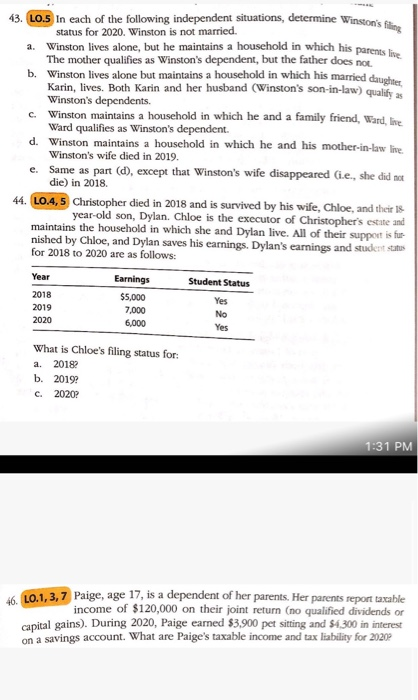

a. 43. LO.5 in each of the following independent situations, determine Winston's filling Winston lives alone, but he maintains a household in which his parents lice The mother qualifies as Winston's dependent, but the father does not b. Winston lives alone but maintains a household in which his married daughter Karin, lives. Both Karin and her husband (Winston's son-in-law) qualify 23 Winston's dependents. c. Winston maintains a household in which he and a family friend, Ward, line Ward qualifies as Winston's dependent d. Winston maintains a household in which he and his mother-in-law live Winston's wife died in 2019. e. Same as part (d), except that Winston's wife disappeared (.e., she did not 44. LO.4,5 Christopher died in 2018 and is survived by his wife, Chloe, and their 18 year-old son, Dylan. Chloe is the executor of Christopher's estate and maintains the household in which she and Dylan live. All of their support is fur nished by Chloe, and Dylan saves his earnings. Dylan's earnings and student status for 2018 to 2020 are as follows: die) in 2018. Year 2018 2019 2020 Earnings $5,000 7,000 Student Status Yes No Yes 6,000 What is Chloe's filing status for: a. 20182 b. 2019? c. 2020? 1:31 PM 46. LO.1, 3, 7 Paige, age 17, is a dependent of her parents. Her parents report taxable income of $120,000 on their joint return (no qualified dividends or capital gains). During 2020, Paige earned $3,900 pet sitting and 54,300 in interest on a savings account. What are Paige's taxable income and tax liability for 20202 a. 43. LO.5 in each of the following independent situations, determine Winston's filling Winston lives alone, but he maintains a household in which his parents lice The mother qualifies as Winston's dependent, but the father does not b. Winston lives alone but maintains a household in which his married daughter Karin, lives. Both Karin and her husband (Winston's son-in-law) qualify 23 Winston's dependents. c. Winston maintains a household in which he and a family friend, Ward, line Ward qualifies as Winston's dependent d. Winston maintains a household in which he and his mother-in-law live Winston's wife died in 2019. e. Same as part (d), except that Winston's wife disappeared (.e., she did not 44. LO.4,5 Christopher died in 2018 and is survived by his wife, Chloe, and their 18 year-old son, Dylan. Chloe is the executor of Christopher's estate and maintains the household in which she and Dylan live. All of their support is fur nished by Chloe, and Dylan saves his earnings. Dylan's earnings and student status for 2018 to 2020 are as follows: die) in 2018. Year 2018 2019 2020 Earnings $5,000 7,000 Student Status Yes No Yes 6,000 What is Chloe's filing status for: a. 20182 b. 2019? c. 2020? 1:31 PM 46. LO.1, 3, 7 Paige, age 17, is a dependent of her parents. Her parents report taxable income of $120,000 on their joint return (no qualified dividends or capital gains). During 2020, Paige earned $3,900 pet sitting and 54,300 in interest on a savings account. What are Paige's taxable income and tax liability for 20202