Answered step by step

Verified Expert Solution

Question

1 Approved Answer

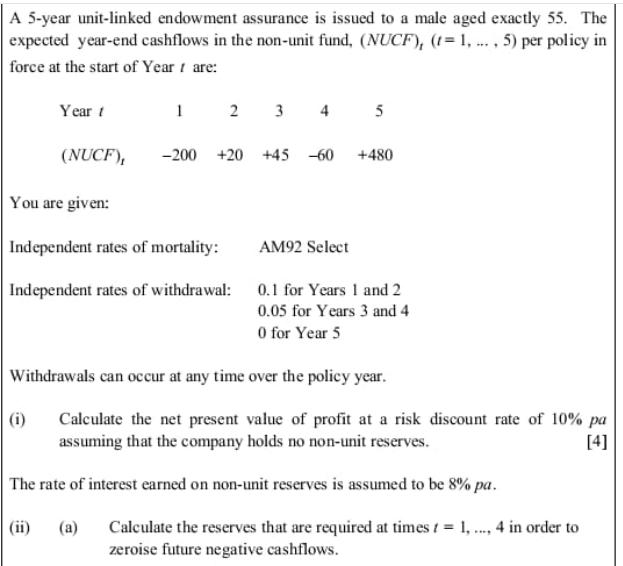

A 5-year unit-linked endowment assurance is issued to a male aged exactly 55. The expected year-end cashflows in the non-unit fund, (NUCF), (= 1,...,

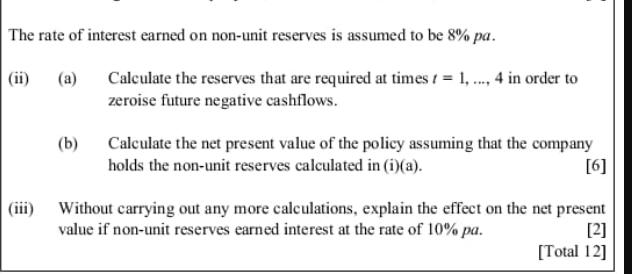

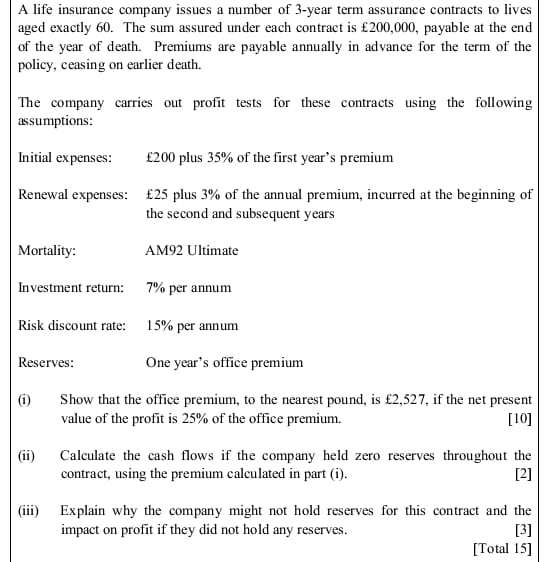

A 5-year unit-linked endowment assurance is issued to a male aged exactly 55. The expected year-end cashflows in the non-unit fund, (NUCF), (= 1,..., 5) per policy in force at the start of Year / are: Year t 1 2 3 4 5 (NUCF), -200 +20 +45-60 +480 You are given: Independent rates of mortality: Independent rates of withdrawal: AM92 Select 0.1 for Years 1 and 2 0.05 for Years 3 and 4 0 for Year 5 Withdrawals can occur at any time over the policy year. (i) Calculate the net present value of profit at a risk discount rate of 10% pa assuming that the company holds no non-unit reserves. The rate of interest earned on non-unit reserves is assumed to be 8% pa. [4] (ii) (a) Calculate the reserves that are required at times = 1,..., 4 in order to zeroise future negative cashflows. The rate of interest earned on non-unit reserves is assumed to be 8% pa. (ii) (a) (iii) (b) Calculate the reserves that are required at times = 1,..., 4 in order to zeroise future negative cashflows. Calculate the net present value of the policy assuming that the company holds the non-unit reserves calculated in (i)(a). [6] Without carrying out any more calculations, explain the effect on the net present value if non-unit reserves earned interest at the rate of 10% pa. [2] [Total 12] A life insurance company issues a number of 3-year term assurance contracts to lives aged exactly 60. The sum assured under each contract is 200,000, payable at the end of the year of death. Premiums are payable annually in advance for the term of the policy, ceasing on earlier death. The company carries out profit tests for these contracts using the following assumptions: Initial expenses: 200 plus 35% of the first year's premium Renewal expenses: 25 plus 3% of the annual premium, incurred at the beginning of the second and subsequent years Mortality: AM92 Ultimate Investment return: 7% per annum Risk discount rate: 15% per annum Reserves: One year's office premium (i) Show that the office premium, to the nearest pound, is 2,527, if the net present value of the profit is 25% of the office premium. [10] (ii) Calculate the cash flows if the company held zero reserves throughout the contract, using the premium calculated in part (i). [2] (iii) Explain why the company might not hold reserves for this contract and the impact on profit if they did not hold any reserves.. [3] [Total 15]

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

For the given questions regarding the unitlinked endowment assurance and the profit tests for the te...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started