Answered step by step

Verified Expert Solution

Question

1 Approved Answer

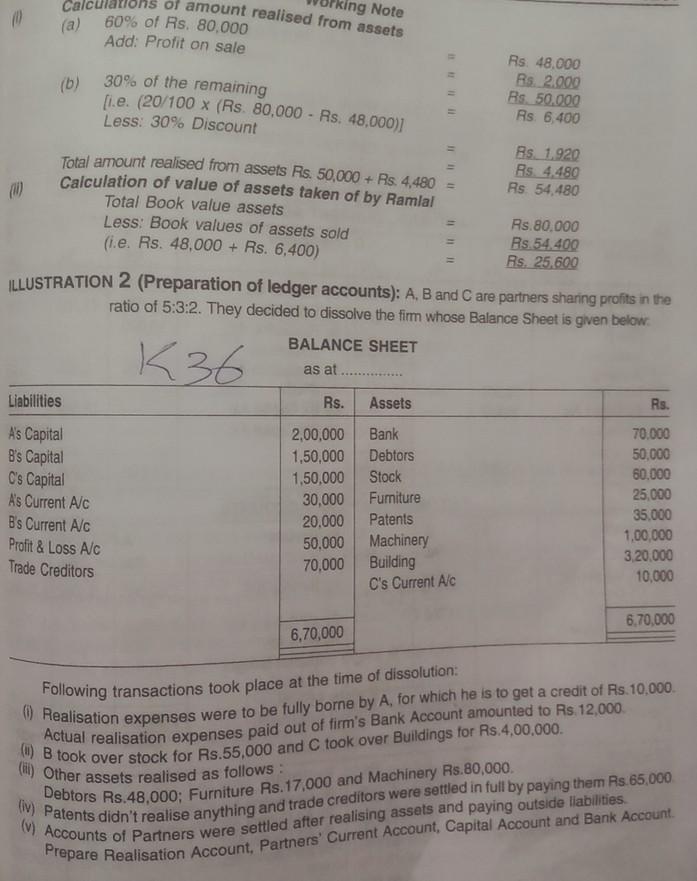

(a) (6) Calculations of amount realised from assets king Note 00 % of Rs. 80,000 Add: Profit on sale Rs. 48.000 Rs. 2.000 30% of

(a) (6) Calculations of amount realised from assets king Note 00 % of Rs. 80,000 Add: Profit on sale Rs. 48.000 Rs. 2.000 30% of the remaining Rs. 50.000 fi.e. (20/100 x (Rs. 80,000 - Rs. 48,000) Rs. 6,400 Less: 30% Discount Rs. 1.920 Total amount realised from assets Rs. 50,000 + Rs. 4,480 = Rs. 4.480 Calculation of value of assets taken of by Ramlal Rs 54,480 Total Book value assets Less: Book values of assets sold Rs. 80.000 (i.e. Rs. 48,000 + Rs. 6,400) Rs 54.400 Rs. 25,600 ILLUSTRATION 2 (Preparation of ledger accounts): A, B and C are partners sharing profits in the ratio of 5:3:2. They decided to dissolve the firm whose Balance Sheet is given below BALANCE SHEET as at Liabilities Rs. Assets Rs. Bank 70.000 As Capital 2,00,000 Debtors 50,000 B's Capital 1.50,000 60.000 C's Capital 1,50,000 Stock 25,000 A's Current A/C 30,000 Furniture 35.000 B's Current A/C 20.000 Patents 1,00,000 Profit & Loss A/C 50.000 Machinery 3,20,000 Trade Creditors 70.000 Building 10,000 C's Current Alc K36 6,70,000 6,70,000 Following transactions took place at the time of dissolution: Realisation expenses were to be fully borne by A, for which he is to get a credit of Rs.10,000. Actual realisation expenses paid out of firm's Bank Account amounted to Rs. 12,000 B took over stock for AS.65,000 and C took over Buildings for Rs.4,00.000. (1) Other assets realised as follows: w) Patents didn't realise anything and trade creditors were settled in full by paying them Rs 65,000 (V) Accounts of Partners were settled after realising assets and paying outside liabilities Debtors Rs.48,000; Furniture Rs. 17,000 and Machinery Rs.80,000. Prepare Realisation Account Partners' Current Account, Capital Account and Bank Account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started