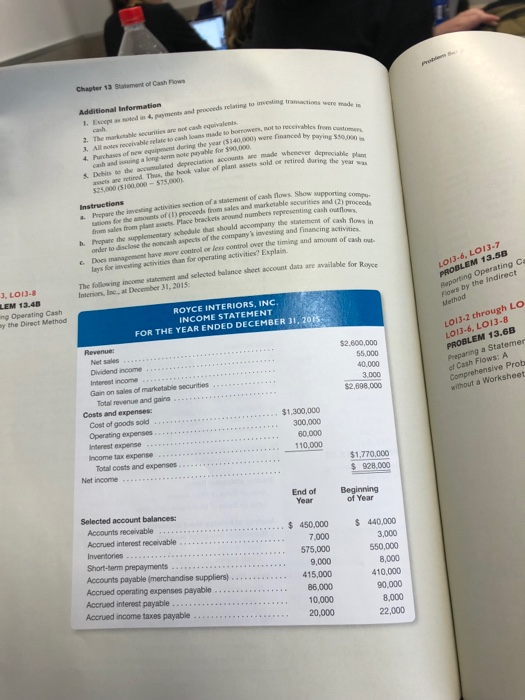

a a Chapter 13 Statement of Cash Flows and proceeds relating to imesting trarmactions were made in ivesting 1. Except as noted in 4, 2. The markotable securities are not cash equivalents All notes receivable selate to cash loans made to borrowens, not to receivables f 4. Purchases of new equipment daring the year (5140,000) were finance long-serm note payable for $90,000 accumulated depreciation accounts are made whenever deprocit are setirod Thas, the heok value of plant assets sold or retired during the Debits 50 the kindlaid 25,000 (5100,000-$75,000 a. Prepare the investing activities Instructions section of a statement of eash flows. Show supporting compu- foe the amounts of (1) proceeds from sales and marketable securities and (2 h. Prepare the supplementary schodule that should accompanry the stanement of cash from sales from plant assets. Place brackets around numbers representing cashoulows order to disclose the noncash aspects of the companys investing and financing activitics lays for investing activities than for operating activities? Explain cash flows in G. Does managoment have more control or less contrel over the timing and amoum of cash of cash out- The following income staterment and selected balance shect account data are available for Roves Interiors, Inc, at December 31, 2015 3, LO13-8 LEM 13.48 ng Operating Cash LO13-6, L013-7 13.58 Reporting Operating Ca Flows by the Indirect Method y the Direct Method ROYCE INTERIORS, INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2015 LO13-2 through LO LO13-6, L013-8 $2,600,000 55,000 40,000 3000 $2,698.000 13.6B a Statemer Dividend income of Cash Flows: A Comprehensive Prob without a Worksheet Gain on sales of marketable securities Total revenue and gaine Costs and expenses Cost of goods sold Operating expenses Interest expense ncome tax expense $1,300,000 300,000 60,000 110,000 Total costs and expenses $1,770,000 $ 928,000 Net income End of Year Beginning of Year Selected account balances: Accounts receivable Accrued interest receivable Short-term prepayments Accounts payable (merchandise suppliers) Accrued operating expenses payable Accrued interest payable Accrued income taxes payable 7,000 575,000 9,000 415,000 86,000 10,000 20,000 450,000 440,000 3,000 550,000 8,000 10,000 90,000 8,000 22,000 1 615 Additional Information 1. Dividend revenue is recognized on the cash basis. All other income statement amounts are recognized on the accrual basis. 2. Operating expenses include depreciation expense of $49,000. Instructions Prepare a partial statement of cash flows, including only the operating activities section of the statement and using the direct method. Place brackets around numbers representing cash pay- ments. Show supporting computations for the following: 1. Cash received from customers. 2. Interest and dividends received. a. 3. Cash paid to suppliers and employees 4. Interest paid 5. Income taxes paid. fanagement of Royce Interiors, Inc, is exploring ways to increase the cash flows from opera- tions. One way that cash flows could be increased is through more aggressive collection of receivables. Assuming that management has already taken all the steps possible to increase revenue and reduce expenses, describe two other ways that cash flows from operations could b. M be increased. Using the information presented in Problem 13.4B, prepare a partial statement of cash flows for ihe current year, showing the computation of net cash flows from operating activities using tho ndirect method. Explain why the increase in accounts receivable over the year was subtracted from bet income in computing the cash flows from operating activities. You are the controller for Foxboro Technologies, Your staff has prepared an income statement for her r aas developed the following additional information by analyzing changes in company's balance sheet accounts. FOXBORO TECHNOLOGIES INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2015 3,000 Interst income $3,400,000 60,000 oni sales of marketable sfr