Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) A commercial bank is planning to give a loan of $3,000,000 to a firm. The bank expects to charge an up-front fee of 0.15%

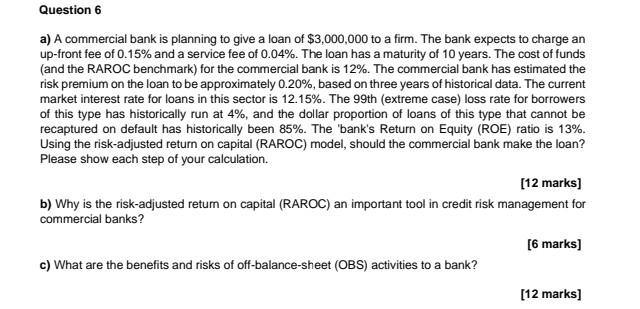

a) A commercial bank is planning to give a loan of $3,000,000 to a firm. The bank expects to charge an up-front fee of 0.15% and a service fee of 0.04%. The loan has a maturity of 10 years. The cost of funds (and the RAROC benchmark) for the commercial bank is 12%. The commercial bank has estimated the risk premium on the loan to be approximately 0.20%, based on three years of historical data. The current market interest rate for loans in this sector is 12.15%. The 99th (extreme case) loss rate for borrowers of this type has historically run at 4%, and the dollar proportion of loans of this type that cannot be recaptured on default has historically been 85%. The 'bank's Return on Equity (ROE) ratio is 13%. Using the risk-adjusted return on capital (RAROC) model, should the commercial bank make the loan? Please show each step of your calculation. [12 marks] b) Why is the risk-adjusted retum on capital (RAROC) an important tool in credit risk management for commercial banks? [6 marks] c) What are the benefits and risks of off-balance-sheet (OBS) activities to a bank? [12 marks] a) A commercial bank is planning to give a loan of $3,000,000 to a firm. The bank expects to charge an up-front fee of 0.15% and a service fee of 0.04%. The loan has a maturity of 10 years. The cost of funds (and the RAROC benchmark) for the commercial bank is 12%. The commercial bank has estimated the risk premium on the loan to be approximately 0.20%, based on three years of historical data. The current market interest rate for loans in this sector is 12.15%. The 99th (extreme case) loss rate for borrowers of this type has historically run at 4%, and the dollar proportion of loans of this type that cannot be recaptured on default has historically been 85%. The 'bank's Return on Equity (ROE) ratio is 13%. Using the risk-adjusted return on capital (RAROC) model, should the commercial bank make the loan? Please show each step of your calculation. [12 marks] b) Why is the risk-adjusted retum on capital (RAROC) an important tool in credit risk management for commercial banks? [6 marks] c) What are the benefits and risks of off-balance-sheet (OBS) activities to a bank? [12 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started