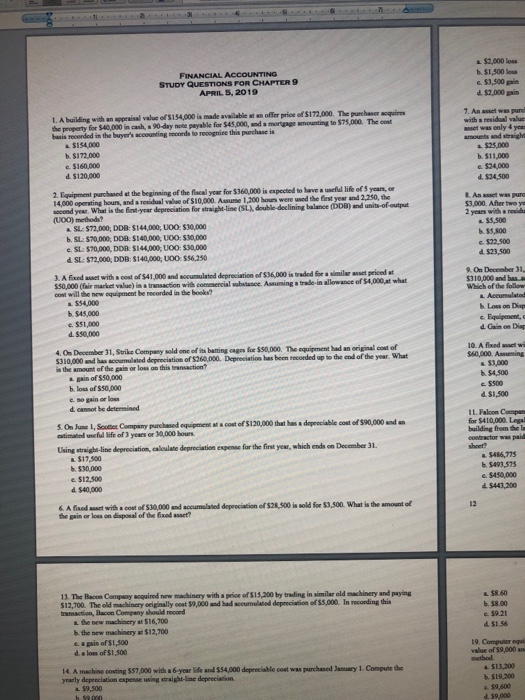

a a $2,000 loss b. $1,500 loa FINANCIAL ACCOUNTING STUDY QUESTIONS FOR CHAPTER9 APRIL 5, 2019 $3,300 d. $2,000 gin 1. A building with an asppraisal value ofr$154,000 is made a the property for $40,000 in cash, 90-day note payable for $45,000, and a mortgage basis recorded in the buyer's accounting necords to recognine this purchase is available at an offer price of $172,000. The purehaser acquires 7. An asset was purc with a residual value asset was only 4 yea amounts and strsigh $25,000 amounting to S75,000 The cost $154,000 $172,000 e. $160,000 $11,000 e $24,000 d. $120,000 d $24,500 2. Equipment purchased at the beginning of the fiscal year for $360,000 is expected to have a ucfial life of s yan, o econd yeer. What is the fint-year depreciation for straight-line (SL doubie declining balance DDB) and units-of output hours, and a residual vaue of $10,000. Assume 1,200 houns were used the first year and 2,250, the &. An aset was pure $3,000. After two y 2 years with a resid $5,500 (UO0) methods? SL:$72,000, DDB: $144,000, U0O: $30,000 .SL:$70,000, DDB: $140,000, UO0: $30,000 e SL: $70,000, DDB: $144,000, UO0: $30,000 $5,800 c. $22500 d $23,500 d SL:$72,000, DDB: $140,000, UO0 $56,250 cost of$41,000 and uoc mulateddcpreciation ofSS4,000 is .dedfor a sumilar asset value) in a transaction wits commercial substance. Assuning a trade-in allowance of $4,000 at what 9. On December 31, $310,000 and basa 3, A fined met with cost will the new equipment be recorded in the books? Which of the follow $54000 $45,000 e. $$1,000 d. $30,000 a Accumalatod Loss on Dap d Gain on Dis 4.0m December 31, Strike Company sold one of its batting cages foe $50,000. The equipment had an original cost of is the amount of the gais or loss on this transaction 10 A fixed aset wi $60,000. Assuming $3,000 $310,000 and h has acoumulsted depreciation of $260,000. Depreciation has been recorded up to the end of the year. What gain of $50,000 b. loss of $50,000 c.50 gain or loss d. cannot be deternined b.$4,500 .$500 d $1,500 11. Faloon Compan for $410,00o0. Legal building from the la at a cost of $120,000 that has a depeeciable cost of $90,000 and an 5. On June I, Scotter Company purchased equipement axtimated useful life of 3 years or 30,000 hours cost Using straight-line depreciation, caleulate depreciation expense for the first year, which ends on December 31. $17,500 b $30,000 e. $12,500 d 540,000 $493,575 e. $450,000 $443,200 A flixed sst with a cost of $30,000 and accumlated deprociation of S28,500 is sold for $3,500. What is the amount of the gain or loss on disposal of the fixed asset? 12 13. The Bacon Company soquined new machinery with a prioe of $15,200 by trading in similar old machinery and paying $12,700. The old mackinery originally cost $9,000 and had accumulated depreciatsion of $5,000. In reconding this tranaction, Bacon Company should nocord $8.60 b. $8.00 e $9.21 d $1.56 a the new machinery at $16,700 b. the new machinery $12,700 e. a pain of $1,500 d. a loss of S1,500 19. Compuler equi value of $9,000 an method 14 A machine costing $57,000 with a 6-year life and $54,000 depeeciable cost was purchased January 1. Compute the a. $13,200 h. $19,200 L $9,500 d 59,000