Answered step by step

Verified Expert Solution

Question

1 Approved Answer

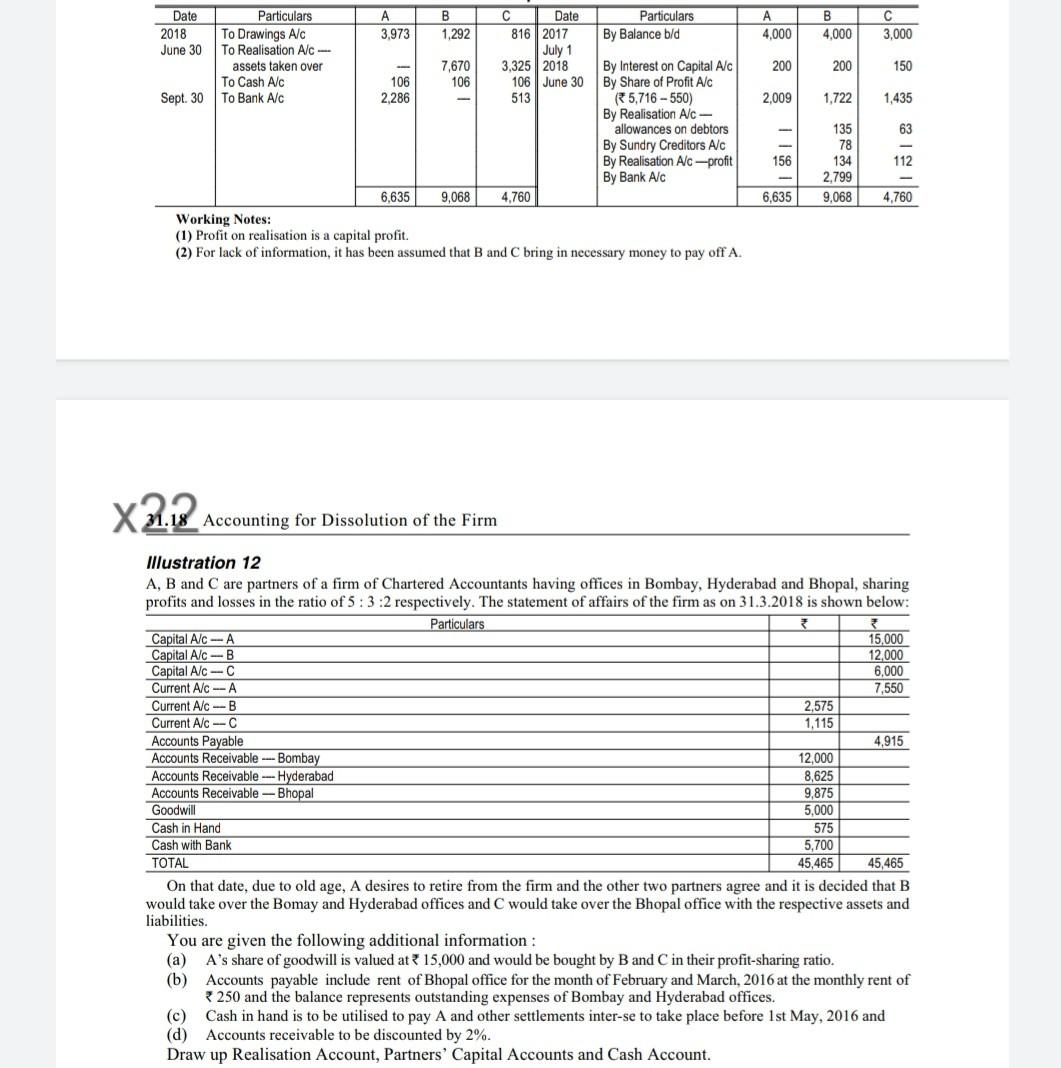

A 4,000 B 4,000 C 3,000 2018 200 200 150 2,009 1,722 1,435 63 Date Particulars B Date Particulars To Drawings Alc 3,973 1,292 816

A 4,000 B 4,000 C 3,000 2018 200 200 150 2,009 1,722 1,435 63 Date Particulars B Date Particulars To Drawings Alc 3,973 1,292 816 2017 By Balance bld June 30 To Realisation Alc- July 1 assets taken over 7,670 3,325 2018 By Interest on Capital A/C To Cash Alc 106 106 106 June 30 By Share of Profit Alc Sept. 30 To Bank Alc 2,286 513 5,716 - 550) By Realisation Alc- allowances on debtors By Sundry Creditors Alc By Realisation Alc-profit By Bank A/C 6,635 9.068 4,760 Working Notes: (1) Profit on realisation is a capital profit. (2) For lack of information, it has been assumed that B and C bring in necessary money to pay off A. 156 135 78 134 2,799 9,068 112 6,635 4,760 X2.18 Accounting for Dissolution of the Firm Illustration 12 A, B and C are partners of a firm of Chartered Accountants having offices in Bombay, Hyderabad and Bhopal, sharing profits and losses in the ratio of 5:3:2 respectively. The statement of affairs of the firm as on 31.3.2018 is shown below: Particulars Capital AlcA 15,000 Capital Alc-B 12,000 Capital Alc-C 6,000 Current A/c --A 7,550 Current A/c --B 2,575 Current A/c --C 1,115 Accounts Payable 4,915 Accounts Receivable --- Bombay 12,000 Accounts Receivable ---Hyderabad 8,625 Accounts Receivable - Bhopal 9.875 Goodwill 5,000 Cash in Hand 575 Cash with Bank 5,700 TOTAL 45,465 45,465 On that date, due to old age, A desires to retire from the firm and the other two partners agree and it is decided that B would take over the Bomay and Hyderabad offices and C would take over the Bhopal office with the respective assets and liabilities. You are given the following additional information: (a) A's share of goodwill is valued at 15,000 and would be bought by B and C in their profit-sharing ratio. (b) Accounts payable include rent of Bhopal office for the month of February and March, 2016 at the monthly rent of 250 and the balance represents outstanding expenses of Bombay and Hyderabad offices. (c) Cash in hand is to be utilised to pay A and other settlements inter-se to take place before Ist May, 2016 and (d) Accounts receivable to be discounted by 2%. Draw up Realisation Account, Partners' Capital Accounts and Cash Account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started