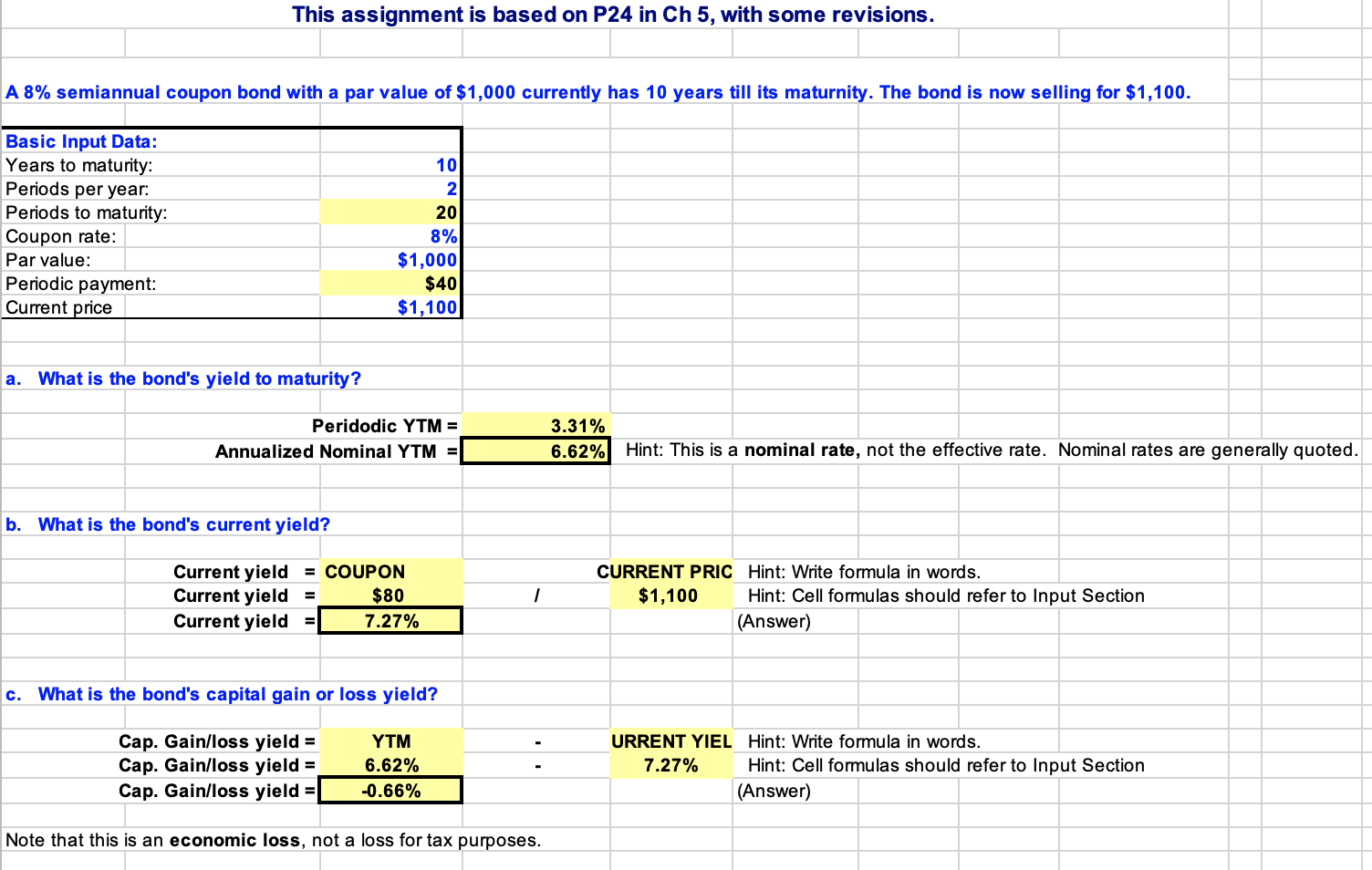

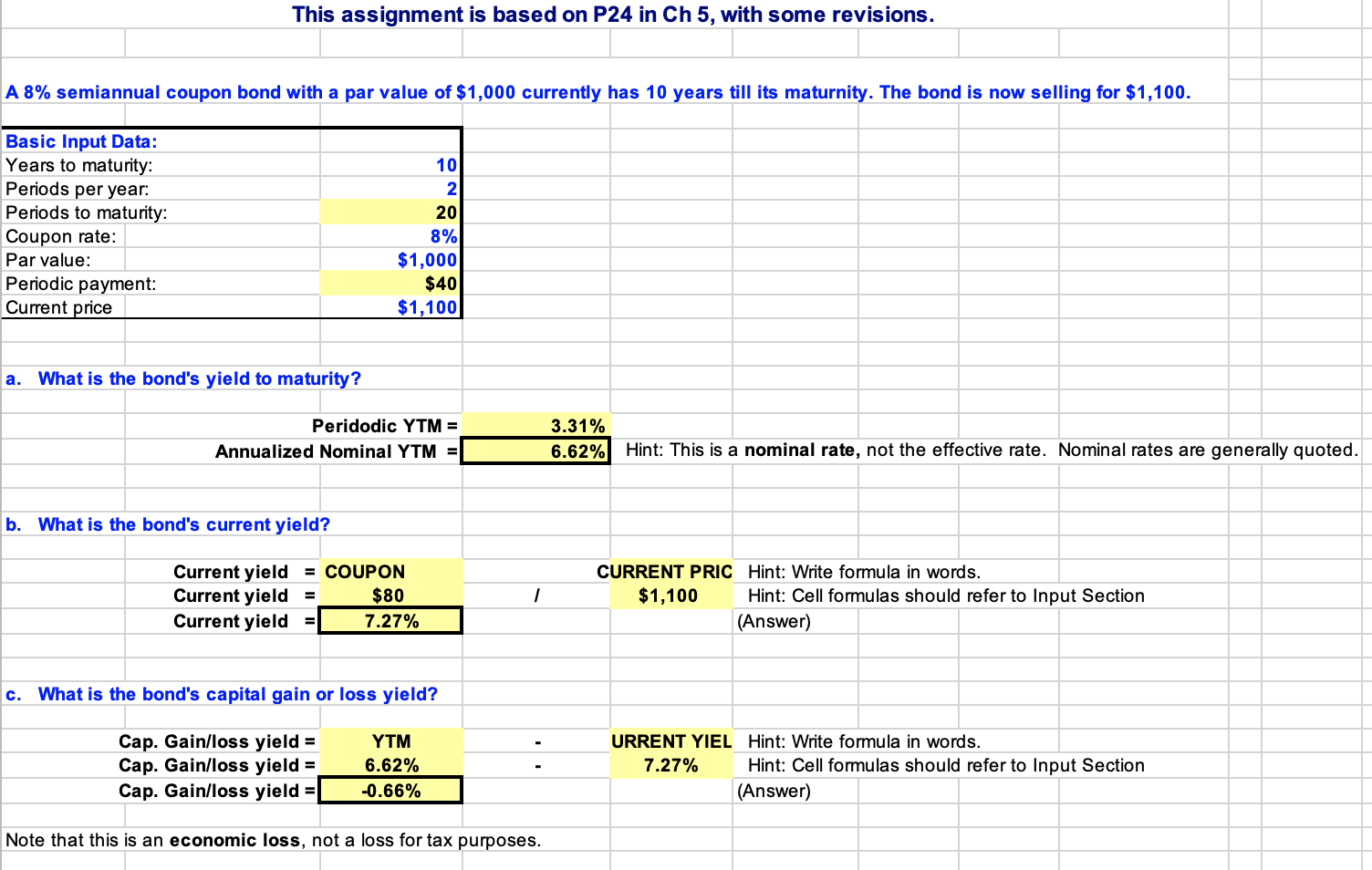

A 8% semiannual coupon bond with a par value of $1,000 currently has 10 years till its maturnity. The bond is now selling for $1,100.

a. What is the bond's yield to maturity?

b. What is the bond's current yield?

'c. What is the bond's capital gain or loss yield?

