Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A.) $47.89 B.) $31.61 C.) $17.63 D.) $21.07 E.) $24.21 DICLOCO DO DOO Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of

A.) $47.89

B.) $31.61

C.) $17.63

D.) $21.07

E.) $24.21

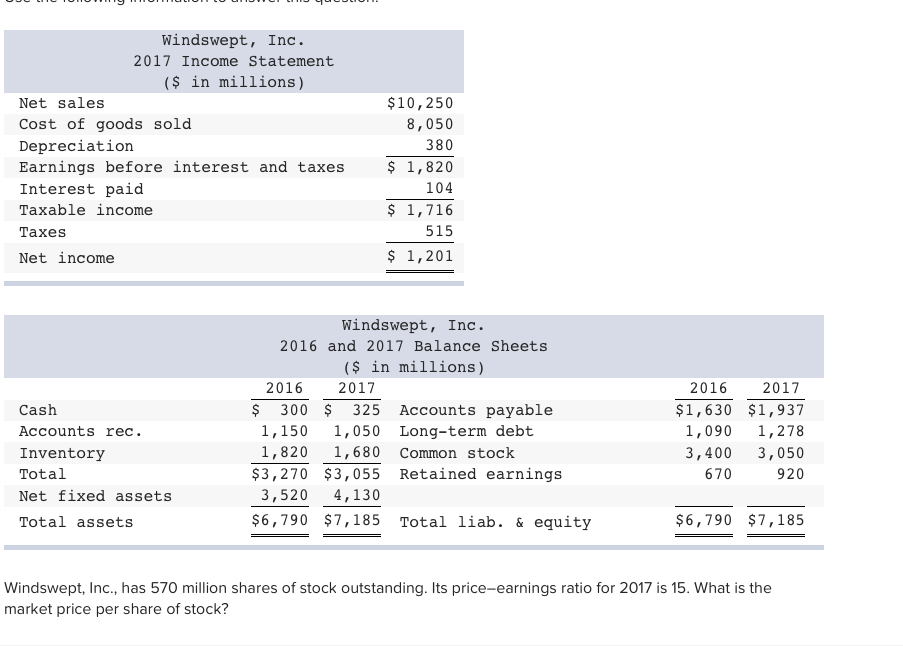

DICLOCO DO DOO Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income $10,250 8,050 380 $ 1,820 104 $ 1,716 515 $ 1,201 Cash Accounts rec. Inventory Total Net fixed assets Total assets Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 $ 300 $ 325 Accounts payable 1,150 1,050 Long-term debt 1,820 1,680 Common stock $3,270 $3,055 Retained earnings 3,520 4,130 $6,790 $7,185 Total liab. & equity 2016 $1,630 1,090 3,400 670 2017 $1,937 1,278 3,050 920 $6,790 $7,185 Windswept, Inc., has 570 million shares of stock outstanding. Its price-earnings ratio for 2017 is 15. What is the market price per share of stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started