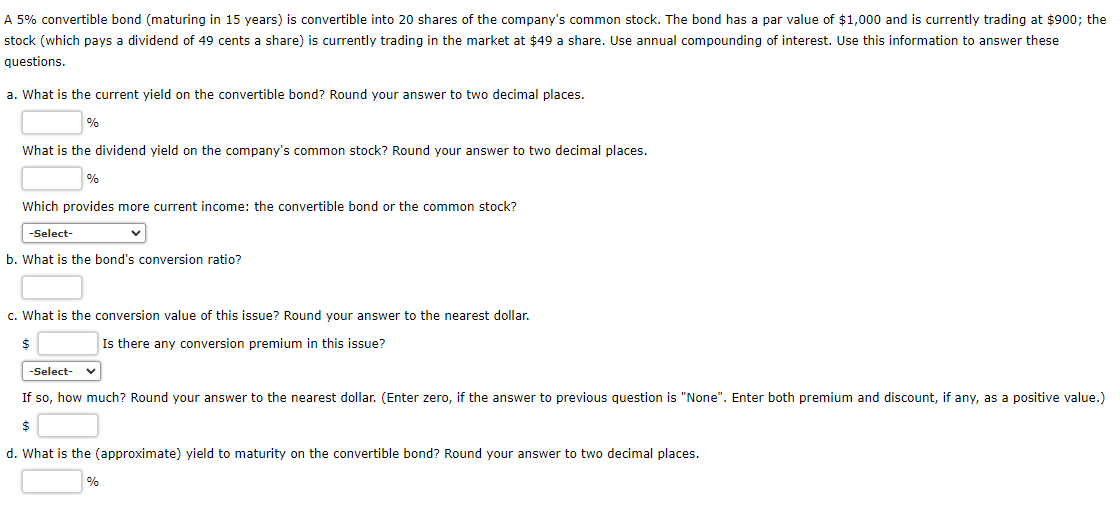

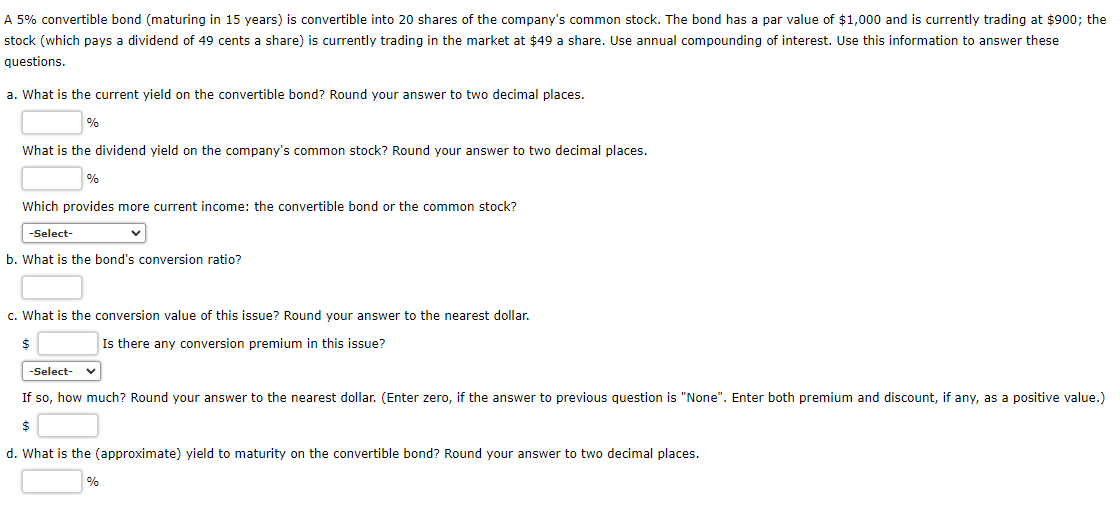

A 5% convertible bond (maturing in 15 years) is convertible into 20 shares of the company's common stock. The bond has a par value of $1,000 and is currently trading at $900; the stock (which pays a dividend of 49 cents a share) is currently trading in the market at $49 a share. Use annual compounding of interest. Use this information to answer these questions. a. What is the current yield on the convertible bond? Round your answer to two decimal places. % What is the dividend yield on the company's common stock? Round your answer to two decimal places. Which provides more current income: the convertible bond or the common stock? -Select- b. What is the bond's conversion ratio? c. What is the conversion value of this issue? Round your answer to the nearest dollar. $ Is there any conversion premium in this issue? -Select- If so, how much? Round your answer to the nearest dollar. (Enter zero, if the answer to previous question is "None". Enter both premium and discount, if any, as a positive value.) $ d. What is the approximate) yield to maturity on the convertible bond? Round your answer to two decimal places. % A 5% convertible bond (maturing in 15 years) is convertible into 20 shares of the company's common stock. The bond has a par value of $1,000 and is currently trading at $900; the stock (which pays a dividend of 49 cents a share) is currently trading in the market at $49 a share. Use annual compounding of interest. Use this information to answer these questions. a. What is the current yield on the convertible bond? Round your answer to two decimal places. % What is the dividend yield on the company's common stock? Round your answer to two decimal places. Which provides more current income: the convertible bond or the common stock? -Select- b. What is the bond's conversion ratio? c. What is the conversion value of this issue? Round your answer to the nearest dollar. $ Is there any conversion premium in this issue? -Select- If so, how much? Round your answer to the nearest dollar. (Enter zero, if the answer to previous question is "None". Enter both premium and discount, if any, as a positive value.) $ d. What is the approximate) yield to maturity on the convertible bond? Round your answer to two decimal places. %