Question

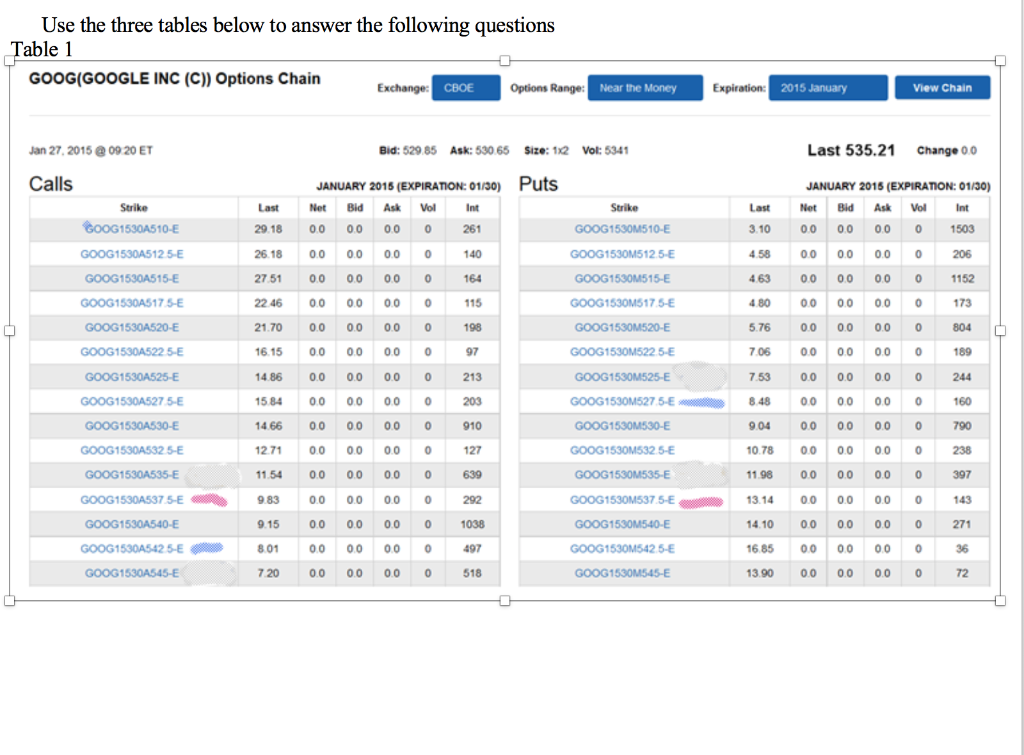

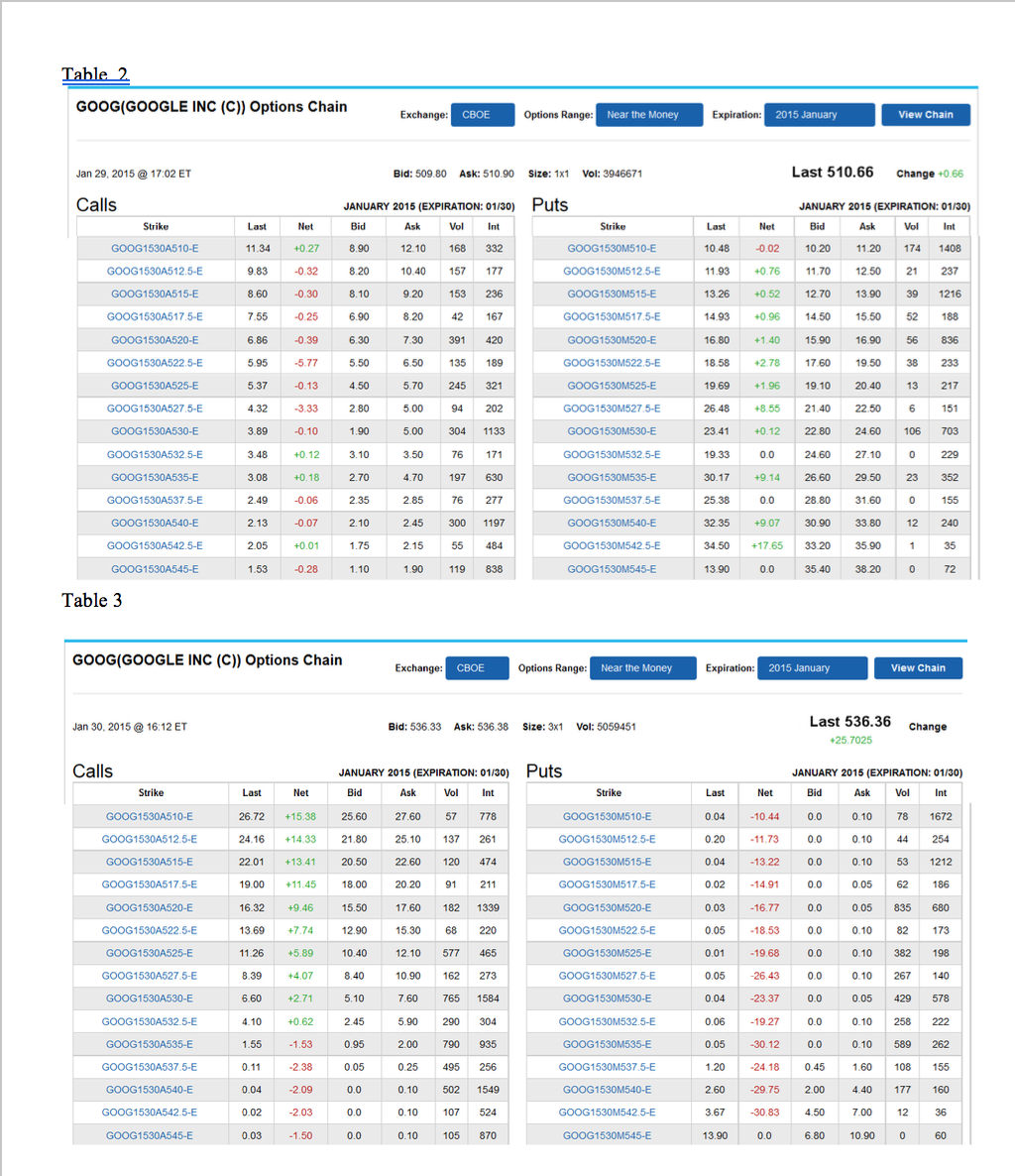

a) (5 points) Suppose we play a strangle by buying a 542.5 call and a 527.5 put on Table 1 and close at Table 2.

a) (5 points) Suppose we play a strangle by buying a 542.5 call and a 527.5 put on Table 1 and close at Table 2. Calculate the profit or loss AND rate of return.

b) (5 points) Suppose we waited and closed at Table 3 instead of Table 2. Calculate the profit or loss AND rate of return.

c) (25 points) We are now going to graph the profit functions for the strangle for both the long and short strangle where both players opened up the positions at Table 1. We are going to plot the profit / loss for both players for two points on each of the profit functions Point(s) A are associated with the spot at expiration as it is in Table 2: spot = $510.66 (there are two point A's, one for buyer of the strangle and one for the writer of the strangle). The second point Bs are associated with the spot at expiration at Table 3 = 536.36. Again, there are two point Bs. Be sure to label the break-even points (there are two of them!).

d) (10 points) For point(s) A, include the math as to how you calculated the payoffs for each player and prove that this is indeed a zero sum game! Assume importantly that the owner of the option that is in the money EXERCISES the option

e) (10 points) There are two breakeven points on your graph for the players of the strangles. Pick the larger of the two and explain exactly how this is indeed the breakeven point assuming importantly that the player of the short strange is going to honor the option that they wrote that is in the money. Please go through the total costs and total revenue like we did in class numerous times. That is, what does the writer of this option have to do exactly? Assume importantly that the owner of the option that is in the money EXERCISES the option

f)(10 points) Assuming the spot price of GOOG is frozen at its value on Table 2 until expiration, plot the evolution of the premium on the 527.5 put.

