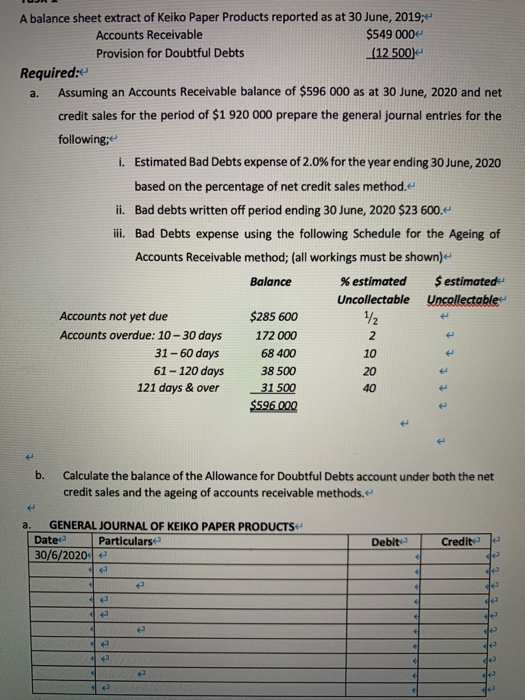

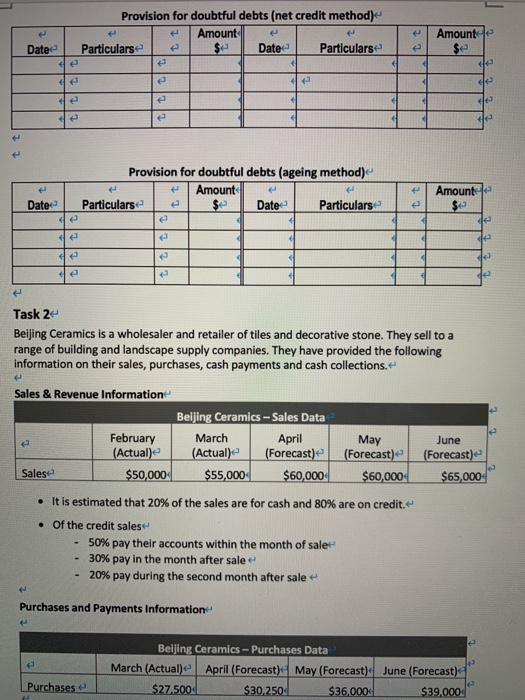

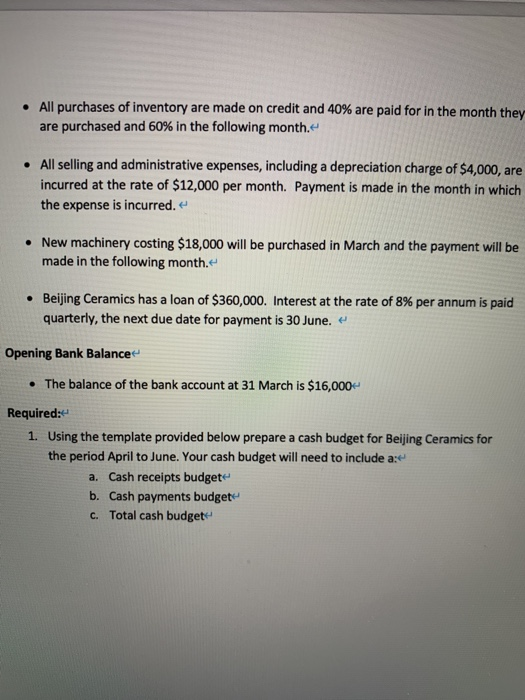

a. A balance sheet extract of Keiko Paper Products reported as at 30 June, 2019; Accounts Receivable $549 000 Provision for Doubtful Debts (12 500) Required: Assuming an Accounts Receivable balance of $596 000 as at 30 June, 2020 and net credit sales for the period of $1 920 000 prepare the general journal entries for the following: 1. Estimated Bad Debts expense of 2.0% for the year ending 30 June, 2020 based on the percentage of net credit sales method. ii. Bad debts written off period ending 30 June, 2020 $23 600.- ili. Bad Debts expense using the following Schedule for the Ageing of Accounts Receivable method; (all workings must be shown) Balance % estimated $ estimated Uncollectable Uncollectable Accounts not yet due $285 600 1/2 Accounts overdue: 10 - 30 days 172 000 2 31-60 days 68 400 10 61 - 120 days 38 500 20 121 days & over 31 500 $596 000 40 b. Calculate the balance of the Allowance for Doubtful Debts account under both the net credit sales and the ageing of accounts receivable methods. a. GENERAL JOURNAL OF KEIKO PAPER PRODUCTS Date Particulars 30/6/2020 Debit Credite de de de so Provision for doubtful debts (net credit method) Amount Particulars $e Date Particularse e Amount le $e Date e d de de de de de Provision for doubtful debts (ageing method) Amount Particularse Date Particulars Amount le Date de 4 da de Task 24 Beijing Ceramics is a wholesaler and retailer of tiles and decorative stone. They sell to a range of building and landscape supply companies. They have provided the following information on their sales, purchases, cash payments and cash collections. Sales & Revenue Information Beijing Ceramics - Sales Data February March April May June (Actual) (Actual) (Forecast) (Forecast) (Forecast) Salese $50,000 $55,000 $60,000 $60,000 $65,000 It is estimated that 20% of the sales are for cash and 80% are on credite of the credit sales 50% pay their accounts within the month of sale 30% pay in the month after sale - 20% pay during the second month after sale Purchases and Payments Information Beijing Ceramics - Purchases Data March (Actual) April (Forecast) May (Forecast) June (Forecast) $27.500 $30,250 $36.000 $39.000 Purchases e All purchases of inventory are made on credit and 40% are paid for in the month they are purchased and 60% in the following month. All selling and administrative expenses, including a depreciation charge of $4,000, are incurred at the rate of $12,000 per month. Payment is made in the month in which the expense is incurred. New machinery costing $18,000 will be purchased in March and the payment will be made in the following month. Beijing Ceramics has a loan of $360,000. Interest at the rate of 8% per annum is paid quarterly, the next due date for payment is 30 June Opening Bank Balance The balance of the bank account at 31 March is $16,000- Required: 1. Using the template provided below prepare a cash budget for Beijing Ceramics for the period April to June. Your cash budget will need to include a a. Cash receipts budget b. Cash payments budget- c. Total cash budget