Answered step by step

Verified Expert Solution

Question

1 Approved Answer

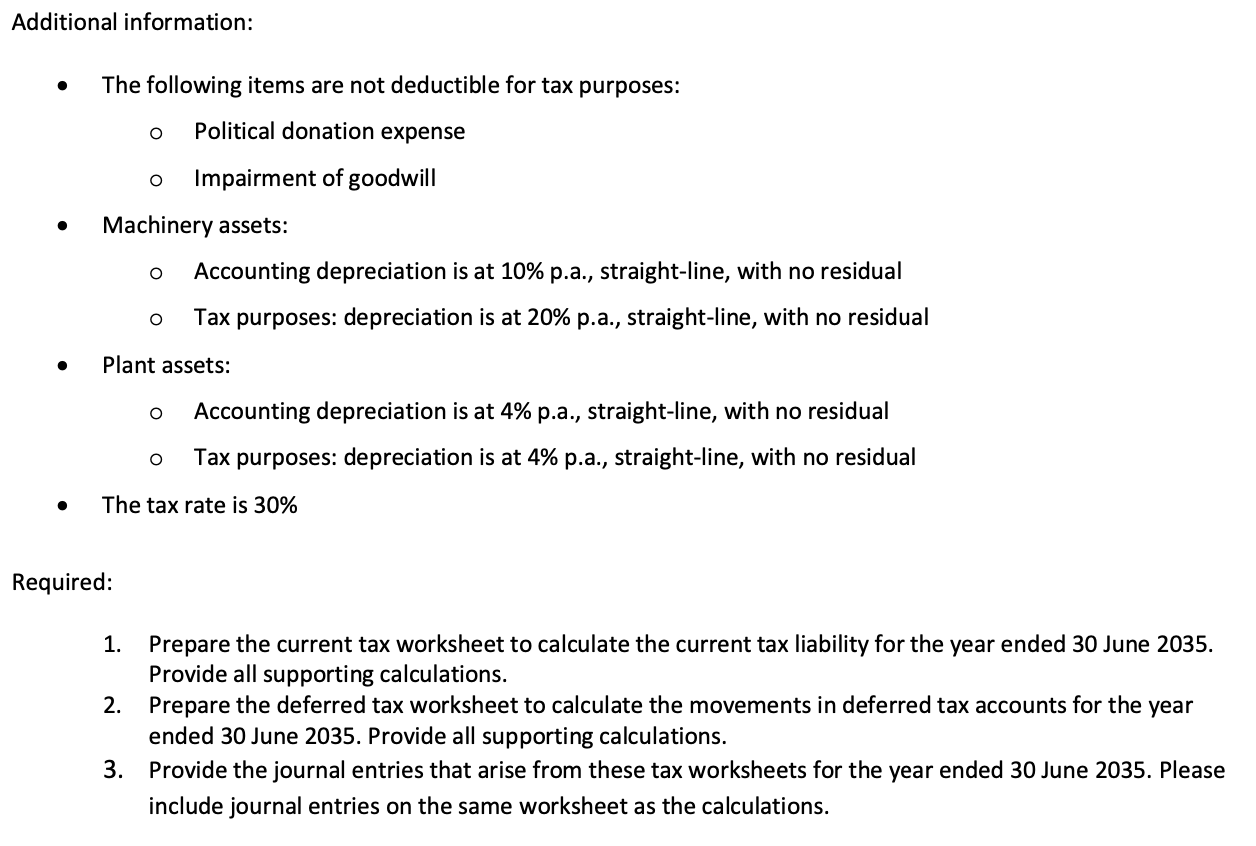

You are a senior accountant in a tier 2 accounting firm based in Australia. Your client, Banana Ltd, has prepared its adjusted trial balance for

You are a senior accountant in a tier 2 accounting firm based in Australia. Your client, Banana Ltd, has prepared its adjusted trial balance for the year ended 30 June 2035. Your manager has asked you to assist the client to determine the income tax expense for the year and the tax assets and liabilities that arise from the transactions and events of the year.

