Question

A $500,000 SMP investment is being considered. It is anticipated that annual savings of $92,5000 will result from the investment. A salvage value of

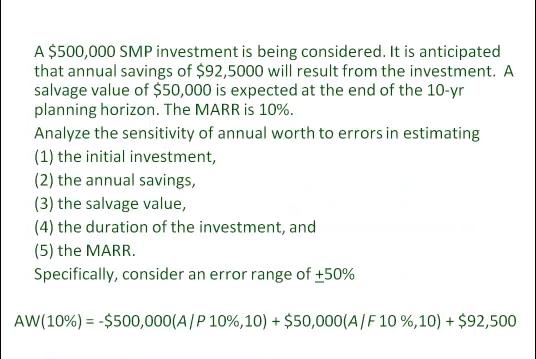

A $500,000 SMP investment is being considered. It is anticipated that annual savings of $92,5000 will result from the investment. A salvage value of $50,000 is expected at the end of the 10-yr planning horizon. The MARR is 10%. Analyze the sensitivity of annual worth to errors in estimating (1) the initial investment, (2) the annual savings, (3) the salvage value, (4) the duration of the investment, and (5) the MARR. Specifically, consider an error range of +50% AW (10%) = $500,000(A/P 10%, 10) + $50,000(A/F 10 %, 10) + $92,500

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer The original annual worth calculation is as follows AW10 500000 AP 10 10 50000 AF 10 10 92500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Operating System questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App