Answered step by step

Verified Expert Solution

Question

1 Approved Answer

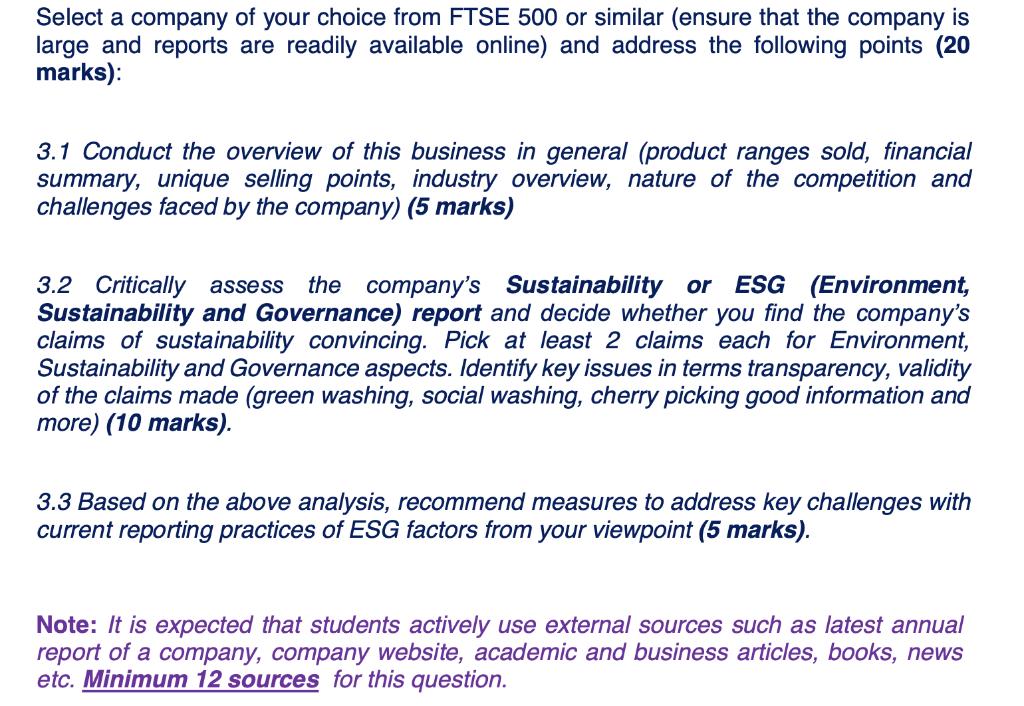

Select a company of your choice from FTSE 500 or similar (ensure that the company is large and reports are readily available online) and

Select a company of your choice from FTSE 500 or similar (ensure that the company is large and reports are readily available online) and address the following points (20 marks): 3.1 Conduct the overview of this business in general (product ranges sold, financial summary, unique selling points, industry overview, nature of the competition and challenges faced by the company) (5 marks) 3.2 Critically assess the company's Sustainability or ESG (Environment, Sustainability and Governance) report and decide whether you find the company's claims of sustainability convincing. Pick at least 2 claims each for Environment, Sustainability and Governance aspects. Identify key issues in terms transparency, validity of the claims made (green washing, social washing, cherry picking good information and more) (10 marks). 3.3 Based on the above analysis, recommend measures to address key challenges with current reporting practices of ESG factors from your viewpoint (5 marks). Note: It is expected that students actively use external sources such as latest annual report of a company, company website, academic and business articles, books, news etc. Minimum 12 sources for this question.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

I have randomly selected the company British American Tobacco BAT for this question 31 Overview of British American Tobacco BAT British American Tobacco is a multinational company that operates in the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started