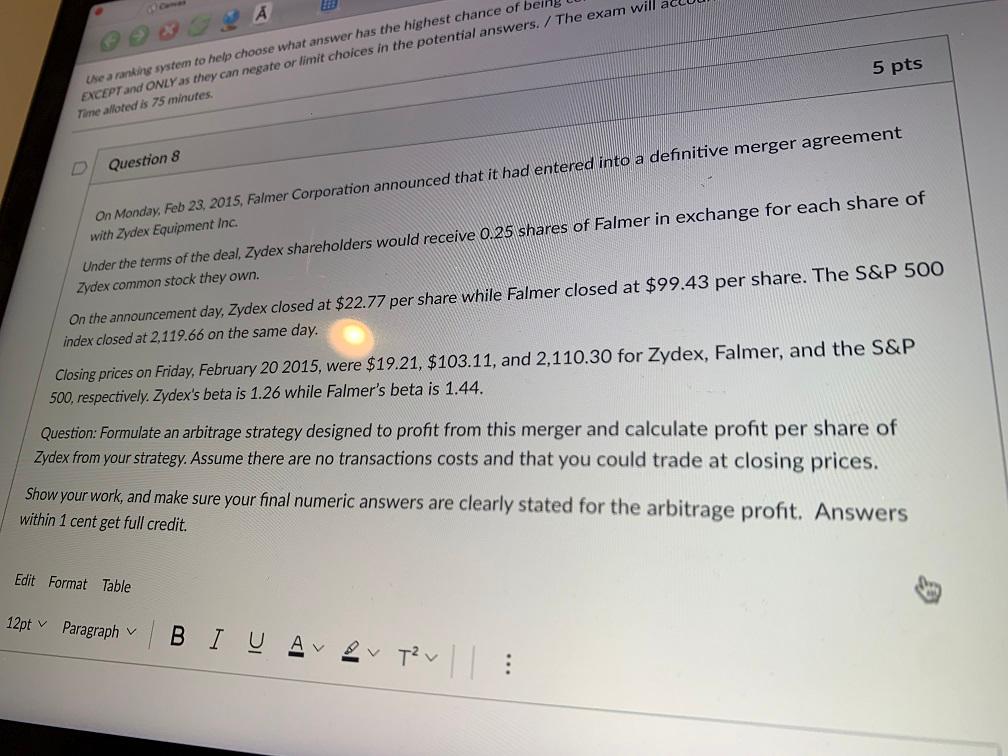

A 5 pts the ranking system to help choose what answer has the highest chance of being EXCEPT and ONLY as they can negate or limit choices in the potential answers. / The exam will Time alloted is 75 minutes. Question 8 On Monday, Feb 23, 2015, Falmer Corporation announced that it had entered into a definitive merger agreement with Zydex Equipment Inc. Under the terms of the deal, Zydex shareholders would receive 0.25 shares of Falmer in exchange for each share of Zydex common stock they own. On the announcement day, Zydex closed at $22.77 per share while Falmer closed at $99.43 per share. The S&P 500 index closed at 2.119.66 on the same day. Closing prices on Friday, February 20 2015, were $19.21, $103.11, and 2,110.30 for Zydex, Falmer, and the S&P 500, respectively. Zydex's beta is 1.26 while Falmer's beta is 1.44. Question: Formulate an arbitrage strategy designed to profit from this merger and calculate profit per share of Zydex from your strategy. Assume there are no transactions costs and that you could trade at closing prices. Show your work, and make sure your final numeric answers are clearly stated for the arbitrage profit. Answers within 1 cent get full credit. Edit Format Table 12pt Paragraph BI U Av Tev || : A 5 pts the ranking system to help choose what answer has the highest chance of being EXCEPT and ONLY as they can negate or limit choices in the potential answers. / The exam will Time alloted is 75 minutes. Question 8 On Monday, Feb 23, 2015, Falmer Corporation announced that it had entered into a definitive merger agreement with Zydex Equipment Inc. Under the terms of the deal, Zydex shareholders would receive 0.25 shares of Falmer in exchange for each share of Zydex common stock they own. On the announcement day, Zydex closed at $22.77 per share while Falmer closed at $99.43 per share. The S&P 500 index closed at 2.119.66 on the same day. Closing prices on Friday, February 20 2015, were $19.21, $103.11, and 2,110.30 for Zydex, Falmer, and the S&P 500, respectively. Zydex's beta is 1.26 while Falmer's beta is 1.44. Question: Formulate an arbitrage strategy designed to profit from this merger and calculate profit per share of Zydex from your strategy. Assume there are no transactions costs and that you could trade at closing prices. Show your work, and make sure your final numeric answers are clearly stated for the arbitrage profit. Answers within 1 cent get full credit. Edit Format Table 12pt Paragraph BI U Av Tev ||