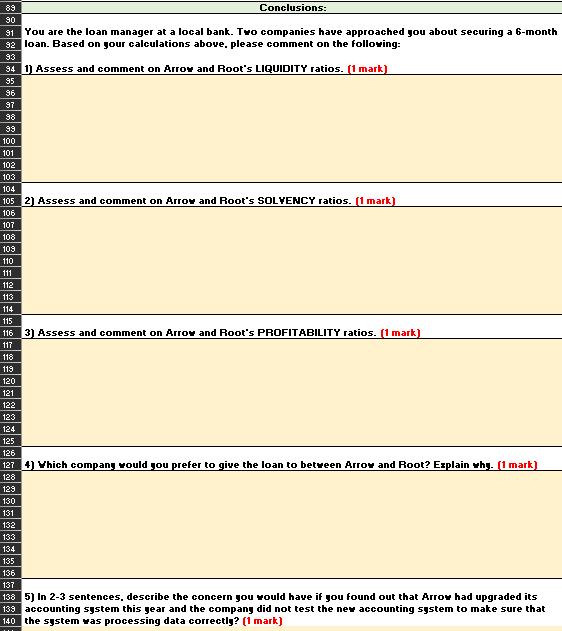

Question

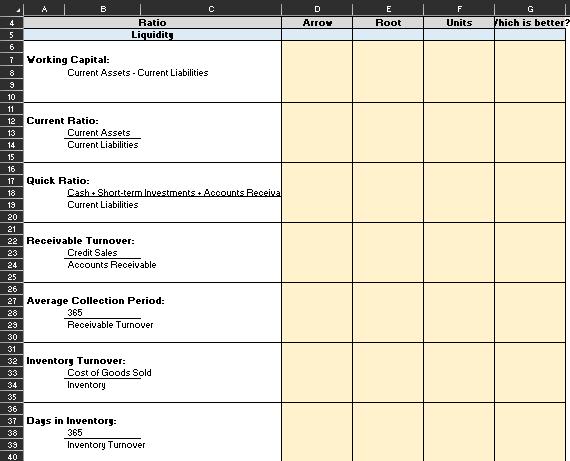

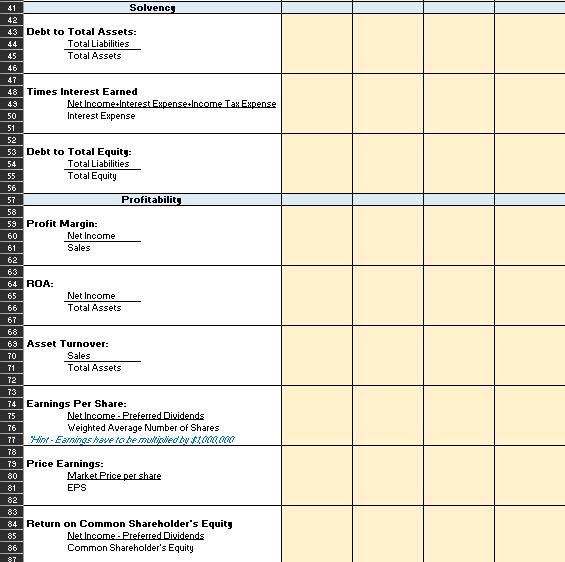

Prepare your math for Arrow and Root in columns D and E. To avoid transposition errors, you should link your formulas to the numbers on

Prepare your math for Arrow and Root in columns D and E. To avoid transposition errors, you should link your formulas to the numbers on the financial statement when you type them in. Please complete all calculations to 2 decimal places.

Please write the units for each ratio calculation in column F. When you click into the cells in column F, you can choose the units from drop-down menus. If a ratio uses % as a unit, please do your math with whole numbers (ie. 5.25 instead of 0.0525).

In column G, write a comment about which company's ratio result is better based on your calculations. (The ratios may be the same or similar depending on the financial statements you are using.) Please keep in mind that when you compare the working capital ratios of different companies, they need to be about the same size. For this assignment, let's say that Arrow and Root are the same.

*****Im Only doing Arrow

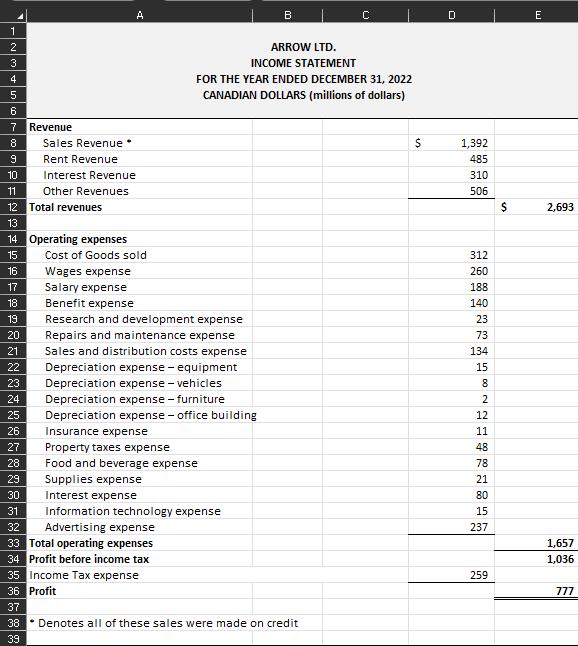

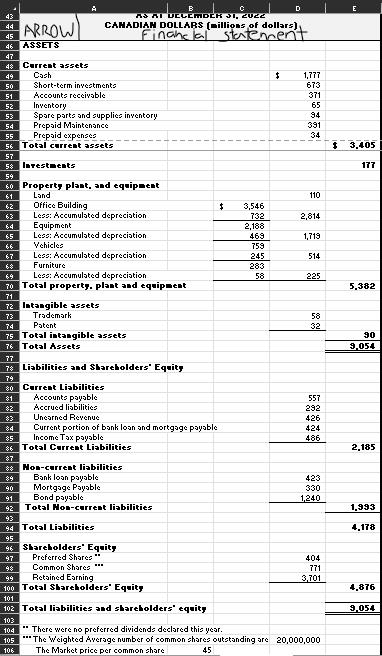

1 2 3 4 5 6 7 8 9 10 Revenue Sales Revenue. Rent Revenue Interest Revenue 11 Other Revenues 12 Total revenues 13 14 Operating expenses 15 16 17 18 19 20 21 22 23 24 25 26 27 A Cost of Goods sold FOR THE YEAR ENDED DECEMBER 31, 2022 CANADIAN DOLLARS (millions of dollars) Wages expense Salary expense Benefit expense Research and development expense Repairs and maintenance expense Sales and distribution costs expense Depreciation expense - equipment Depreciation expense - vehicles Depreciation expense - furniture Depreciation expense - office building Insurance expense Property taxes expense Food and beverage expense Supplies expense Interest expense B ARROW LTD. INCOME STATEMENT 28 29 30 31 Information technology expense 32 Advertising expense 33 Total operating expenses 34 Profit before income tax 35 Income Tax expense 36 Profit 37 38 39 Denotes all of these sales were made on credit 12 $ D 1,392 485 310 506 312 260 188 140 23 73 134 15 8 2 12 11 48 78 21 80 15 237 259 $ E 2,693 1,657 1,036 777

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Arrow Ltd Financial Ratios Column D Column E Column F Column G Working Capital 1777 424 1353 Millions of Canadian dollars Arrow has better working capital than Root Current Ratio 1777 424 419 Times Ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started