Question

A 9.98% coupon, 14.0 -year annual bond has a yield to maturity of 7.57%. Assuming the par value is 1,000 and the YTM does

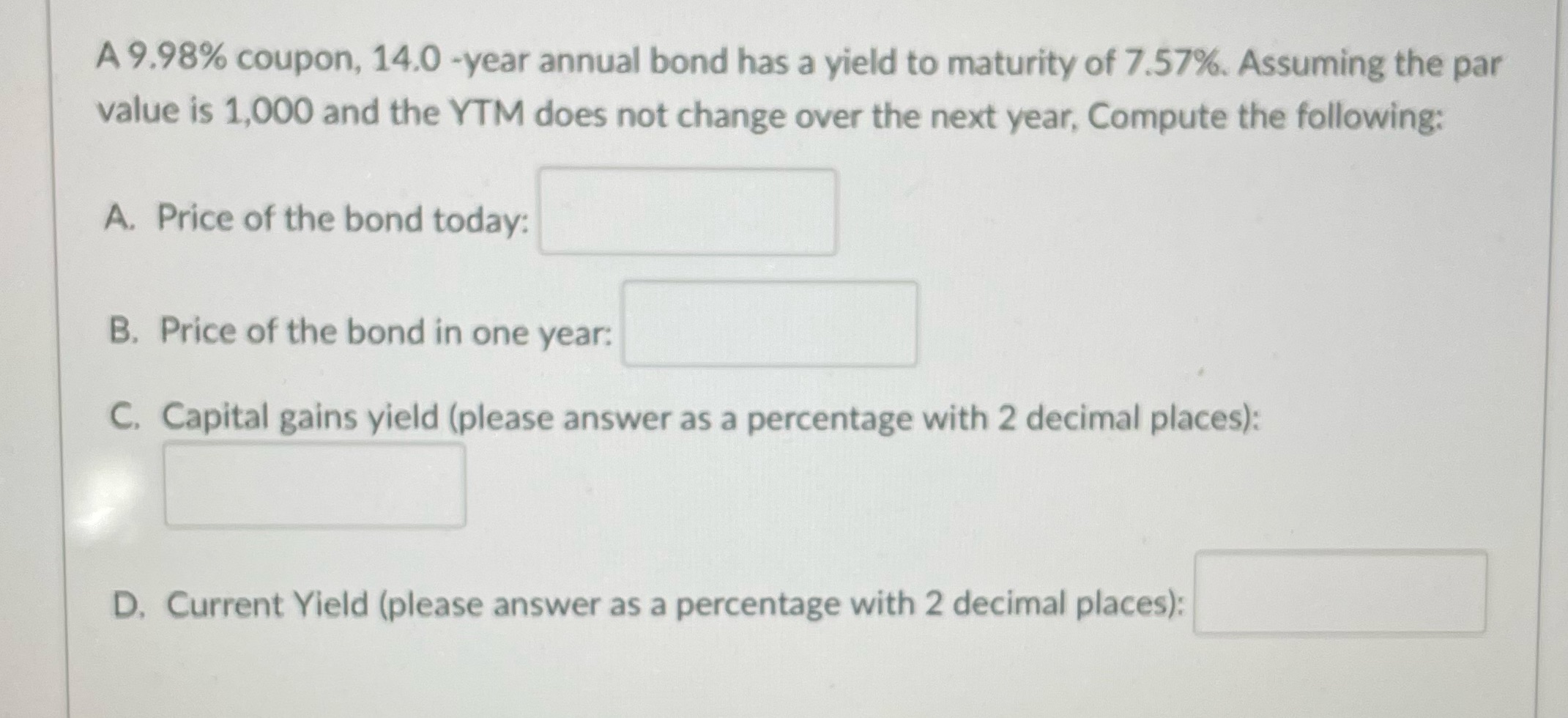

A 9.98% coupon, 14.0 -year annual bond has a yield to maturity of 7.57%. Assuming the par value is 1,000 and the YTM does not change over the next year, Compute the following: A. Price of the bond today: B. Price of the bond in one year: C. Capital gains yield (please answer as a percentage with 2 decimal places): D. Current Yield (please answer as a percentage with 2 decimal places):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer A Price of the bond today Using the formula for bond prici...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fixed Income Analysis

Authors: Barbara S. Petitt

5th Edition

1119850541, 978-1119850540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App