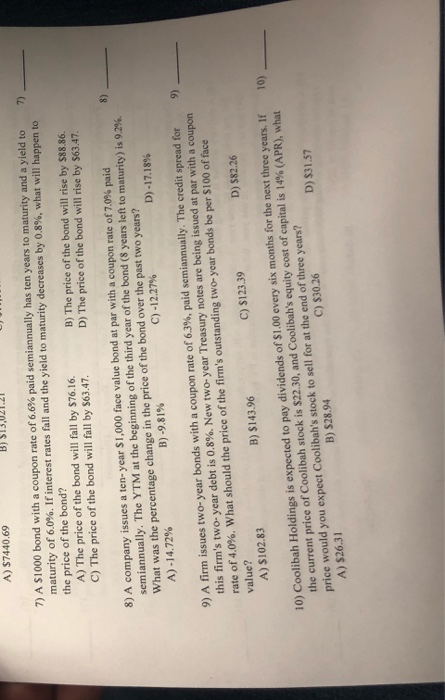

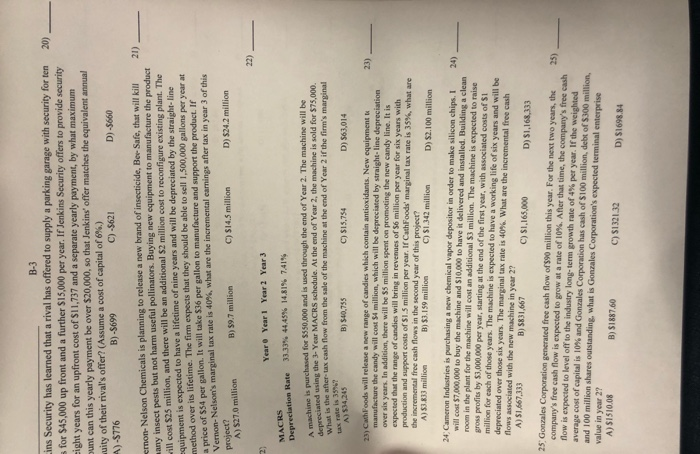

A) $7440.69 7) A S1000 bond with a coupon rate of 6.6% paid semiannually has ten years to maturity and a yield to maturity of 6.0%. If interest rates fall and the yield to maturity decreases by 0.8%, what will happen to the price of the bond? A) The price of the bond will fall by $76.16. C) The price of the bond will fall by $63.47. (7) B) The price of the bond will rise by $88.86. D) The price of the bond will rise by $63.47. 8) A company issues a ten- year $1,000 face value bond at par with a coupon rate of 7.0% paid semiannually. The YTM at the beginning of the third year of the bond (8 years left to maturity) is 9.2%. What was the percentage change in the price of the bond over the past two years? A) -14.72% C) -12.27% D) -17.18% %18'6- (8 9) A firm issues two- year bonds with a coupon rate of 6.3%, paid semiannually. The credit spread for (6 this firm's two- year debt is 0.8%. New two- year Treasury notes are being issued at par with a coupon rate of 4.0%. What should the price of the firm's outstanding two- year bonds be per $100 of face value? A) S102.83 B) $143.96 C) $123.39 D) $82.26 10) Coolibah Holdings is expected to pay dividends of $1.00 every six months for the next three years. If the current price of Coolibah stock is $22.30, and Coolibah's equity cost of capital is 14% (APR), what price would you expect Coolibah's stock to sell for at the end of three years? A) $26.31 10: B) $28.94 C) $30.26 B-3 ins Security has learned that a rival has offered to supply a parking garage with security for ten s for $45,000 up front and a further $15,000 per year. If Jenkins Security offers to provide security eight years for an upfront cost of $11,737 and a separate yearly payment, by what maximum punt can this yearly payment be over $20,000, so that Jenkins' offer matches the equivalent annual wuity of their rival's offer? (Assume a cost of capital of 6%.) C) -$621 6695- (g 0995- (a 9LLS- ( emon- Nelson Chemicals is planning to release a new brand of insecticide, Bee Safe, that will kilI any insect pests but not harm useful pollinators. Buying new equipment to manufacture the product will cost $25 million, and there will be an additional $2 million cost to reconfigure existing plant. The equipment is expected to have a lifetime of nine years and will be depreciated by the straight- line method over its lifetime. The firm expects that they should be able to sell 1,500,000 gallons per year at a price of $54 per gallon. It will take $36 per gallon to manufacture and support the product. If (1) Vernon-Nelson's marginal tax rate is 40%, what are the incremental earnings after tax in year 3 of this D) $24.2 million pofoad A) S27.0 million C) S14.5 million B) $9.7 million (zz Year Year1 Year 2 Year 3 Depreciation Rate A machine is purchased for 5550,000 and is used through the end of Year 2. The machine will be depreciated using the 3- Year MACRS schedule. At the end of Year 2, the machine is sold for $75.000. What is the after- tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%? A)534,245 B) $40,755 D) $63,014 SL'SIS O 23) CathFoods will release a new range of candies which contain antioxidants. New equipment te manufacture the candy will cost $4 million, which will be depreciated by straight- line depreciation over six years. In addition, there will be $5 million spent on promoting the new candy line. It is expected that the range of candies will bring in revenues of 56 million per year for six years with production and support costs of S1.5 million per year. If CathFoods' marginal tax rate is 35%, what are the incremental free cash flows in the second year of this project? A) S3.833 million B) $3.159 million c) s1.342 million D) $2.100 million 24 Cameron Industries is purchasing a new chemical vapor depositor in order to make silicon chips. I will cost $7,000,000 to buy the machine and S10,000 to have it delivered and installed. Building a clean room in the plant for the machine will cost an additional S3 million. The machine is expected to raise gross profits by $3,000,000 per year, starting at the end of the first year, with associated costs of $1 million for each of those years. The machine is expected to have a working life of six years and will be depreciated over those six years. The marginal tax rate is 40%. What are the incremental free cash flows associated with the new machine in year 2? A)S1,667,333 (17 B) S831,667 D) S1,168,333 25 Gonzales Corporation generated free cash flow of $90 million this year. For the next two years, the company's free cash flow is expected to grow at a rate of 10%. After that time, the company's free cash flow is expected to level off to the industry long-term growth rate of 4% per year. If the weighted average cost of capital is 10% and Gonzales Corporation has cash of S100 million, debt of $300 million, and 100 million shares outstanding, what is Gonzales Corporation's expected terminal enterprise 000's91'IS () 25) value in year 2? A) SIS10.08 09'L88IS (8 18 869IS (a