Use the three tables below to answer the following questions Table 1 GOOG(GOOGLE INC (C)) Options Chain Exchange CBOE Options Range: Near the Money Expiration 2015 January View Chain Jan 27, 2015 @ 09 20 ET Bid: 529 85 Ask: 530 65 Size: 1x2 Vol: 5341 Last 535.21 Change 0.0 Calls Strike GOOG1530A510-E GOOG1530A512 5- Last 29.18 26.18 JANUARY 2016 (EXPIRATION: 01/30) Puts Net Ask Vol 00 000 261 140 Strike GOOG1530M510-E Last 3.10 4.58 463 GOOG1530A515-E 164 GOOG1530A5175-E 115 4.80 21.70 0.0 5.76 198 97 16.15 7.06 213 7.53 GOOG1530A520-E GOOG1530A522 5-E GOOG1530A525-E GOOG1530A5275-E GOOG1530A530-E GOOG1530A5325-E GOOG1530A535-E 000 14.86 1584 14.66 1271 1154 9.83 9.15 8.01 720 0.0 0.0 0. 0 0.0 0.0 0.0 0.0 0.0 0.0 0 00 0. 00 0.0 0.0 0.0 00 0.0 0.0 0 0.0 0.0 0 0.0 000 0.0 0.0 0 00 000 00 00 0 JANUARY 2015 (EXPIRATION: 01/30) Net Ask Vol Int 0.0 0.0 0.0 0 1503 0.0 0.0 0.0 0 206 00 00 00 0 1152 0.0 000 173 0.0 0.0 0.0 0 804 0.0 0.0 0.0 0 0.0 00 00 00 0 160 0.0 0.0 0.0 0 790 0.0 0.0 0.0 0 238 00 00 00 0 397 0.0 0.0 0.0 0 143 0.0 0.0 0.0 0 271 00 00 00 0 36 0.0 0.0 0.0 0 72 GOOG1530M512.5-E GOOG1530M515-E GOOG1530M517 SE GOOG1530M520- GOOG1530M522.5-E GOOG1530M525-E GOOG1530M527 5-E GOOG1530M530-E GOOG1530M532.5-E GOOG1530M535-E GOOG1530M537.5-E GOOG1530M540-E GOOG1530M5425-E GOOG1530M545-E 848 9.04 10.78 11.98 13.14 14.10 16.85 13.90 639 292 1038 GOOG1530A5375-E GOOG1530A540-E GOOG1530A542 5-E 497 GOOG1530A545-E 00 518 Table 2 GOOG(GOOGLE INC (C)) Options Chain Exchange: CBOE Options Range: Near the Money Expiration: 2015 January View Chain Jan 29, 2015 @ 17:02 ET Bid: 509.80 Ask: 510.90 Size: 1x1 Vol: 3946671 Last 510.66 Change +0.66 JANUARY 2015 (EXPIRATION: 01/30) Bid Ask Vol Int Net Net -0.02 JANUARY 2015 (EXPIRATION: 01/30) Bid Ask Vol Int 10.20 11.20 174 1408 +0.27 8.90 12.10 168 332 Last 11.34 9.83 8.60 Puts Strike GOOG1530M510-E GOOG1530M512.5-E GOOG1530M515-E GOOG1530M517.5-E -0.32 8.20 10.40 Calls Strike GOOG1530A510-E GOOG1530A512.5-E GOOG1530A515-E GOOG1530A517.5-E GOOG1530A520-E GOOG1530A522.5-E 12.50 237 -0.30 8.10 9.20 Last 10.48 11.93 13.26 14.93 16.80 18.58 1216 -0.25 7.55 6.86 6.90 6.30 5.50 8.20 7.30 +0.76 +0.52 +0.96 +1.40 +2.78 56 GOOG1530M520-E GOOG1530M522.5-E GOOG1530M525-E 11.70 12.70 14.50 15.90 17.60 19.10 21.40 22.80 233 GOOG1530A525-E GOOG1530A527.5-E -0.39 -5.77 -0.13 -3.33 -0.10 +0.12 +0.18 -0.06 GOOG1530M527 5-E GOOG1530A530-E 1.90 GOOG1530M530-E +0.12 GOOG1530A532.5-E 3.10 5.00 3.50 4.70 285 229 13.90 15.50 52 16.90 19.50 38 20.40 22.50 24.60 106 27.100 29.50 31.600 33.80 12 35.90 1 38.20 0 GOOG1530A535-E GOOG1530A537.5-E GOOG1530A540-E 2.70 2.35 304 76 197 76 300 55 119 1133 171 630 277 1197 484 838 26.48 23.41 19.33 30.17 25.38 32.35 34.50 13.90 GOOG1530M532.5-E GOOG1530M535-E GOOG1530M537.5-E 2.49 0.0 +9.14 0.0 2.13 -0.07 2.10 2.45 GOOG1530M540-E 26.60 28.80 30.90 33 20 35.40 +0.01 1.75 GOOG1530A542.5-E GOOG1530A545-E 2.05 1.53 2.15 1.90 +9.07 +17.65 0.0 GOOG1530M542.5-E GOOG1530M545-E 35 72 -0.28 1.10 Table 3 GOOG(GOOGLE INC (C)) Options Chain Exchange: CBOE Options Range: Near the Money Expiration: 2015 January View Chain Jan 30, 2015 @ 16:12 ET Bid: 536.33 Ask: 536.38 Size: 3x1 Vol: 5059451 Last 536.36 +25 7025 Change Calls Strike Last Net Last Net GOOG1530A510-E 26.72 0.04 -10.44 +15.38 +14.33 +13.41 JANUARY 2015 (EXPIRATION: 01/30) Bid Ask Vol Int 0.0 0.10 78 1672 0.0 0.10 0.10 53 1212 GOOG1530A512.5-E GOOG1530A515-E GOOG1530A517.5-E - 11.73 -13.22 0.0 24.16 22.01 19.00 16.32 +11.45 -14.91 GOOG1530A520-E +9.46 -16.77 +7.74 GOOG1530A522.5-E GOOG1530A525-E GOOG1530A527.5-E -18.53 13.69 11.26 0.20 0.04 0.02 0.03 0.05 0.01 0.05 0.04 0.06 JANUARY 2015 (EXPIRATION: 01/30) Puts Bid Ask Vol Int Strike 25.60 27.60 57 778 GOOG1530M510-E 21.80 25.10 137 261 GOOG1530M512.5-E 20.50 22.60 120 474 GOOG1530M515-E 18.00 20.20 GOOG1530M517.5-E 15.50 17.60 182 1339 GOOG1530M520-E 12.90 15.30 68 220 GOOG1530M522.5-E 10.40 12.10 577 465 GOOG1530M525-E 8.40 10.90 162 GOOG1530M5275-E 5.10 7.60 1584 GOOG1530M530-E 2.45 5.90 290 304 GOOG1530M532.5-E 2.00 790 935 GOOG1530M535-E 0.25 495 256 GOOG1530M537.5-E 0.0 0.10 502 1549 GOOG1530M540-E 0.0 0.10 107 524 GOOG1530M542.5-E 0.0 0.10 105 870 GOOG1530M545-E +5.89 0.0 0.0 8.39 +4.07 273 GOOG1530A530-E 6.60 4.10 +2.71 +0.62 oo 0.05 0.10 0.10 0.10 0.05 0.10 0.10 1.60 4.40 7.00 0.0 -19.68 -26.43 -23.37 -19.27 -30.12 -24.18 -29.75 -30.83 GOOG1530A532.5-E GOOG1530A535-E 1.55 -1.53 0.05 0.0 0.05 GOOG1530A537.5-E GOOG1530A540-E 0.11 0.04 0.02 -2.38 -2.09 -2.03 1.20 2.60 3.67 13.90 0.45 2.00 4.50 177 GOOG1530A542.5-E GOOG1530A545-E 0.03 -1.50 0.0 6.80 10.90 0 60 Use the three tables below to