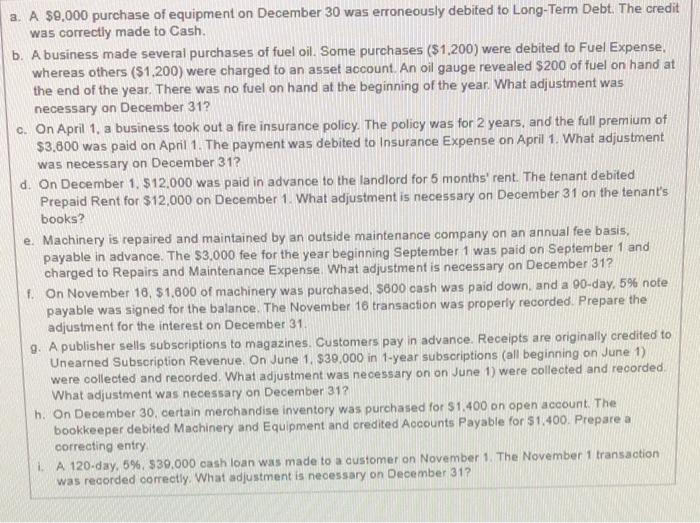

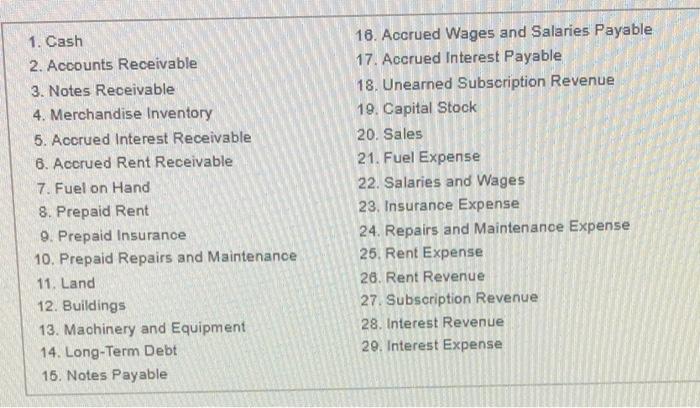

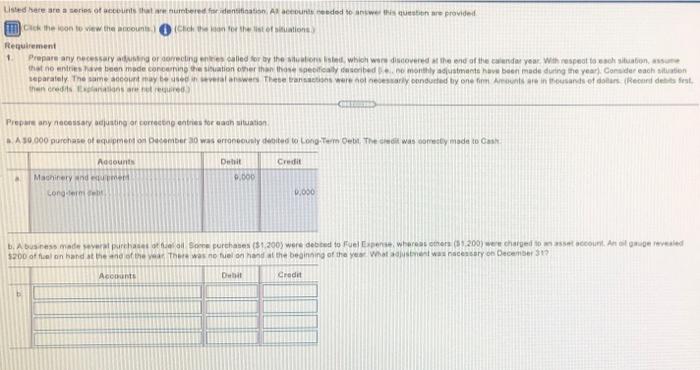

a a. A $9,000 purchase of equipment on December 30 was erroneously debited to Long-Term Debt. The credit was correctly made to Cash. b. A business made several purchases of fuel oil. Some purchases ($1,200) were debited to Fuel Expense. whereas others ($1.200) were charged to an asset account. An oil gauge revealed $200 of fuel on hand at the end of the year. There was no fuel on hand at the beginning of the year. What adjustment was necessary on December 31? c. On April 1. a business took out a fire insurance policy. The policy was for 2 years, and the full premium of $3,800 was paid on April 1. The payment was debited to Insurance Expense on April 1. What adjustment was necessary on December 31? d. On December 1, $12,000 was paid in advance to the landlord for 5 months' rent. The tenant debited Prepaid Rent for $12,000 on December 1. What adjustment is necessary on December 31 on the tenant's books? e Machinery is repaired and maintained by an outside maintenance company on an annual fee basis, payable in advance. The $3.000 fee for the year beginning September 1 was paid on September 1 and charged to Repairs and Maintenance Expense What adjustment is necessary on December 31? f. On November 18, $1,600 of machinery was purchased, 5600 cash was paid down, and a 90-day, 5% note payable was signed for the balance. The November 16 transaction was properly recorded. Prepare the adjustment for the interest on December 31 9. A publisher sells subscriptions to magazines, Customers pay in advance. Receipts are originally credited to Unearned Subscription Revenue. On June 1, $30,000 in 1-year subscriptions (all beginning on June 1) were collected and recorded. What adjustment was necessary on on June 1) were collected and recorded What adjustment was necessary on December 312 h. On December 30, certain merchandise inventory was purchased for $1,400 on open account. The bookkeeper debited Machinery and Equipment and credited Accounts Payable for $1,400. Prepare a correcting entry 1.A 120 day, 5%. 339,000 cash loan was made to a customer on November 1. The November 1 transaction was recorded correctly. What adjustment is necessary on December 31? 1. Cash 2. Accounts Receivable 3. Notes Receivable 4. Merchandise Inventory 5. Accrued Interest Receivable 6. Accrued Rent Receivable 7. Fuel on Hand 8. Prepaid Rent 9. Prepaid Insurance 10. Prepaid Repairs and Maintenance 11. Land 12. Buildings 13. Machinery and Equipment 14. Long-Term Debt 16. Notes Payable 16. Accrued Wages and Salaries Payable 17. Accrued Interest Payable 18. Unearned Subscription Revenue 19. Capital Stock 20. Sales 21. Fuel Expense 22. Salaries and Wages 23. Insurance Expense 24. Repairs and Maintenance Expense 25. Rent Expense 28. Rent Revenue 27. Subscription Revenue 28. Interest Revenue 29. Interest Expense Listed here are a series of constat numbered for dentification All our ended to answer this in are provided click the won to view the couch of the water one Requirement 1 Prepare any necessaring or correcting the called for by the stations set which were discovered at the end of the twendar year with respect to a situations that no entration made concerning the situation other than those specifically described monthly adjustments have been made during the year). Considerachstunden separately. The same account may be used aswers These transactions were not necessary conducted by one from our usands of dollars. (Rede fet the credits Prepare any necessary ting or correcto entries for each situation A 10.000 purchase of equipment on December was tonously debited to Long Term Obit. The credit was comedy made to Car Account Credit Debit 0.000 Machinery and conger 2.000 B. Asess made several otell Sore purchases ($1.200) were detto Felpens whereason 3.200) were charged account. Angered 5200 off on and then of the year. There was no fueron and the beginning of the year what was necessary on December 31 Account Debit Credit