Answered step by step

Verified Expert Solution

Question

1 Approved Answer

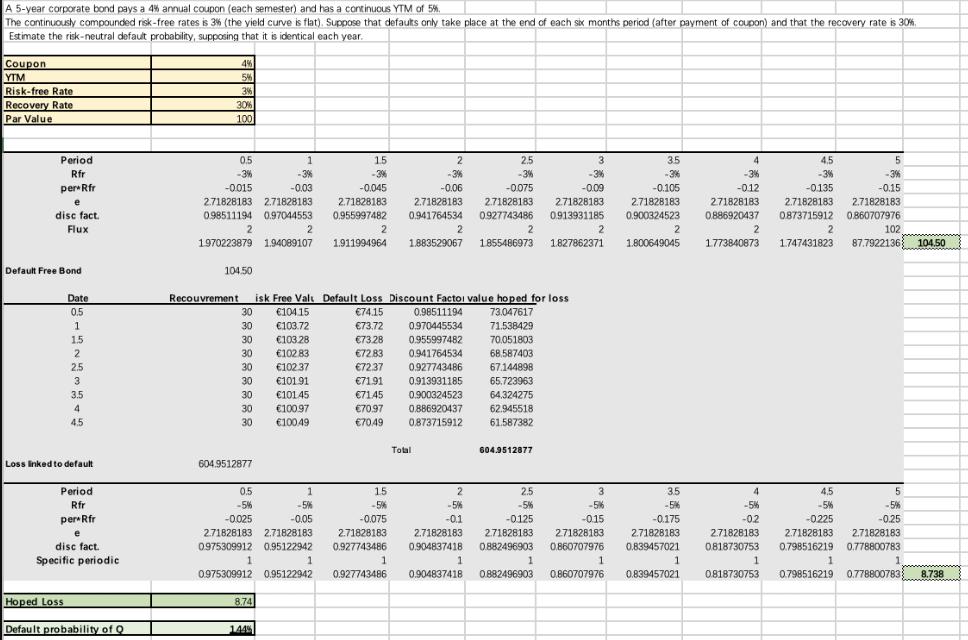

A 5-year corporate bond pays a 4% annual coupon (each semester) and has a continuous YTM of 5%. The continuously compounded risk-free rates is

A 5-year corporate bond pays a 4% annual coupon (each semester) and has a continuous YTM of 5%. The continuously compounded risk-free rates is 3% (the yield curve is flat). Suppose that defauts only take place at the end of each six months period (after payment of coupon) and that the recovery rate is 30%. Estimate the risk-neutral default probability, supposing that it is identical each year. Coupon YTM Risk-free Rate Recovery Rate Par Value Period Rfr per* Rfr e disc fact. Flux Default Free Bond Date 0.5 1 1.5 2 2.5 3 3.5 4 4.5 Loss linked to default Period Rfr per Rfr e disc fact. Specific periodic Hoped Loss Default probability of Q 4% 5% 3% 30% 100 0.5 15 -3% 1 -3% -3% -0.015 -0.03 -0.045 271828183 2.71828183 2.71828183 098511194 0.97044553 0.955997482 2 1970223879 1.94089107 104.50 Recouvrement isk Free Val 104.15 103.72 30 30 30 30 30 30 30 30 30 604.9512877 2 1 0.5 1 -5% -5% -0.025 -0.05 271828183 2.71828183 0.975309912 0.95122942 8.74 103.28 102.83 102.37 101.91 101.45 100.97 100.49 1.44% 0.975309912 0.95122942 1 2.5 3 -3% -3% -3% -0.06 -0.075 -0.09 2.71828183 2.71828183 271828183 0.941764534 0.927743486 0.913931185 1.911994964 1.883529067 1.855486973 1.827862371 1.800649045 2 15 -5% -0.075 2.71828183 0.927743486 Default Loss Discount Factor value hoped for loss 73.047617 1 2 74.15 73.72 73.28 72.83 72.37 0.927743486 0.913931185 71.91 71.45 70.97 70.49 0.927743486 2 0.98511194 0970445534 0.955997482 0.941764534 Total 0.900324523 0.886920437 0873715912 2 1 0.904837418 71.538429 70.051803 68,587403 67.144898 65.723963 64.324275 62.945518 61.587382 604.9512877 2 2 2.5 3 3.5 -5% -5% -5% -5% -01 -0.125 -0.15 -0.175 2.71828183 271828183 271828183 2.71828183 0.904837418 0.882496903 0.860707976 0.839457021 1 1 3.5 -3% -0.105 2.71828183 0.900324523 0882496903 0.860707976 2 1 0.839457021 4 -3% -0.12 271828183 0.886920437 2 4.5 -3% -0.135 2.71828183 0873715912 1773840873 1747431823 4 2 1 5 4,5 -5% -5% -5% -0.225 -0.25 2.71828183 2.71828183 0818730753 0.798516219 0.778800783 -0.2 271828183 0.818730753 0.798516219 0.778800783 8.738 1 -3% -0.15 2.71828183 0860707976 102 87.7922136 104.50 5 1

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the riskneutral default probability we need to calculate the expected loss associated wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started