Answered step by step

Verified Expert Solution

Question

1 Approved Answer

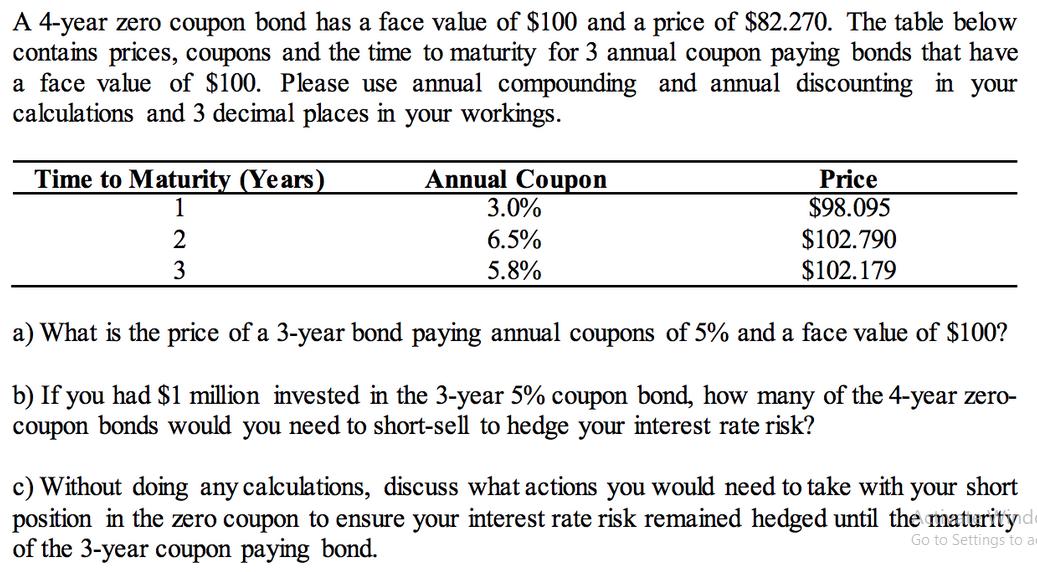

A 4-year zero coupon bond has a face value of $100 and a price of $82.270. The table below contains prices, coupons and the

A 4-year zero coupon bond has a face value of $100 and a price of $82.270. The table below contains prices, coupons and the time to maturity for 3 annual coupon paying bonds that have a face value of $100. Please use annual compounding and annual discounting in your calculations and 3 decimal places in your workings. Time to Maturity (Years) 1 2 3 Annual Coupon 3.0% 6.5% 5.8% Price $98.095 $102.790 $102.179 a) What is the price of a 3-year bond paying annual coupons of 5% and a face value of $100? b) If you had $1 million invested in the 3-year 5% coupon bond, how many of the 4-year zero- coupon bonds would you need to short-sell to hedge your interest rate risk? c) Without doing any calculations, discuss what actions you would need to take with your short position in the zero coupon to ensure your interest rate risk remained hedged until the maturity d of the 3-year coupon paying bond. Go to Settings to a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started