Answered step by step

Verified Expert Solution

Question

1 Approved Answer

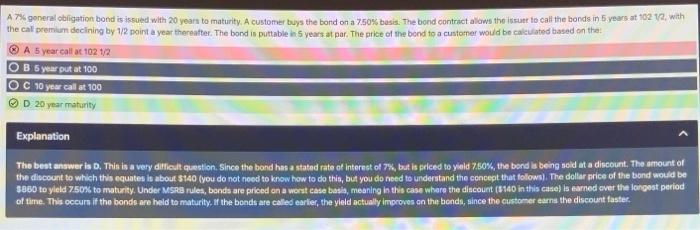

A 7% general obligation bond is issued with 20 years to maturity. A customer buys the bond on a 7.50% basis. The bond contract allows

A 7% general obligation bond is issued with 20 years to maturity. A customer buys the bond on a 7.50% basis. The bond contract allows the issuer to call the bonds in 5 years at 102 12, with the call premium declining by 1/2 point a year thereafter. The bond is puttable in 5 years at par. The price of the bond to a customer would be calculated based on the:

A 5 year call at 102 1/2

B 5 year put at 100

C 10 year call at 100

D 20 year maturity

Explanation The best answer is D. This is a very difficult question. Since the bond has a stated rate of interest of 7%, but is priced to yield 7.50%, the bond is being sold at a discount. The amount of the discount to which this equates is about $140 (you do not need to know how to do this, but you do need to understand the concept that follows). The dollar price of the bond would be $860 to yield 7.50% to maturity. Under MSRB rules, bonds are priced on a worst case basis, meaning in this case where the discount ($140 in this case) is earned over the longest period of time. This occurs if the bonds are held to maturity. If the bonds are called earlier, the yield actually improves on the bonds, since the customer earns the discount faster.

I do not understand the explanation. If you can break down the calculations would be great.

A7%general obligation bond is issued with 20 years to maturity. A customer buys the bond on a 7.50% basis. The bond contract allows the issue to cali the bonds in 5 years at 962 12. with the cal premium decining by 12 point a year thereafter. The bord in pottable in 5 years at par. The price of the bond to a customer would be calculated based on the * A 5 year call at 102 1/2 OB 5 year put at 100 OC 10 year call at 100 D 20 year maturity Explanation The best answer is D. This is a very difficult question. Since the band has a stated rate of interest of 7%, but is priced to yield 7.50%, the bond is being sold at a discount. The amount of the discount to which this equates is about $140 (you do not need to know how to do this, but you do ned to understand the concept that follows. The dollar price of the bond would be $850 to yield 7.50% to maturity. Under MSRB rules, bonds are priced on a worst case basis, meaning in this case where the discount ($140 in this case) is earned over the longest period of time. This occurs if the bonds are held to maturity. If the bonds are called earlier, the yield actually improves on the bond, since the customer carns the discount faster Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started