Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) A firm is considering the following mutually exclusive investment projects. Project Matahari requires an initial outlay of RM500,000 and will provide cash inflow of

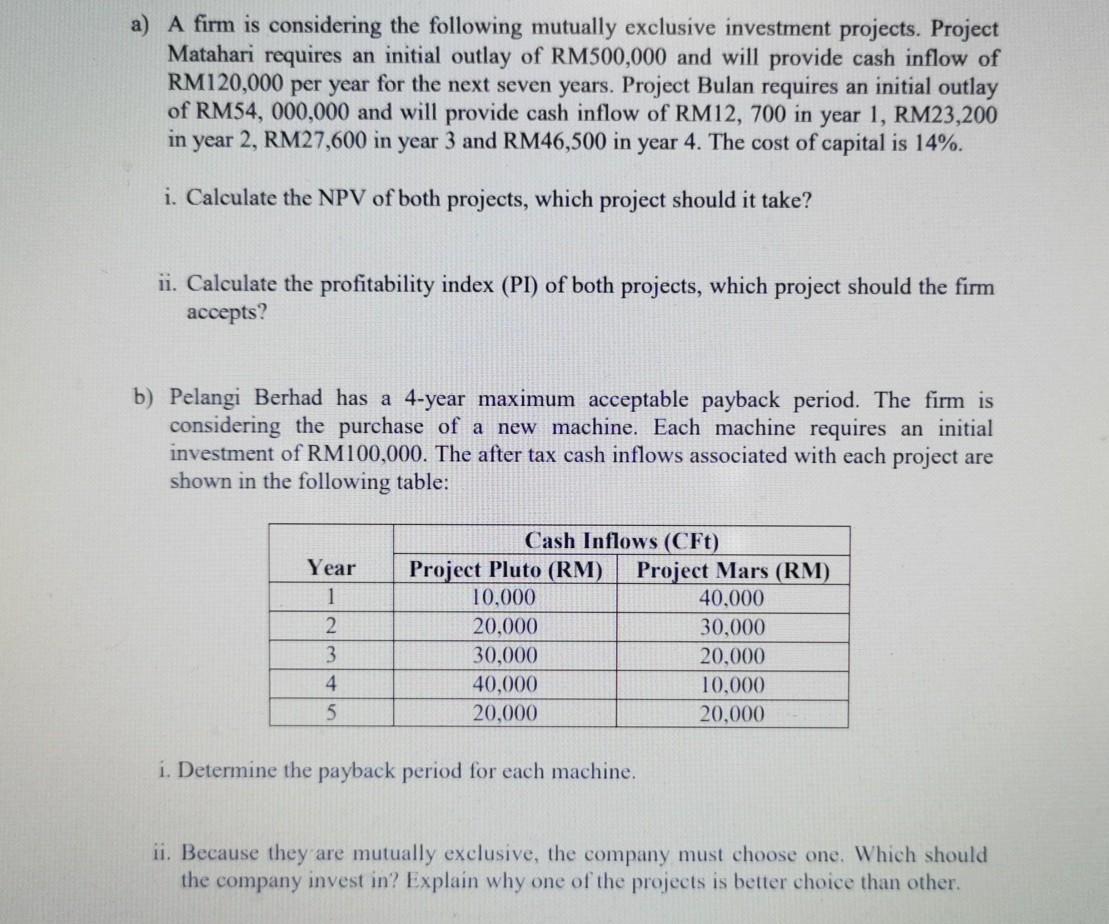

a) A firm is considering the following mutually exclusive investment projects. Project Matahari requires an initial outlay of RM500,000 and will provide cash inflow of RM120,000 per year for the next seven years. Project Bulan requires an initial outlay of RM54, 000,000 and will provide cash inflow of RM12, 700 in year 1, RM23,200 in year 2, RM27,600 in year 3 and RM46,500 in year 4. The cost of capital is 14%. i. Calculate the NPV of both projects, which project should it take? ii. Calculate the profitability index (PI) of both projects, which project should the firm accepts? b) Pelangi Berhad has a 4-year maximum acceptable payback period. The firm is considering the purchase of a new machine. Each machine requires an initial investment of RM100,000. The after tax cash inflows associated with each project are shown in the following table: Year 1 2 Cash Inflows (CFt) Project Pluto (RM) Project Mars (RM) 10,000 40.000 20,000 30,000 30,000 20.000 40,000 10,000 20,000 20,000 3 4 5 i. Determine the payback period for each machine. ii. Because they are mutually exclusive, the company must choose one. Which should the company invest in? Explain why one of the projects is better choice than other

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started