answer the following questions Table 1 GOOG(GOOGLE INC (C)) Options Chain Exchange CBOE Options Range: Near the Money Expiration 2015 January View Chain Jan 27, 2015 @ 09 20 ET Bid: 529 85 Ask: 530 65 Size: 1x2 Vol: 5341 Last 535.21 Change 0.0 Calls Strike GOOG1530A510-E GOOG1530A512 5- Last 29.18 26.18 JANUARY 2016 (EXPIRATION: 01/30) Puts Net Ask Vol 00 000 261 140 Strike GOOG1530M510-E Last 3.10 4.58 463 GOOG1530A515-E 164 GOOG1530A5175-E 115 4.80 21.70 0.0 5.76 198 97 16.15 7.06 213 7.53 GOOG1530A520-E GOOG1530A522 5-E GOOG1530A525-E GOOG1530A5275-E GOOG1530A530-E GOOG1530A5325-E GOOG1530A535-E 000 14.86 1584 14.66 1271 1154 9.83 9.15 8.01 720 0.0 0.0 0. 0 0.0 0.0 0.0 0.0 0.0 0.0 0 00 0. 00 0.0 0.0 0.0 00 0.0 0.0 0 0.0 0.0 0 0.0 000 0.0 0.0 0 00 000 00 00 0 JANUARY 2015 (EXPIRATION: 01/30) Net Ask Vol Int 0.0 0.0 0.0 0 1503 0.0 0.0 0.0 0 206 00 00 00 0 1152 0.0 000 173 0.0 0.0 0.0 0 804 0.0 0.0 0.0 0 0.0 00 00 00 0 160 0.0 0.0 0.0 0 790 0.0 0.0 0.0 0 238 00 00 00 0 397 0.0 0.0 0.0 0 143 0.0 0.0 0.0 0 271 00 00 00 0 36 0.0 0.0 0.0 0 72 GOOG1530M512.5-E GOOG1530M515-E GOOG1530M517 SE GOOG1530M520- GOOG1530M522.5-E GOOG1530M525-E GOOG1530M527 5-E GOOG1530M530-E GOOG1530M532.5-E GOOG1530M535-E GOOG1530M537.5-E GOOG1530M540-E GOOG1530M5425-E GOOG1530M545-E 848 9.04 10.78 11.98 13.14 14.10 16.85 13.90 639 292 1038 GOOG1530A5375-E GOOG1530A540-E GOOG1530A542 5-E 497 GOOG1530A545-E 00 518 Table 2 GOOG(GOOGLE INC (C)) Options Chain Exchange: CBOE Options Range: Near the Money Expiration: 2015 January View Chain Jan 29, 2015 @ 17:02 ET Bid: 509.80 Ask: 510.90 Size: 1x1 Vol: 3946671 Last 510.66 Change +0.66 JANUARY 2015 (EXPIRATION: 01/30) Bid Ask Vol Int Net Net -0.02 JANUARY 2015 (EXPIRATION: 01/30) Bid Ask Vol Int 10.20 11.20 174 1408 +0.27 8.90 12.10 168 332 Last 11.34 9.83 8.60 Puts Strike GOOG1530M510-E GOOG1530M512.5-E GOOG1530M515-E GOOG1530M517.5-E -0.32 8.20 10.40 Calls Strike GOOG1530A510-E GOOG1530A512.5-E GOOG1530A515-E GOOG1530A517.5-E GOOG1530A520-E GOOG1530A522.5-E 12.50 237 -0.30 8.10 9.20 Last 10.48 11.93 13.26 14.93 16.80 18.58 1216 -0.25 7.55 6.86 6.90 6.30 5.50 8.20 7.30 +0.76 +0.52 +0.96 +1.40 +2.78 56 GOOG1530M520-E GOOG1530M522.5-E GOOG1530M525-E 11.70 12.70 14.50 15.90 17.60 19.10 21.40 22.80 233 GOOG1530A525-E GOOG1530A527.5-E -0.39 -5.77 -0.13 -3.33 -0.10 +0.12 +0.18 -0.06 GOOG1530M527 5-E GOOG1530A530-E 1.90 GOOG1530M530-E +0.12 GOOG1530A532.5-E 3.10 5.00 3.50 4.70 285 229 13.90 15.50 52 16.90 19.50 38 20.40 22.50 24.60 106 27.100 29.50 31.600 33.80 12 35.90 1 38.20 0 GOOG1530A535-E GOOG1530A537.5-E GOOG1530A540-E 2.70 2.35 304 76 197 76 300 55 119 1133 171 630 277 1197 484 838 26.48 23.41 19.33 30.17 25.38 32.35 34.50 13.90 GOOG1530M532.5-E GOOG1530M535-E GOOG1530M537.5-E 2.49 0.0 +9.14 0.0 2.13 -0.07 2.10 2.45 GOOG1530M540-E 26.60 28.80 30.90 33 20 35.40 +0.01 1.75 GOOG1530A542.5-E GOOG1530A545-E 2.05 1.53 2.15 1.90 +9.07 +17.65 0.0 GOOG1530M542.5-E GOOG1530M545-E 35 72 -0.28 1.10 Table 3 GOOG(GOOGLE INC (C)) Options Chain Exchange: CBOE Options Range: Near the Money Expiration: 2015 January View Chain Jan 30, 2015 @ 16:12 ET Bid: 536.33 Ask: 536.38 Size: 3x1 Vol: 5059451 Last 536.36 +25 7025 Change Calls Strike Last Net Last Net GOOG1530A510-E 26.72 0.04 -10.44 +15.38 +14.33 +13.41 JANUARY 2015 (EXPIRATION: 01/30) Bid Ask Vol Int 0.0 0.10 78 1672 0.0 0.10 0.10 53 1212 GOOG1530A512.5-E GOOG1530A515-E GOOG1530A517.5-E - 11.73 -13.22 0.0 24.16 22.01 19.00 16.32 +11.45 -14.91 GOOG1530A520-E +9.46 -16.77 +7.74 GOOG1530A522.5-E GOOG1530A525-E GOOG1530A527.5-E -18.53 13.69 11.26 0.20 0.04 0.02 0.03 0.05 0.01 0.05 0.04 0.06 JANUARY 2015 (EXPIRATION: 01/30) Puts Bid Ask Vol Int Strike 25.60 27.60 57 778 GOOG1530M510-E 21.80 25.10 137 261 GOOG1530M512.5-E 20.50 22.60 120 474 GOOG1530M515-E 18.00 20.20 GOOG1530M517.5-E 15.50 17.60 182 1339 GOOG1530M520-E 12.90 15.30 68 220 GOOG1530M522.5-E 10.40 12.10 577 465 GOOG1530M525-E 8.40 10.90 162 GOOG1530M5275-E 5.10 7.60 1584 GOOG1530M530-E 2.45 5.90 290 304 GOOG1530M532.5-E 2.00 790 935 GOOG1530M535-E 0.25 495 256 GOOG1530M537.5-E 0.0 0.10 502 1549 GOOG1530M540-E 0.0 0.10 107 524 GOOG1530M542.5-E 0.0 0.10 105 870 GOOG1530M545-E +5.89 0.0 0.0 8.39 +4.07 273 GOOG1530A530-E 6.60 4.10 +2.71 +0.62 oo 0.05 0.10 0.10 0.10 0.05 0.10 0.10 1.60 4.40 7.00 0.0 -19.68 -26.43 -23.37 -19.27 -30.12 -24.18 -29.75 -30.83 GOOG1530A532.5-E GOOG1530A535-E 1.55 -1.53 0.05 0.0 0.05 GOOG1530A537.5-E GOOG1530A540-E 0.11 0.04 0.02 -2.38 -2.09 -2.03 1.20 2.60 3.67 13.90 0.45 2.00 4.50 177 GOOG1530A542.5-E GOOG1530A545-E 0.03 -1.50 0.0 6.80 10.90 0 60Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started