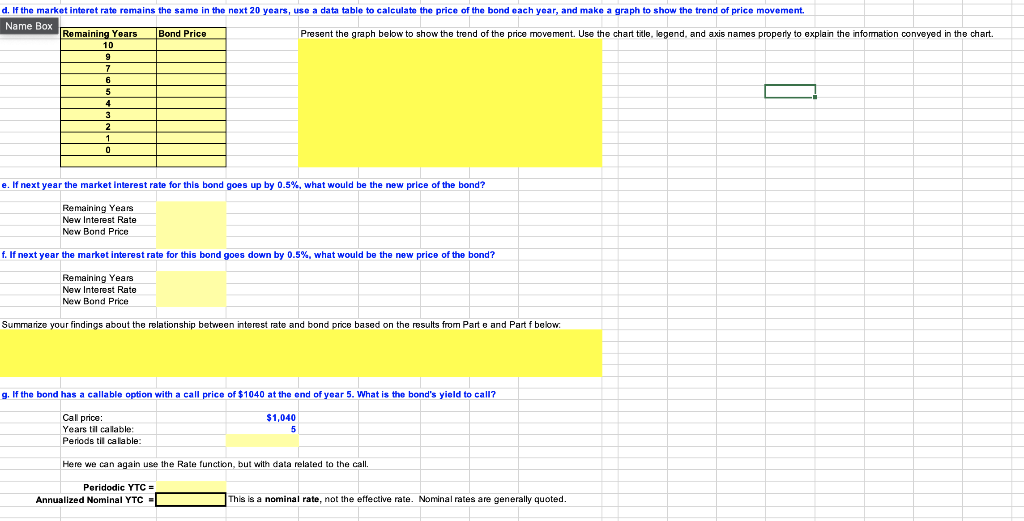

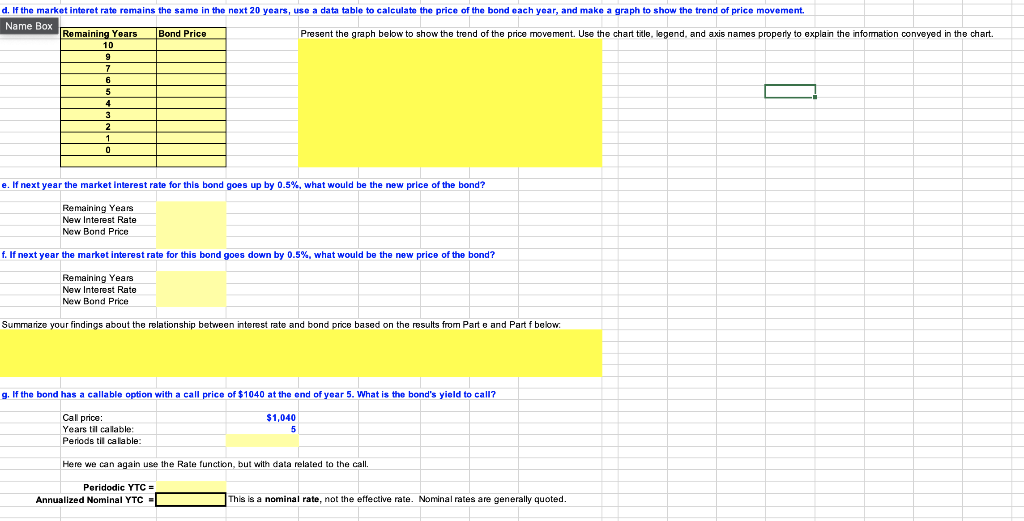

'd. If the market interet rate remains the same in the next 20 years, use a data table to calculate the price of the bond each year, and make a graph to show the trend of price movement.

'e. If next year the market interest rate for this bond goes up by 0.5%, what would be the new price of the bond?

'f. If next year the market interest rate for this bond goes down by 0.5%, what would be the new price of the bond?

'g. If the bond has a callable option with a call price of $1040 at the end of year 5. What is the bond's yield to call?