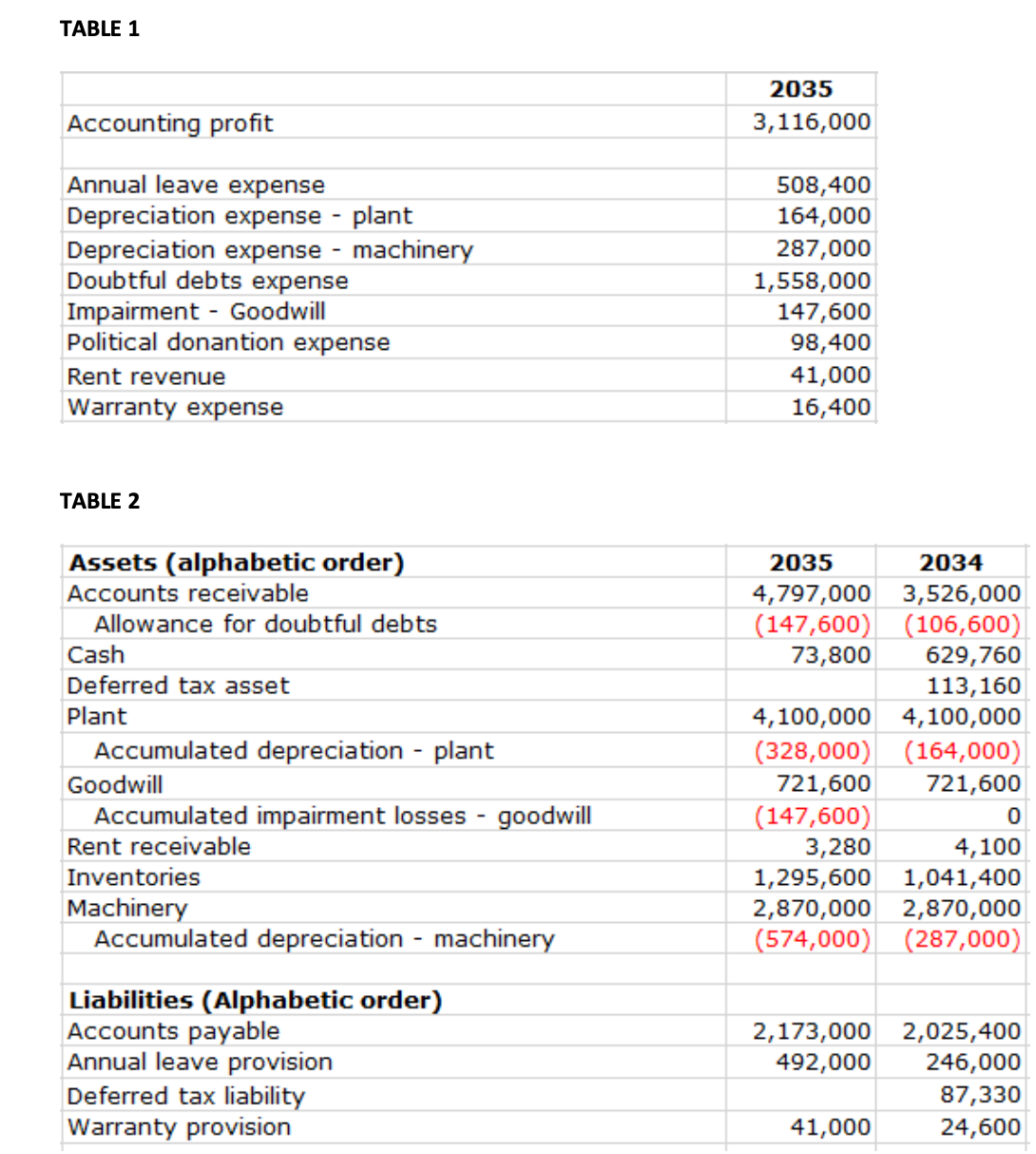

The following tables provide relevant information from the adjusted trial balance:

TABLE 1 2035 Accounting profit 3,116,000 Annual leave expense 508,400 Depreciation expense - plant 164,000 Depreciation expense - machinery 287,000 Doubtful debts expense 1,558,000 Impairment Goodwill 147,600 Political donantion expense 98,400 Rent revenue Warranty expense 41,000 16,400 TABLE 2 Assets (alphabetic order) Accounts receivable Allowance for doubtful debts Cash Deferred tax asset Plant Accumulated depreciation - plant Goodwill Accumulated impairment losses - goodwill Rent receivable Inventories Machinery Accumulated depreciation - machinery Liabilities (Alphabetic order) Accounts payable Annual leave provision Deferred tax liability Warranty provision 2035 4,797,000 2034 3,526,000 (147,600) (106,600) 73,800 629,760 113,160 4,100,000 4,100,000 (328,000) (164,000)| 721,600 721,600 (147,600) 0 3,280 4,100 1,295,600 1,041,400 2,870,000 2,870,000 (574,000) (287,000) 2,173,000 2,025,400 492,000 246,000 87,330 41,000 24,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started