are the sole responsibility of the publisher and have not been reviewed or endorsed by the Chartered Professional Accountants of Canada. The company's actual inventory balances were as follows: Dec. 31, 2018 $32,000 Dec. 31, 2019 $36,000 Dec. 31, 2020 $18,000 Raw material Work in process Costs Direct labour hours Finished goods Costs Direct labour hours $44,000 1,800 $34.000 1,400 $60,000 2,500 $16,000 700 $25,000 1,080 $14,000 550 For both years, all administrative costs were fixed. A portion of the selling expenses was variable because it resulted from an 8% commission paid on net sales. Portland reports any over- or under-applied over- head as an adjustment to cost of goods sold. a Instructions a. For the year ended December 31, 2020, prepare the revised income statement for Portland Optics, Inc., using the variable-costing method. Be sure to include the contribution margin on the revised income statement. b. Describe two advantages of using variable costing rather than absorption costing