Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. $4360654.54 b. $38407727.27 c. $5450818.18 d. $4905736.36 STEP: 4 of 4 Suppose that Denver Financial Co. expects the exchange rate of the New Zealand

a. $4360654.54 b. $38407727.27 c. $5450818.18 d. $4905736.36

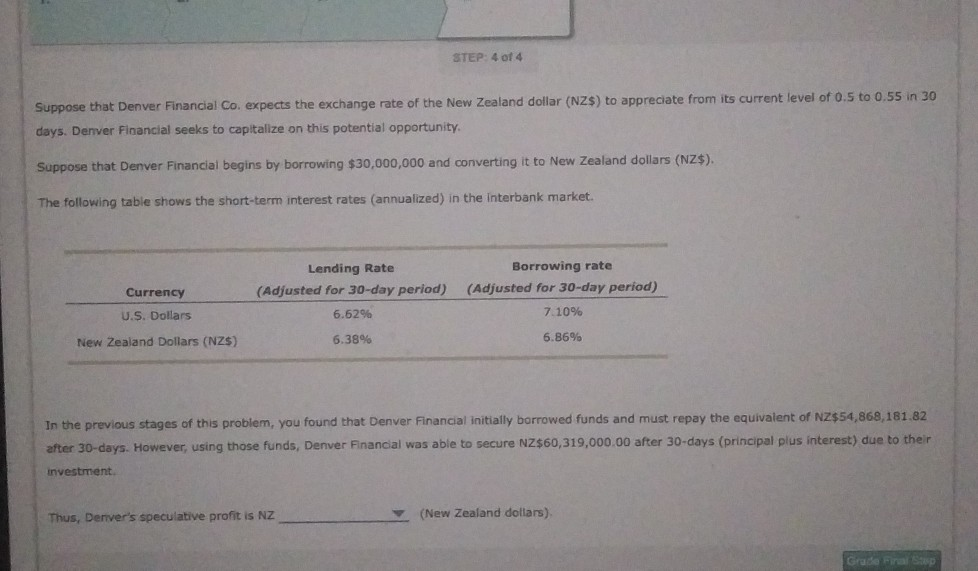

STEP: 4 of 4 Suppose that Denver Financial Co. expects the exchange rate of the New Zealand dollar (NZ$) to appreciate from its current level of 0.5 to 0.55 in 30 days. Denver Financial seeks to capitalize on this potential opportunity Suppose that Denver Financial begins by borrowing $30,000,000 and converting it to New Zealand dollars (NZ$). The following table shows the short-term interest rates (annualized) in the Interbank market. Currency U.S. Dollars Lending Rate (Adjusted for 30-day period) 6.62% Borrowing rate (Adjusted for 30-day period) 7.10% New Zealand Dollars (NZS) 6.38% 6.86% In the previous stages of this problem, you found that Denver Financial initially borrowed funds and must repay the equivalent of NZ$54,868,181.82 after 30-days. However, using those funds, Denver Financial was able to secure NZ$60,319,000.00 after 30-days (principal plus interest) due to their investment Thus, Denver's speculative profit is NZ (New Zealand dollars) Grade rapStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started