Answered step by step

Verified Expert Solution

Question

1 Approved Answer

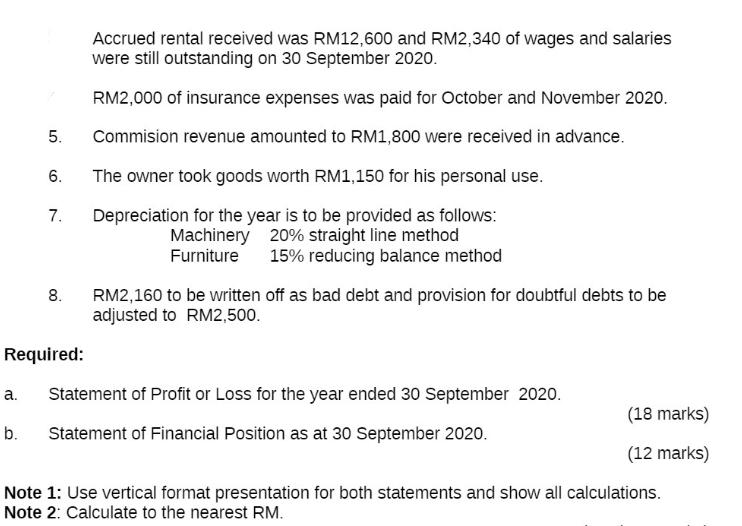

a. 5. b. 6. 7. Required: 8. Accrued rental received was RM12,600 and RM2,340 of wages and salaries were still outstanding on 30 September

a. 5. b. 6. 7. Required: 8. Accrued rental received was RM12,600 and RM2,340 of wages and salaries were still outstanding on 30 September 2020. RM2,000 of insurance expenses was paid for October and November 2020. Commision revenue amounted to RM1,800 were received in advance. The owner took goods worth RM1,150 for his personal use. Depreciation for the year is to be provided as follows: Machinery 20% straight line method Furniture 15% reducing balance method RM2,160 to be written off as bad debt and provision for doubtful debts to be adjusted to RM2,500. Statement of Profit or Loss for the year ended 30 September 2020. Statement of Financial Position as at 30 September 2020. (18 marks) (12 marks) Note 1: Use vertical format presentation for both statements and show all calculations. Note 2: Calculate to the nearest RM.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the Statement of Profit or Loss and the Statement of Financial Position we need to consid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started