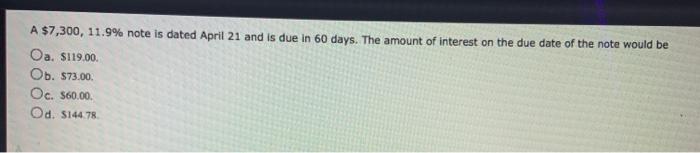

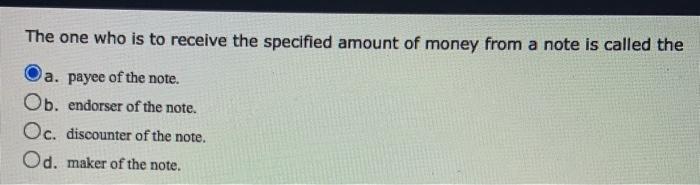

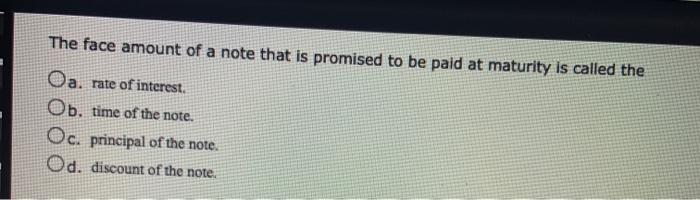

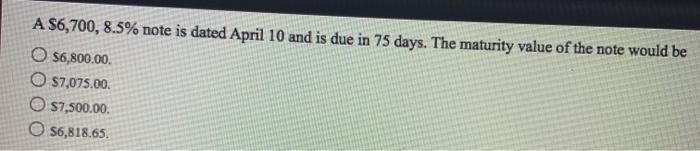

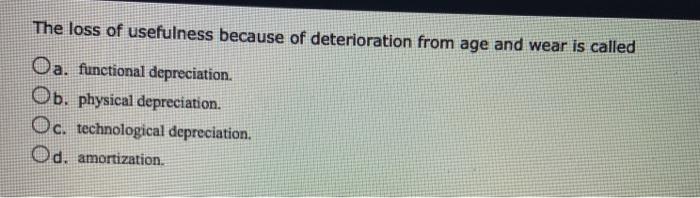

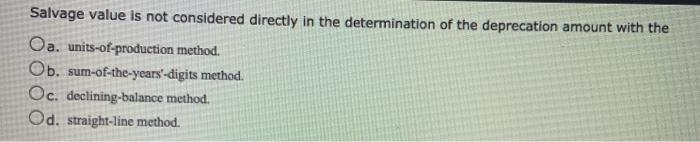

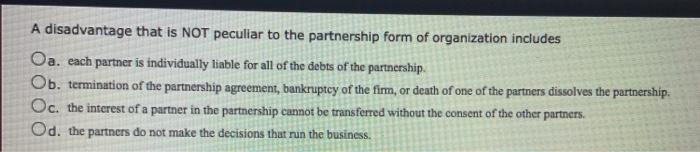

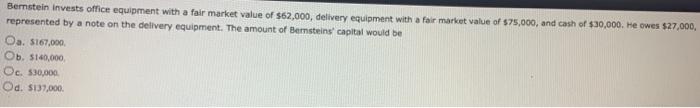

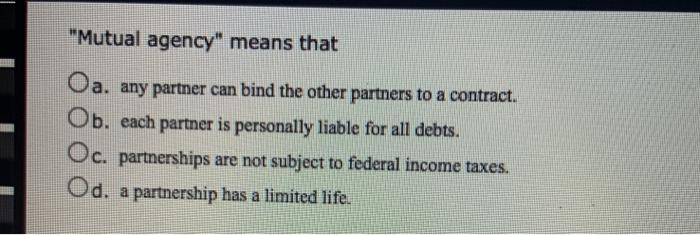

A $7,300, 11.9% note is dated April 21 and is due in 60 days. The amount of interest on the due date of the note would be Oa. $119.00 Ob. 573.00 Oc. $60.00 Od 5144.78 The one who is to receive the specified amount of money from a note is called the a. payee of the note. Ob. endorser of the note. Oc. discounter of the note. Od. maker of the note. The face amount of a note that is promised to be paid at maturity is called the Oa. rate of interest Ob, time of the note. Oc. principal of the note. Od. discount of the note. A $6,700, 8.5% note is dated April 10 and is due in 75 days. The maturity value of the note would be O $6,800.00 O $7,075.00 O $7,500.00 O S6,818.65 The loss of usefulness because of deterioration from age and wear is called Oa. functional depreciation. Ob. physical depreciation. Oc. technological depreciation, Od, amortization Salvage value is not considered directly in the determination of the deprecation amount with the Oa. units-of-production method. Ob. sum-of-the-years'-digits method. Oc. declining-balance method. Od straight-line method. A disadvantage that is NOT peculiar to the partnership form of organization includes Oa. each partner is individually liable for all of the debts of the partnership Ob. termination of the partnership agreement, bankruptcy of the fim, or death of one of the partners dissolves the partnership. Oc. the interest of a partner in the partnership cannot be transferred without the consent of the other partners. Od the partners do not make the decisions that run the business. Bernstein invests office equipment with a fair market value of $62,000, delivery equipment with a fair market value of $75,000, and cash of $30,000. He owes $27,000, represented by a note on the delivery equipment. The amount of Bernsteins' capital would be Oa. 5167,000 Ob. $140,000 Oc. $30,000 Od. 5137,000 "Mutual agency" means that Oa. any partner can bind the other partners to a contract. Ob. each partner is personally liable for all debts. Oc. partnerships are not subject to federal income taxes. Od. a partnership has a limited life