This assignment is based on P24 in Ch 5, with some revisions. A 8% semiannual coupon bond with a par value of $1,000 currently has 10 years till its maturnity. The bond is now selling for $1,100. Basic Input Data: Years to maturity: Periods per year: Periods to maturity: Coupon rate: Par value: Periodic payment: Current price 10 2 20 8% $1,000 $40 $1,100 a. What is the bond's yield to maturity? Peridodic YTM = Annualized Nominal YTM = 3.31% 6.62% Hint: This is a nominal rate, not the effective rate. Nominal rates are generally quoted. b. What is the bond's current yield? Current yield = COUPON Current yield $80 Current yield = 7.27% 1 CURRENT PRIC Hint: Write formula in words. $1,100 Hint: Cell formulas should refer to Input Section (Answer) c. What is the bond's capital gain or loss yield? Cap. Gain/loss yield = Cap. Gain/loss yield = Cap. Gain/loss yield = YTM 6.62% -0.66% URRENT YIEL Hint: Write formula in words. 7.27% Hint: Cell formulas should refer to Input Section (Answer) Note that this is an economic loss, not a loss for tax purposes. price movement. d. If the market interet rate remains the same in the next 20 years, use a data table to calculate the price of the bond each year, and make a graph to show the trend Name Box Remaining Years Bond Price Present the graph below to show the trend of the price movement. Use the chart title, legend, and axis names properly to explain the information conveyed in the chart. 10 fi 5 4 3 2 1 0 e. If next year the market interest rate for this bond goes up by 0.5%, what would be the new price of the bond? Remaining Years New Interest Rate New Bond Price f. If next year the market interest rate for this bond goes down by 0.5%, what would be the new price of the bond? Remaining Years New Interest Rate New Bond Price Summarize your findings about the relationship between interest rate and bond price based on the results from Parts and Part f below. g. If the bond has a callable option with a call price of $1040 at the end of year 5. What is the bond's yield to call? Cal price $1,040 Years til callable: 5 Periods til calable: Here we can again use the Rate function, but with data related to the call. Peridodic YTC = Annualized Nominal YTC- This is a nominal rate, not the effective rate. Nominal rates are generally quoted. This assignment is based on P24 in Ch 5, with some revisions. A 8% semiannual coupon bond with a par value of $1,000 currently has 10 years till its maturnity. The bond is now selling for $1,100. Basic Input Data: Years to maturity: Periods per year: Periods to maturity: Coupon rate: Par value: Periodic payment: Current price 10 2 20 8% $1,000 $40 $1,100 a. What is the bond's yield to maturity? Peridodic YTM = Annualized Nominal YTM = 3.31% 6.62% Hint: This is a nominal rate, not the effective rate. Nominal rates are generally quoted. b. What is the bond's current yield? Current yield = COUPON Current yield $80 Current yield = 7.27% 1 CURRENT PRIC Hint: Write formula in words. $1,100 Hint: Cell formulas should refer to Input Section (Answer) c. What is the bond's capital gain or loss yield? Cap. Gain/loss yield = Cap. Gain/loss yield = Cap. Gain/loss yield = YTM 6.62% -0.66% URRENT YIEL Hint: Write formula in words. 7.27% Hint: Cell formulas should refer to Input Section (Answer) Note that this is an economic loss, not a loss for tax purposes. price movement. d. If the market interet rate remains the same in the next 20 years, use a data table to calculate the price of the bond each year, and make a graph to show the trend Name Box Remaining Years Bond Price Present the graph below to show the trend of the price movement. Use the chart title, legend, and axis names properly to explain the information conveyed in the chart. 10 fi 5 4 3 2 1 0 e. If next year the market interest rate for this bond goes up by 0.5%, what would be the new price of the bond? Remaining Years New Interest Rate New Bond Price f. If next year the market interest rate for this bond goes down by 0.5%, what would be the new price of the bond? Remaining Years New Interest Rate New Bond Price Summarize your findings about the relationship between interest rate and bond price based on the results from Parts and Part f below. g. If the bond has a callable option with a call price of $1040 at the end of year 5. What is the bond's yield to call? Cal price $1,040 Years til callable: 5 Periods til calable: Here we can again use the Rate function, but with data related to the call. Peridodic YTC = Annualized Nominal YTC- This is a nominal rate, not the effective rate. Nominal rates are generally quoted