Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A City's authorized spending plan totaled S780 million for fiscal year 2018. Revenues from taxes on sales and incomes totaled S240 and S120 million

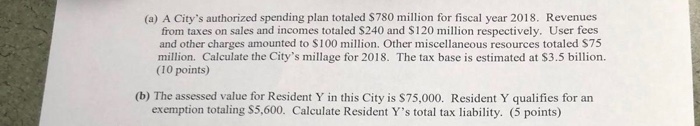

(a) A City's authorized spending plan totaled S780 million for fiscal year 2018. Revenues from taxes on sales and incomes totaled S240 and S120 million respectively. User fees and other charges amounted to S100 million. Other miscellaneous resources totaled $75 million. Calculate the City's millage for 2018. The tax base is estimated at $3.5 billion. (10 points) (b) The assessed value for Resident Y in this City is $75,000. Resident Y qualifies for an exemption totaling S5,600. Calculate Resident Y's total tax liability. (5 points)

(a) A City's authorized spending plan totaled S780 million for fiscal year 2018. Revenues from taxes on sales and incomes totaled S240 and S120 million respectively. User fees and other charges amounted to S100 million. Other miscellaneous resources totaled $75 million. Calculate the City's millage for 2018. The tax base is estimated at $3.5 billion. (10 points) (b) The assessed value for Resident Y in this City is $75,000. Resident Y qualifies for an exemption totaling S5,600. Calculate Resident Y's total tax liability. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started