Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A company has an EPS of Rs. 2.5 for the last year and the DPS of Rs. 1. The earnings is expected to

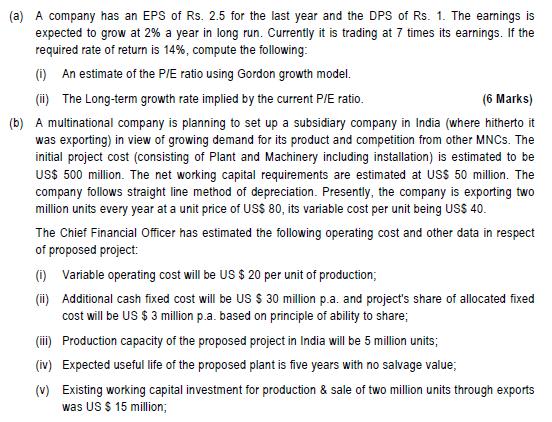

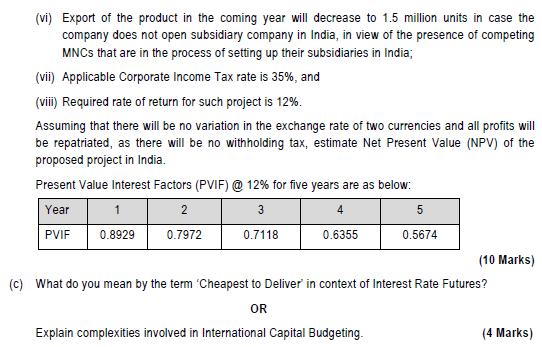

(a) A company has an EPS of Rs. 2.5 for the last year and the DPS of Rs. 1. The earnings is expected to grow at 2% a year in long run. Currently it is trading at 7 times its earnings. If the required rate of return is 14%, compute the following: (i) An estimate of the P/E ratio using Gordon growth model. (ii) The Long-term growth rate implied by the current P/E ratio. (6 Marks) (b) A multinational company is planning to set up a subsidiary company in India (where hitherto it was exporting) in view of growing demand for its product and competition from other MNCs. The initial project cost (consisting of Plant and Machinery including installation) is estimated to be US$ 500 million. The net working capital requirements are estimated at US$ 50 million. The company follows straight line method of depreciation. Presently, the company is exporting two million units every year at a unit price of US$ 80, its variable cost per unit being US$ 40. The Chief Financial Officer has estimated the following operating cost and other data in respect of proposed project: (i) Variable operating cost will be US $20 per unit of production; (ii) Additional cash fixed cost will be US $ 30 million p.a. and project's share of allocated fixed cost will be US $3 million p.a. based on principle of ability to share; (iii) Production capacity of the proposed project in India will be 5 million units; (iv) Expected useful life of the proposed plant is five years with no salvage value; (v) Existing working capital investment for production & sale of two million units through exports was US $ 15 million; (vi) Export of the product in the coming year will decrease to 1.5 million units in case the company does not open subsidiary company in India, in view of the presence of competing MNCs that are in the process of setting up their subsidiaries in India; (vii) Applicable Corporate Income Tax rate is 35%, and (viii) Required rate of return for such project is 12%. Assuming that there will be no variation in the exchange rate of two currencies and all profits will be repatriated, as there will be no withholding tax, estimate Net Present Value (NPV) of the proposed project in India. Present Value Interest Factors (PVIF) @ 12% for five years are as below: Year PVIF 1 2 3 4 5 0.8929 0.7972 0.7118 0.6355 0.5674 (10 Marks) (c) What do you mean by the term 'Cheapest to Deliver in context of Interest Rate Futures? OR Explain complexities involved in International Capital Budgeting. (4 Marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a i An estimate of the PE ratio using Gordon growth model The Gordon growth model calculates the PE ratio using the following formula PE ratio Dividend Payout Ratio Required Rate of Return Dividend Gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started