Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A $7,400.00 demand loan was taken out on March 4 at a fixed interest rate of 7.67% with fixed monthly payments of $1,230.00. The

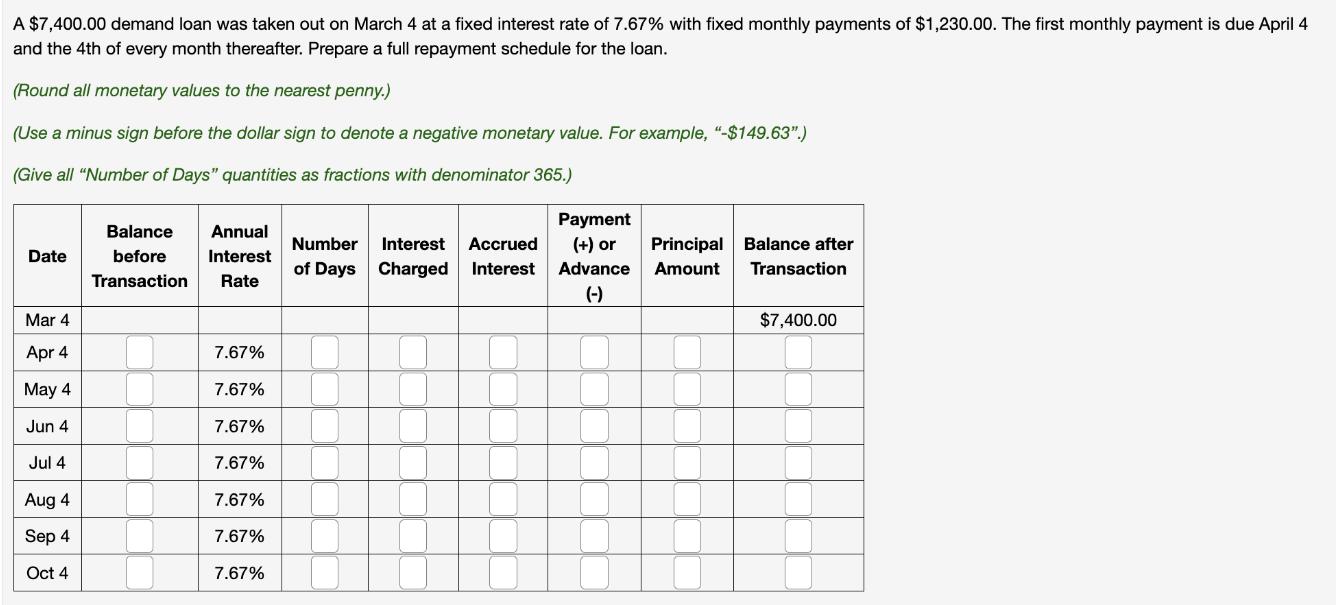

A $7,400.00 demand loan was taken out on March 4 at a fixed interest rate of 7.67% with fixed monthly payments of $1,230.00. The first monthly payment is due April 4 and the 4th of every month thereafter. Prepare a full repayment schedule for the loan. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63".) (Give all "Number of Days" quantities as fractions with denominator 365.) Date Mar 4 Apr 4 May 4 Jun 4 Jul 4 Aug 4 Sep 4 Oct 4 Balance Annual before Interest Transaction Rate 7.67% 7.67% 7.67% 7.67% 7.67% 7.67% 7.67% Payment (+) or Number Interest Accrued Principal of Days Charged Interest Advance Amount (-) Balance after Transaction $7,400.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Heres a full repayment schedule for the loan Date Balance before Transaction Annual Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started